Comments

Commented by Carsten Mainitz on January 13th, 2022 | 14:13 CET

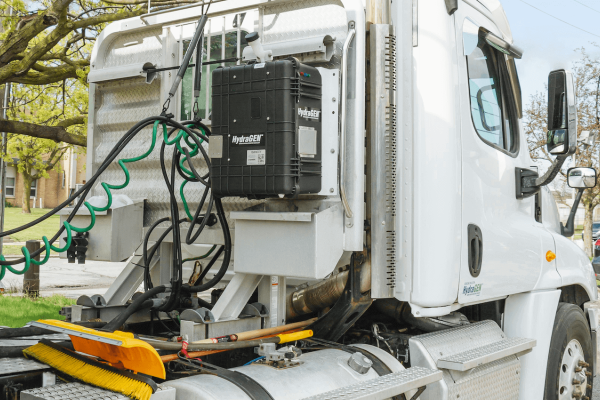

dynaCERT, Plug Power, Nikola - Will hydrogen be the comeback of 2022?

Electromobility is an important building block for reducing CO2 emissions. However, batteries are not efficient enough due to their limited range and long charging times, especially in heavy-duty traffic. The most promising technology is hydrogen. However, after a veritable hype last year, many values experienced an abrupt crash after it became clear that the necessary infrastructure was not yet ready. But in 2022, the course could slowly be set, and hydrogen stocks could make the comeback of the year. We took a closer look at three promising candidates.

ReadCommented by André Will-Laudien on January 13th, 2022 | 13:45 CET

Triumph Gold, Delivery Hero, HelloFresh - Exploding like TeamViewer!

Inflation is galloping, so the central banks will have to react soon. In the matter of COVID-19, an endemic is expected after the overcoming of Omicron. That would likely bring a boom to the economies. The high volatility on the capital markets has now manifested itself, and the basis of the argument changes almost daily. For us, it is a suitable opportunity to take a look at highly volatile investment vehicles. Actually, the sails are set, but inflation can still dash the party - but that would again be a buying argument for the precious metals!

ReadCommented by Stefan Feulner on January 13th, 2022 | 12:45 CET

TeamViewer, Saturn Oil + Gas, BP - Target price USD 100

Oil prices continue to rise. A barrel of Brent currently costs USD 84.32 and is thus on the verge of breaking through a double top formation from the highs of 2018 and 2021. A breakout would generate a fresh buy signal, the target range of which already lies beyond the USD 100 mark. Underpinned by an easing of the Corona situation and an unexpected onset of winter in the US, a new 10-year high at USD 122.88 could even beckon. The primary beneficiaries of this inflationary development are once again the oil producers.

ReadCommented by Mario Hose on January 13th, 2022 | 12:01 CET

Stocks offer trading opportunities: BrainChip, TeamViewer, XPhyto

On Thursday, most German indices started trading with negative signs. The DAX is currently trading at 15,989 points, down around 0.25%. The psychological mark of 16,000 points has not held compared to the previous day. The MDAX last traded at 34,874 points (-0.14%), TecDAX at 3,637 points (-0.62%) and SDAX at 16,062 points with 0.13% in the red. In the single stocks, on the other hand, there are exciting developments for the stock traders.

ReadCommented by Nico Popp on January 13th, 2022 | 11:03 CET

Bayer, First Hydrogen, NEL: This is how innovative investing works!

Innovation pays off - especially on the stock market. That is because innovative products generate price fantasy, which can generate rich returns on the stock market within a very short period of time. In addition to classic trend themes, such as hydrogen, established companies can also score with innovations. We present three stocks and explain whether they offer opportunities or not.

ReadCommented by Nico Popp on January 13th, 2022 | 10:23 CET

JinkoSolar, Barsele Minerals, Barrick Gold: Where challenges are opportunities

The road to success is sometimes rocky and characterized by imponderables. Especially on the stock market, unclear situations can be good opportunities in the long run. Sometimes the market doesn't buy a company's long-term plans, or a fundamental situation overshadows what is actually a good investment story. We present three companies where there is currently a bit of sand in the gears and explain whether opportunities can arise.

ReadCommented by Armin Schulz on January 12th, 2022 | 13:42 CET

Bayer, XPhyto Therapeutics, MorphoSys - Which pharmaceutical companies bring returns?

Most recently, the pharmaceutical industry has been accused of being greedy and getting rich off Corona. While it is true that 2021 has been dominated by vaccine news, the industry can do much more than just produce vaccines against Corona. Handelsblatt ran a headline on January 10, "In the shadow of Corona," citing the growing number of cancers over the past several years. This year, more than 45 new drugs are expected to hit the market to help fight cancer and genetic defects, among other things. Today, we look at three companies that do not make Corona vaccines.

ReadCommented by Carsten Mainitz on January 12th, 2022 | 13:21 CET

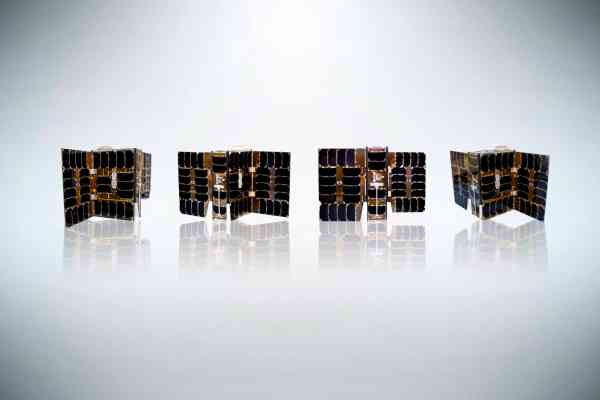

Deutsche Lufthansa, Kleos Space, BYD - The picture is brightening up

Exploding infection figures, contact restrictions, and no prospect of improvement are some of the impressions one could get from the current news situation. In contrast, individual scientists are cautiously optimistic that the new variant could be the beginning of the end of the pandemic and the change to an endemic. In an endemic situation, people continue to become infected with the virus; however, by that time, most people's immune systems have already been exposed to the virus or are protected by vaccination, so there is no longer a burden on the health care system. A more normal life would thus be possible again, with significantly fewer restrictions.

ReadCommented by Mario Hose on January 12th, 2022 | 13:17 CET

Energy stocks after oil price rise: BP, Saturn Oil + Gas, Shell

The price of energy continues to be the focus of the public and investors in the new year. The price of WTI crude oil reached a new high for the year on Wednesday at almost USD 82.00 per barrel. Brent crude is currently trading at over USD 84.00 per barrel. Also, the price of Natural Gas of February 2022 contracts has increased today by 4.73% to 4.45 USD. The development in the commodity market also usually reflects in the balance sheets of producers.

ReadCommented by Stefan Feulner on January 12th, 2022 | 12:54 CET

Tilray, Ayurcann, Aurora Cannabis - When will the boom 2.0 come?

About five years ago, the boom of cannabis stocks started. Companies like Aurora Cannabis, Canopy Growth and Tilray were able to multiply within a few months. However, the boom was followed by a quick end on the stock market. With corrections of 90% in some cases, the exaggerations were harshly corrected. However, the cannabis market is still in a strong growth phase. The legalization in many countries and the cannabis 3.0 wave promise the companies enormous growth leaps in the next few years. Thus, the steep rise seen at the time could be repeated, at least to some extent.

Read