Comments

Commented by André Will-Laudien on November 26th, 2021 | 11:28 CET

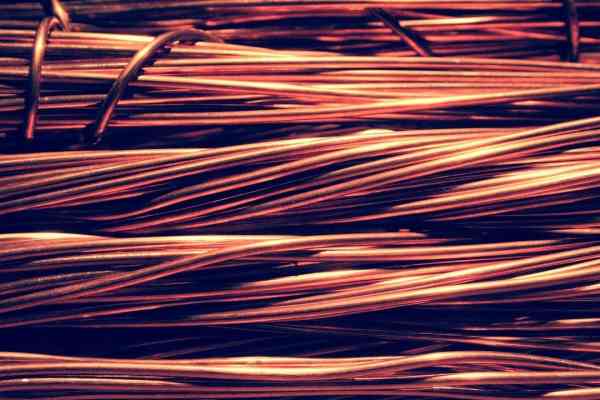

The copper sensation continues! Nordex, Nevada Copper, JinkoSolar, Daimler

When it comes to calculating the copper market in the next few years, expert opinions differ. According to a study by Wood Mackenzie, primary copper demand will increase by 30% to approximately 25 million tons by 2030. The main argument for further rising prices remains the global copper shortage because demand continuously exceeds supply, and recycling rates cannot cover industrial stockpiling either. The German copper smelter Aurubis is trading at an all-time high and wants to build a multi-metal plant in the USA. Such news is confirmation of an awakening among investors to allow new mining and processing operations to emerge. There are few new mines in sight at the moment, but there is news from Nevada.

ReadCommented by Nico Popp on November 26th, 2021 | 10:39 CET

Hochtief, TalkPool, Bilfinger: Real estate shares and the new German government

The coalition agreement of the new German government reads ambitiously and met with a positive response from the real estate industry. Above all, the planned reduction in bureaucracy and digitization should be in the interests of all concerned - after all, analog land registers repeatedly cause errors and delays, which are quickly expensive, especially in construction. But the coalition's plans also include greener construction and stricter regulations on insulation and heating. We present three stocks and explain whether they will benefit or not.

ReadCommented by André Will-Laudien on November 25th, 2021 | 15:19 CET

Varta, Graphano Energy, BYD, NIO: Who supplies the blockbuster battery?

There is no way around a high-performance battery when benchmarking for those who see electromobility at the forefront. In the last 3 years, there have been no real leaps forward in development. Still, at least power compression in lithium-ion technology achieved a doubling of range and, in parallel, also lowered the previously long charging times. As a result, this has made an electric vehicle suitable for long distances for the first time, even though recharging must be expected in winter due to non-engine services such as heating. But technological development continues, new materials are being tested, and one day it will be available - the super battery. We look at some industry players.

ReadCommented by Stefan Feulner on November 25th, 2021 | 14:31 CET

BASF, Osino Resources, Standard Lithium - Why does nobody believe it?

Since inflation rates have been growing, central banks have placated that price increases would only be temporary and would level off next year due to the recovery after the Corona lockdowns. Therefore, an interest rate hike is far from an issue; only the pumping of unlimited money into the capital market is to be slowed down to a snail's pace. If the high inflation rates prove permanent, only one thing will help - the flight into gold.

ReadCommented by Stefan Feulner on November 25th, 2021 | 13:42 CET

XPeng, Meta Materials, Aixtron - Welcome to the Metaverse

Sound fundamental analysis is essential to be successful in the stock market in the long term; at least, this was the basic rule before the Reddit hype about GameStop & Co. The news that Facebook wants to reinvent itself under the name "Meta" prompted investors to buy shares in the Company of the same name. The Company is quite promising and has great potential in the long term due to the development of new materials for 5G, photovoltaics and consumer electronics. From our side, "Congratulations, dear Meta shareholders."

ReadCommented by André Will-Laudien on November 25th, 2021 | 12:58 CET

Nel ASA, Enapter, Plug Power, ThyssenKrupp - Hydrogen now or never!

It sounds crazy, yet we have arrived at the times when billionaires ask social platforms if they can flog a part of their shares to flush some money into the empty state coffers. In an age of powerful wealth shifts in favor of stock owners, this is perhaps legitimate, or nice, as it is sometimes referred to in the press. But appearances are deceptive. Behind a generally formulated question about whether one should sell shares lies the precise calculation of shifting blame if the announced sale causes a significant price loss. What then happens is a self-fulfilling prophecy with one small difference: the intention to sell was previously legitimized, so to speak, by public vote.

ReadCommented by Fabian Lorenz on November 25th, 2021 | 12:44 CET

BioNTech, Valneva, Cardiol Therapeutics: Vaccination boosters also share boosters?

The Corona pandemic has been with us all for a good 18 months now, and there is no end in sight. While the industrialized countries are boosting their vaccines, large parts of the world's population have still not been vaccinated for the first time. That means that shares of manufacturers of vaccines or drugs against COVID-19 will continue to be the focus of investors. Driven by the booster and mandatory vaccination discussions, BioNTech has left the correction behind, and the share is marching towards EUR 300. Drug developer Cardiol Therapeutics should now pick up again after the successful capital increase. In any event, analysts see price potential. Vaccine developer Valneva benefits from the EU order but has not yet recovered from Tuesday's "flash crash".

ReadCommented by Nico Popp on November 25th, 2021 | 11:46 CET

BB Biotech, Sativa Wellness, Carnival: Anti-aging as a megatrend

Anti-aging medicine is one of the most exciting research topics of our time. Already in 2018, Citigroup named the field as one of the ten rising topics of the future. While the pandemic has obscured many long-term ventures in the media, the work continues. People have long been optimizing and working to feel at least a little younger. We present three stocks related to biotechnology, anti-aging and wellness.

ReadCommented by Carsten Mainitz on November 25th, 2021 | 10:21 CET

wallstreet:online, flatexDEGIRO, Commerzbank - Here are the winners for 2022!

Low interest rates and high inflation are creating strong demand for equities. Even if uncertainties about upcoming interest rate increases and the fourth Corona wave prevail, the stock market lights continue to be green. Possible price setbacks represent good entry possibilities. The following three stocks offer good opportunities.

ReadCommented by André Will-Laudien on November 24th, 2021 | 14:07 CET

Bitcoin Group, CoinAnalyst, SAP, TeamViewer - The next rockets are launching now!

Currently, the volatility in certain market segments is hard to beat. The DAX reached its preliminary high of over 16,300 points; yesterday, it fell below 16,000 again within one trading day. Bitcoin also made true leaps up to USD 67,000 and later back down to USD 56,000. Since the central banks had to admit to a certain inflation potential, market participants have been considering the right investment vehicle for a permanent rise in prices. Is it still the stock markets, or shouldn't long-term interest rates also slowly gain momentum? Here, there has been a zero return for a good 5 years, and in real terms today, there is even a whopping minus interest rate of over 4%. So if you are hoarding money, you are bound to lose without adding anything. We look at stocks with upside potential.

Read