Comments

Commented by Stefan Feulner on December 20th, 2021 | 11:11 CET

Nikola, Clean Logistics, Plug Power - Drastic measures required

Germany raised its climate targets in the middle of this year and adopted binding emissions targets for the years up to 2045 - the target year for climate neutrality. Alongside the energy sector and industry, Germany's biggest emitter of greenhouse gases is the transport sector. However, this is the only sector that has not reduced greenhouse gas emissions in recent decades. Commercial vehicles account for around 35% of CO2 emissions. It is precisely here that quick and precise action is needed to ensure that the rosy plans are implemented. Smaller companies in particular far outstrip the large corporations in terms of know-how.

ReadCommented by Nico Popp on December 20th, 2021 | 10:08 CET

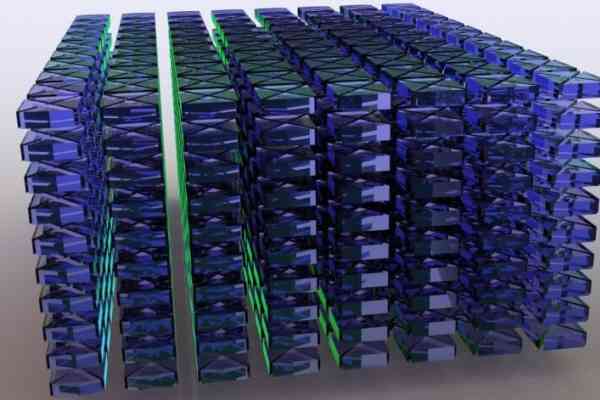

Apple, Meta Materials, Daimler: Tesla looks down the tube

Innovation is everything when it comes to gaining new market share. Those who lead the way in innovation automatically have a head start that few competitors can catch up on. Just think of Apple's iPhone. By the time Samsung caught up with the Android operating system, the tastiest pieces of the pie had already been distributed: Those who have no problem spending EUR 1000 for a smartphone have often been loyal to Apple since the first years of the iPhone. And that is one of the reasons why Apple is posting good figures quarter after quarter.

ReadCommented by Carsten Mainitz on December 17th, 2021 | 14:06 CET

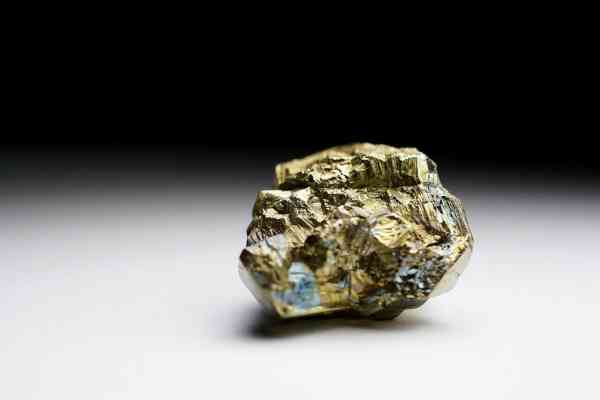

Triumph Gold, First Majestic, K+S - Something is happening here!

Inflation has reached its highest level in decades in many countries. Even though the US Federal Reserve has already sent clear signals for upcoming interest rate increases, the real interest rate will remain negative for a long time, and the loss of purchasing power will be felt. In such a situation, investors can protect their money by investing in tangible assets such as stocks, real estate, and commodities.

ReadCommented by Stefan Feulner on December 17th, 2021 | 12:58 CET

Steinhoff, MAS Gold, Barrick Gold - What is next?

The monetary guardians in the US, England and the eurozone have met. While the Bank of England could even surprise with an interest rate hike of 0.25%, the Federal Reserve announced a faster withdrawal from the bond-buying program and held out the prospect of up to three interest rate hikes next year. The ECB's hands are tied in the fight against rising inflation. The pandemic emergency purchase program PEPP expires in March of next year; otherwise, the monetary policy remains, arguably forced, ultra-loose.

ReadCommented by Armin Schulz on December 17th, 2021 | 12:50 CET

Nikola, First Hydrogen, Plug Power - Will the transport industry rely on hydrogen?

While the future of cars is most likely to be electric, the race in the transport industry has not yet been decided. There are electric buses, but they are more likely to be used in warmer climates. In winter, when heating is needed, electric buses are useless. The same applies to trucks and vans, as the high weight of the batteries means that some tractive power is lost here, and longer journeys also become impossible. The transport industry is responsible for a large proportion of CO2 emissions. If we want to achieve the climate targets we have set, we need a solution. Hydrogen could solve the problem, as the vehicles can be refueled much faster and the range is greater. But green hydrogen is still too expensive. Today we look at three companies working on hydrogen solutions.

ReadCommented by André Will-Laudien on December 17th, 2021 | 11:38 CET

TeamViewer, SAP, Osino Resources, ThyssenKrupp - These shares are far too cheap!

Sometimes things do not work out as expected on the stock market. At the beginning of October, the DAX started to sell off, the 200-day line was clearly undercut twice at 14,850 points, and many crash prophets became quite loud again. However, as is so often the case, they were not proven right, as the market reached the 15,700 point mark again at the beginning of December. Of course, 500 points are still missing from the high, but it feels like the overall market is bombproof and probably will not let itself get out of control. Who would have thought it - a full 1000 points reversal, the crash proclaimed by many sides was once again canceled without a sound. We present a few favorable titles.

ReadCommented by Nico Popp on December 17th, 2021 | 10:18 CET

Nordex, Saturn Oil + Gas, Varta: In search of energy multipliers

The energy transition is a megatrend. The consequences of it are complex and affect almost every industry. Did you know that the BASF plant in Ludwigshafen alone needs as much electricity as Denmark? It is no wonder that the shift from fossil to renewable energy sources will not happen overnight. We look at three stocks and classify their role in the energy transition. This much is already clear: Sometimes, opportunities lurk off the beaten track.

ReadCommented by André Will-Laudien on December 16th, 2021 | 14:09 CET

Clean Logistics, Plug Power, Nel, FuelCell Energy - 2022, let's go hydrogen!

Germany is focusing primarily on green electricity from wind and sun due to climate protection. It can already be used comparatively effectively in e-cars, for example. However, this is far more difficult in industry: Fuels such as oil, coke or gas are to be replaced by hydrogen in steel, chemical and cement production. The situation is similar in shipping, aviation and heavy goods transport, where it isn't easy to run on electricity. The rise in fossil fuel prices increases the pressure to switch to alternative energies and new drive concepts. The year 2022 could set an important starting point.

ReadCommented by Fabian Lorenz on December 16th, 2021 | 13:41 CET

Shares with top news: Plug Power, BioNTech, Prospect Ridge

Inflation fears and uncertainty about the impact of the Omicron variant on the course of the Corona pandemic are currently driving stock prices. These are very volatile, with a downward tendency. Highflyers such as Plug Power and BioNTech have also corrected significantly. However, there is positive news about both companies. Plug Power reports further cooperation in the USA to reach the medium-term delivery targets, and BioNTech's vaccine protects against severe disease progression at Omicron. The vaccine is in short supply in Germany. There were several pieces of positive news recently from Prospect Ridge Resources. The gold explorer seems to be sitting on a real treasure.

ReadCommented by Stefan Feulner on December 16th, 2021 | 13:11 CET

TeamViewer, wallstreet:online, Commerzbank - Decisive weeks

The turbulent stock market year is coming to an end. It was mainly characterized by Corona and the ever-increasing inflation. After a short setback, the question is whether the leading indices will reach new highs in the last weeks. Exciting developments are also in store for individual stocks, potentially shaping prices for the following year.

Read