Comments

Commented by Stefan Feulner on July 16th, 2021 | 14:45 CEST

Plug Power, Kodiak Copper, NIO - The shortage as an opportunity

Commodity markets are always subject to the forces of supply and demand. The energy transition and the achievement of climate targets pose new challenges for society. With the expansion of electromobility and renewable energies such as wind and hydropower, demand for some mineral raw materials will increase sharply. This is offset by an extremely tight supply and trade conflict with the leading producer China. There is a threat of further rising prices and, to be seen with the current chip shortage, even production losses.

ReadCommented by Armin Schulz on July 16th, 2021 | 14:02 CEST

BYD, EuroSports Global, VW - Electric mobility booming

Automakers enjoyed their best first quarter in 10 years. One reason for this is the growing number of registered electric cars. If you compare the first quarter of 2020 in Germany with 2021, you can see an increase of 173% in the registration of e-cars, and there is no end in sight. However, more e-cars are not only being sold in Germany; but sales are also increasing worldwide. According to Handelsblatt, if the boom continues, there will be a shortage of millions of battery cells for production. The current industry leader, Tesla, still leads the ranking with the most e-cars delivered by brand, but the competition is catching up. Therefore, we take a look at three companies from the e-mobility segment.

ReadCommented by André Will-Laudien on July 16th, 2021 | 13:22 CEST

Microsoft, Daimler, Mineworx Technologies - Market leaders on the rise!

The claim to market leadership can be made by the Company that can demonstrate the largest market share in comparison with the other market participants. The measure of market share is based either on market volume or market sales in units. Some typical attributions are the market leader in Germany, the European market leader or the world market leader in a relevant product sales market. Of course, market leadership is not indisputable, especially from a subjective point of view. A broader focus is needed to determine who sets the tone.

ReadCommented by Stefan Feulner on July 16th, 2021 | 11:53 CEST

Nel ASA, Memiontec, McPhy - Ride the wave

The world is in a state of flux. Due to the change from fossil fuels to renewable energies, everyone is talking about the shortage of raw materials such as lithium, nickel, or copper. However, the fact that there could be a water shortage is not yet ingrained in the population's consciousness. With the growing population, urbanization and the depletion of existing sources, water will become a precious commodity in the coming decades. New types of water treatment systems offer great potential.

ReadCommented by Nico Popp on July 16th, 2021 | 11:31 CEST

Barrick Gold, Triumph Gold, Standard Lithium: Get in relaxed with stragglers

Inflation is here - and it is not going away: Inflation rose by 5.4% in June within the USA compared to the same period last year. That is more than even pessimistic experts had expected in the run-up to the figures. Inflation is also picking up speed; compared with the previous month, inflation rose by 0.9%. The answer to this development may be gold. Shortly after the figures were published, the precious metal surged. We highlight two gold stocks and use the example of another currently very popular commodity stock to show why the time is favorable for gold now.

ReadCommented by Carsten Mainitz on July 16th, 2021 | 10:20 CEST

Gazprom, Desert Gold, Orocobre - Raw materials remain on course for growth

Raw materials are an important industrial commodity. If there are no raw materials, there are no industrial goods. When you think about this, it quickly becomes clear why commodities will always remain an important investment topic. Of course, there are phases in which some commodities are more attractive than others. The following three stocks can be used to take advantage of precisely this circumstance. Which stock has the greatest potential?

ReadCommented by Carsten Mainitz on July 15th, 2021 | 17:29 CEST

BP, Deutsche Rohstoff, Encavis - Is that it?

Nothing works without energy. But the world also needs to keep an eye on resource extraction and climate protection. ESG is a big investment topic. Even if the ideal target includes primarily renewable energy, that is simply out of touch with reality. Oil and gas producers are an attractive investment due to the high prices of the extracted raw materials. When will the next price jump come?

ReadCommented by André Will-Laudien on July 15th, 2021 | 14:46 CEST

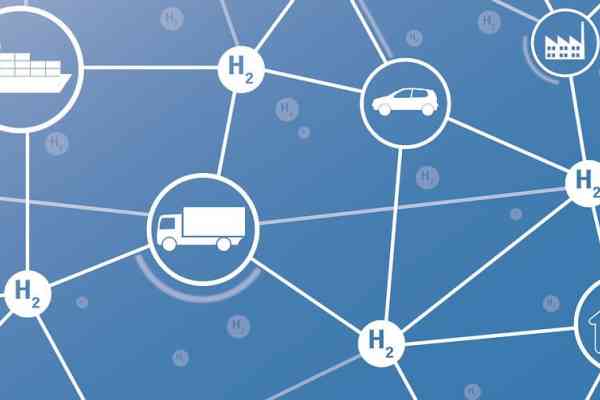

Pure Extraction, BallardPower, JinkoSolar, Siemens Energy - The makers of the future!

The most efficient ways to generate energy are being discussed almost daily. With nearly 8 billion people on the planet, we need to put energy-intensive mobility on a viable and sustainable footing. The shift to post-industrial economies and rapid changes in information technologies, for example, have greatly simplified the coordination of work. In terms of jobs, there is potential for greater flexibility and dispersion, according to Eurostat. The relationship between home and workplace is being redefined. Mobility and energy concepts that adapt to the new forms of work and production are therefore in demand.

ReadCommented by André Will-Laudien on July 15th, 2021 | 13:25 CEST

Defense Metals, Varta, Nordex - Scarce metals are the new gold!

Whether gallium, chromium or rare earths - many metals are indispensable for modern technology. Where supply bottlenecks or shortages threaten, researchers have now determined the criticality of 62 elements in the most comprehensive analysis to date. As it shows, the supply risk is particularly high for the metals needed for the highly specialized tasks in high-tech devices. Iron, copper, nickel and tin, and almost all other metals of the periodic table, make our modern civilization possible. Most technical applications would not exist without them - from cars and computers to televisions and cell phones. How do companies deal with fragile supply chains and shortages?

ReadCommented by Stefan Feulner on July 15th, 2021 | 11:56 CEST

SAP, White Metal Resources, Nokia - Markets facing a decision

The global economy is celebrating a turnaround, and corporate profits are bubbling. Consumer spending is jumping due to austerity during the Corona lockdowns. In addition, growth is fueled by billions of dollars in infrastructure projects from policymakers. Golden times for the stock markets, if it were not for concerns about rampant inflation. According to the Labor Department, consumer prices in the USA rose by 0.9% to 5.4% in June. It is the most significant price increase since August 2008. The FED is being challenged.

Read