Comments

Commented by Stefan Feulner on December 6th, 2021 | 11:41 CET

NIO, Nevada Copper, Volkswagen - Business is booming

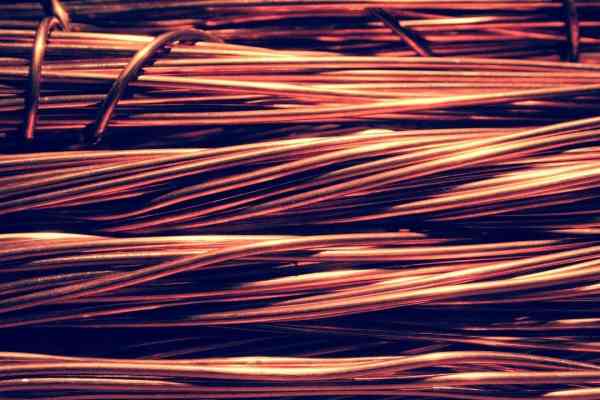

It is hard to imagine climate change without electromobility. The shift from combustion engines to battery-powered vehicles promises bright growth prospects for the automotive lobby. Despite the rosy outlook, a problem is emerging, one that has been known for years and is likely to become even greater in the future - the shortage of raw materials. Above all, the sharp rise in prices for essential metals is expected to eat into the margins of the automotive industry.

ReadCommented by Armin Schulz on December 6th, 2021 | 10:34 CET

Square, CoinAnalyst, SAP - Indices fall and bitcoin crashes

On Friday, not only did the stock indices fall, but Bitcoin crashed by over 16% and with it the other cryptocurrencies. That means that the targeted USD 100,000 mark will probably not be reached this year. The crash is the biggest drop since September 7. The markets had to deal with a wide variety of problems last week. There was first the Omicron variant, and then the US Federal Reserve announced that inflation was not a temporary phenomenon after all and tapering and interest rate increases could be on the cards. US jobless claims forecasts were missed on Friday, and Docusign's stock plunged over 40%. We are in for an exciting week of trading.

ReadCommented by Carsten Mainitz on December 3rd, 2021 | 13:41 CET

Desert Gold, Barrick, First Majestic - Countercyclical opportunities!

The drop of the gold price below USD 1,800 opens up first-class countercyclical investment opportunities for long-term investors. The high inflation worldwide and the low-interest rate policy speak for precious metals as inflation protection and crisis currency. High-quality gold shares have historically outperformed the underlying over longer periods. Who will be ahead in 2022?

ReadCommented by Stefan Feulner on December 3rd, 2021 | 12:38 CET

BioNTech, Defence Therapeutics, QIAGEN - End in sight?

The federal and state governments have met and decided on a de facto lockdown for the unvaccinated. In the future, only vaccinated and recovered people will be allowed to shop in retail stores. The same applies to cinemas, theaters and restaurants. In addition, the unvaccinated will have to accept contact restrictions. According to the outgoing chancellor, this is an "act of national solidarity" and is necessary to get out of the current difficult situation - hard times, which the Omicron variant has just exacerbated. But according to US strategists, it is precisely the newly emerged mutant that could signal the approaching end of the Corona pandemic.

ReadCommented by André Will-Laudien on December 3rd, 2021 | 12:22 CET

BYD, Kleos Space, Airbus, Boeing - This could go wrong again!

The states are again on the verge of tightening all known measures to contain the pandemic. The tourism and aviation industries are always strongly affected by this. The investor can bypass this issue. After all, those who focus on technological achievements related to aviation and aerospace can profit from the increased business volumes in sometimes very disruptive areas. An example here would be Big Data and security technology. These are two booming sectors that are setting many an old-school business ablaze. We are looking at stocks from the high-tech industry in 2021, where the right choice was the trump card.

ReadCommented by Stefan Feulner on December 3rd, 2021 | 11:48 CET

TeamViewer, Water Ways Technologies, Zooplus - Further underwater

The United Nations warns of a growing imbalance in the global water balance with catastrophic consequences. Currently, two billion people live in countries without a secure drinking water supply. By 2050, the number is expected to grow to more than five billion people without adequate access to drinking water. The future belongs to companies that take care of water treatment and offer intelligent systems for water management. The TeamViewer share, on the other hand, continues to be underwater. The latest news is also not very optimistic.

ReadCommented by Armin Schulz on December 3rd, 2021 | 10:22 CET

Nel ASA, Clean Logistics, Plug Power - Is hydrogen fuel for the depot again?

The coalition agreement of the new traffic light government has been in place since November 24. Achieving the set climate targets is at the top of the agenda. One of the cornerstones is the use of green hydrogen, and so it is essential to increase electrolysis capacity in the coming years. Investments in the development of infrastructures for hydrogen are also to receive financial support. There is also to be a quota for public procurement. What the future hydrogen strategy will look like is to be announced in more detail in an update in 2022. Countries within the EU are also to cooperate more closely in this area. We, therefore, take a look at three companies from the hydrogen sector.

ReadCommented by André Will-Laudien on December 2nd, 2021 | 14:04 CET

TUI, Lufthansa, Alerio Gold, Carnival - This winter travel will not be golden!

The upward movement at the stock exchanges is very advanced because the higher valuation of the shares is continuously alimented by cheap money from the central banks. But now, the statistics show real inflationary pushes; for Europe, the inflation on an annual basis amounted to +4.4% in October. It is generally known that these rates do not correspond very closely to reality due to their hedonic measurement method; the actual price markup in the relevant goods is probably already beyond the 6% mark. Based on these dynamics, FED observers assume that the US central bank could double the pace of the current tapering so that bond purchases could end as early as March. That would probably have the first contractionary effects. What about gold and travel in this environment?

ReadCommented by André Will-Laudien on December 2nd, 2021 | 13:23 CET

Attention, the prices are rising: Bitcoin Group, CoinSmart, TeamViewer - Cryptos back in vogue!

The crypto world is evolving rapidly and with volatility, and its following is growing. However, with the turnover on alternative currency trading venues on the rise, policymakers are pressed for action: do they want billions of US dollars to be transferred into unknown coins on a broad scale? Yes, governments are watching, and for good reason...

ReadCommented by Carsten Mainitz on December 2nd, 2021 | 12:52 CET

Nevada Copper, Varta, Aumann - Catching up!

Electromobility is inextricably linked with raw materials such as copper and lithium. The demand for e-cars and batteries is increasing enormously. This megatrend is also pulling up the relevant raw material prices. How can investors profit from this development, and which of the three stocks has the best opportunities in the coming year?

Read