Comments

Commented by Stefan Feulner on October 11th, 2022 | 11:09 CEST

Plug Power, First Hydrogen, Lhyfe - The calm before the storm

The long-term outlook for hydrogen as an energy carrier continues to brighten. In order to become independent of Russian oil and gas, politicians worldwide are accelerating the transformation from fossil fuels to renewable energies. Especially in the problematic transportation sector, green hydrogen is considered a key element. The correction in hydrogen and fuel cell companies, which has been ongoing for more than a year, thus offers attractive anticyclical entry opportunities in the long term.

ReadCommented by André Will-Laudien on October 11th, 2022 | 10:50 CEST

Stocks on a roller coaster ride, pay particular attention here: BYD, Manuka Resources, Porsche, VW

Currently, there are few highlights to report from the stock market. However, the mega-deal for 100,000 e-vehicles between BYD and Sixt is worth mentioning. The successful IPO of Porsche AG was also quite exciting, and for VW, it is an important strengthening of liquid funds for the transformation process towards e-mobility. In addition to inflation figures of just under 10%, we are also seeing significant markdowns in the Bund futures. Interest rates continue to rise, and a wake-up call for precious metals is spreading. Here are a few ideas.

ReadCommented by André Will-Laudien on October 10th, 2022 | 13:33 CEST

High voltage is the order of the day here: Rheinmetall, Hensoldt, Kleos Space, and Kion under power!

In the current environment, good advice is expensive. Some fundamental analyses provide the most favorable valuation parameters in 5 years, while at the same time, the depressive environment is causing one major sell-off after another. Not even a year ago, equities were even considered "no alternative" by banks and fund managers in pension provisioning. Although this is true in the very long term, this calculation only works if the portfolio management system above it correctly assesses the big waves and sets the proper risk ratio. When looking at individual stocks, it is worth first looking at some bombed-out shares.

ReadCommented by Nico Popp on October 10th, 2022 | 12:45 CEST

Opinion dictatorship of big tech like PayPal: The government must do its homework

Anyone who operates at PayPal, Meta or other tech giants has to play by the rules - so far, it's normal. But what happens when market power and regulatory demands cross borders? Just recently, PayPal published a policy that would have fined users USD 2,500 if they spread misinformation. After an outcry, the payment service provider rowed back and now claims that the policy was published "by mistake." So it was all just a coincidence?

ReadCommented by Armin Schulz on October 10th, 2022 | 12:16 CEST

Plug Power, Pathfinder Ventures, Varta - Which shares are a bargain?

On Friday, October 7, the nervousness of investors on the stock markets could be felt again. Large parts of the gains from the beginning of the week were given back. The fear of recession, rising interest rates, and inflation still prevail. For this reason, there are also well-performing companies whose shares are nevertheless dragged down by the overall market. In some cases, there are real exaggerations, and investors can find bargains at the moment. We look at three companies that have recently lost ground but have the potential for a rebound.

ReadCommented by Nico Popp on October 10th, 2022 | 11:32 CEST

Where stable percentages beckon: Shell, Saturn Oil + Gas, Deutsche Bank

Time in the market beats timing in the market. There is a lot of truth in this stock market adage. Anyone who started saving for an ETF ten years ago outshone self-proclaimed stock pickers for a long time - and without any stress or transaction costs. But right now, ETFs are no longer the way to go. Instead of relying on the "watering can" principle, investors should act in a targeted manner. We present three stocks that, at first glance, combine security and opportunity and do a reality check. What can Shell, Saturn Oil & Gas and Deutsche Bank do?

ReadCommented by Stefan Feulner on October 10th, 2022 | 10:43 CEST

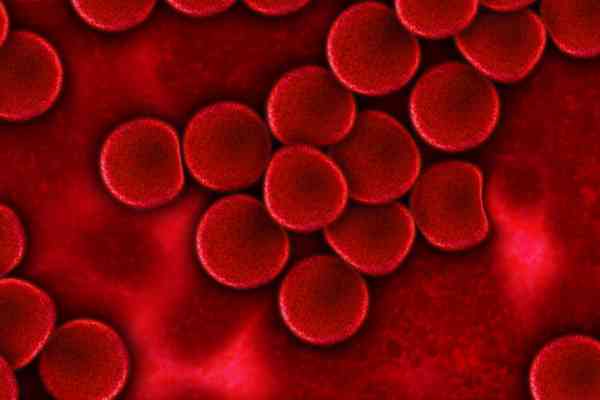

BioNTech, Fonterelli GmbH & Co KGaA, Fonterelli SPAC 2 AG, MorphoSys - Bullish forecasts

The capital-intensive biotech and pharma sector has been stuck in a correction since the central banks changed their strategy at the beginning of the stock market year. In particular, vaccine manufacturers, which have exploded since the outbreak of COVID-19, have lost disproportionately in value since their highs in August of last year. However, the pandemic is likely to be with us for the next few years, albeit in a weakened form. The development of new drugs benefits companies that could now face a similar path as the vaccine producers.

ReadCommented by Stefan Feulner on October 7th, 2022 | 12:35 CEST

First Majestic, Manuka Resources, Barrick Gold - Has the bottom been reached?

Fighting inflation at all costs is the motto of the various central bank members in the US at the moment. Despite recession worries in the financial markets, the FED is determined to curb inflation with a tight interest rate policy. The fact that this has already gotten out of hand and is difficult to contain by further interest rate steps without driving the economy to ruin should be obvious, not only to economists. The first voices calling for an end to interest rate hikes are already being heard. This could mean the starting signal for a sustained upward wave of the precious metals.

ReadCommented by Stefan Feulner on October 7th, 2022 | 11:20 CEST

BYD, Altech Advanced Materials, NIO - Battle for the battery of the future

Electromobility is considered a key technology in the transformation of the transport sector. In 2021 alone, the number of new registrations, as well as the market share of battery-powered vehicles, more than doubled. In addition to the charging infrastructure, efficiency plays a decisive role in the spread of e-cars. BYD is currently the leader with its Blade battery. However, a newcomer entered the market in recent months that could shake up the battery market with a novel technology.

ReadCommented by André Will-Laudien on October 7th, 2022 | 10:15 CEST

Strong rebound in gold: Varta, TUI, Desert Gold - Is it already buying time for these shares?

Despite all the gloom, the capital market offers plenty of opportunities every day. The Varta shares experienced a crash of over 80% in only 12 months but could also swing up by 15% within 1 week. Such movements are part of a revaluation that many stocks are now undergoing. The experienced investor is not bothered by this because, fortunately, there are upward exaggerations as well as downward ones, and both provide buying opportunities. The only question that remains is whether the level reached could already be down. Fundamental analysis helps here, but chart technology also provides valuable clues for timing. We take a closer look at the following stocks.

Read