Comments

Commented by Fabian Lorenz on September 6th, 2023 | 10:00 CEST

Hydrogen losing, oil stocks gaining: Plug Power, Shell and Cashflow Monster Saturn Oil + Gas

Hydrogen is considered the future, but is it too early for pure-play stocks to enter? Companies like Plug Power and Nel are expected to continue posting substantial losses for the foreseeable future. Both are valued in the billions, and both will likely have to carry out a capital increase before they reach break-even. By contrast, oil companies are earning brilliantly. Shell prioritizes margin over revenue, which is winning over analysts. Similarly, Cashflow Monster Saturn Oil & Gas is receiving praise from analysts. Their performance in the second quarter was slightly above analysts' expectations. Will the Canadians soon pay a monster dividend?

ReadCommented by Nico Popp on September 6th, 2023 | 09:00 CEST

Insider report shocks investors: Volkswagen, Mercedes-Benz, Altech Advanced Materials

The ongoing international decline of German automakers is a recurring theme in the media. In reality, the consequences could be fatal for companies and Germany as a whole. An insider report from the German automotive industry reveals where the biggest problems lie and in which areas Chinese competitors have already outpaced Volkswagen, Mercedes-Benz and Co. Additionally, it delves into what is crucial for a comeback of the German automotive industry.

ReadCommented by Armin Schulz on September 6th, 2023 | 08:00 CEST

BioNTech, Cardiol Therapeutics, Bayer - Tiger mosquitoes, and rising Corona numbers bring biotech back in focus

Corona infections are already rising, even though autumn has not even begun. Hospitals are already fearing a high burden during the winter. Gerald Gaß, the Chairman of the Board of the German Hospital Federation, advised high-risk patients, their close contacts and healthcare workers to keep their flu and COVID-19 vaccinations up to date. Due to constant stress triggered by crises and workload-related pressures, the number of heart patients have also increased in recent years. At the end of August, entire neighborhoods and streets in Paris were closed off to spray insecticides against tiger mosquitoes, which spread diseases like dengue and Zika viruses, among others. This is reason enough for us to examine three companies fighting these threats.

ReadCommented by Stefan Feulner on September 6th, 2023 | 07:30 CEST

Cannabis stocks showing signs of life - Aurora Cannabis, Cantourage Group, Canopy Growth

In recent years, the once-hyped cannabis industry was considered a true capital destroyer. Even market leaders like Aurora Cannabis, Tilray, or Canopy Growth saw their stock values plummet by more than 90% at their peak. A letter from the US Department of Health and Human Services has sparked the first signs of a potential revival, which could eventually lead to a sustainable bottoming out in the long run.

ReadCommented by Juliane Zielonka on September 5th, 2023 | 08:10 CEST

Gold rush mood at NVIDIA and Desert Gold - Concrete gold share Vonovia crumbling

Stock market darling NVIDIA is behaving bullish again after a moderate decline. Over 50% of NVIDIA's buying comes from S&P500 heavyweights like Microsoft, Google and Amazon. All these companies invest heavily in GPUs to develop AI models. The rising importance of Artificial Intelligence (AI) and the increased use of GPUs in this industry contribute to the increased demand for gold and other commodities used in the manufacture of GPUs. Desert Gold, an exploration and development company in Mali, is benefiting from this trend. Its main project, the SMSZ project, covers 440 sq km and has proven and indicated gold resources of 8.47 million tons with a grade of 1.14 g/t gold. The venerable concrete gold real estate market is currently experiencing severe dislocation. 31% of project development volume in Germany is experiencing delays in residential construction. We look at what investors should do now to protect their portfolios.

ReadCommented by Nico Popp on September 5th, 2023 | 07:40 CEST

Climate revolution hanging by a thread: Siemens Energy, BASF, Manuka Resources

Most people agree that the economy must become climate-neutral. However, despite promising technologies, the path to climate neutrality is not without obstacles. Handelsblatt newspaper now quotes a joint study by three institutes, according to which seven raw materials are needed to master the transformation of the economy. These include graphite, rare earths, nickel, cobalt, iridium, lithium and manganese. The scientific community also recommends that policymakers promote the entire value chains of key technologies. We look at what this means and where investors can look for opportunities.

ReadCommented by André Will-Laudien on September 5th, 2023 | 07:10 CEST

Changing of the guard in the bull market - Deutsche Bank, TUI and Viva Gold can score!

The valuation on the capital markets has developed quite differently in recent months. The DAX 40 index is currently valued at a P/E ratio of only 12, but this ratio is almost 24 for the growth stocks on the NASDAQ. Some clearly state: "In the DAX, industrial stocks dominate, whereas in the NASDAQ, growth-oriented tech companies prevail." Technology stocks accelerate many times over, even in times of crisis, if the business model fits the times. Nevertheless, they are also subject to interest rate causality, i.e. if refinancing becomes more expensive, the return on equity demanded by investors also increases. In August, the 30-year US bond exceeded the 4.25% yield mark. Historically, this has often signaled a temporary end to the tech bull market. Many second-tier stocks appear to be unjustly neglected. We name three potential beneficiaries of an upward turn in interest rates.

ReadCommented by Armin Schulz on September 4th, 2023 | 07:40 CEST

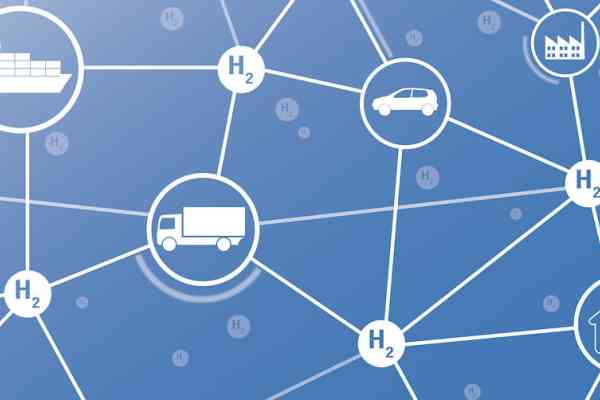

Nel ASA, First Hydrogen, ThyssenKrupp Nucera - EUR 800 million for hydrogen in Europe

The EU is determined to advance green hydrogen in Germany, and to support this goal, the EU Hydrogen Bank was allocated EUR 800 million in March. The auction process is set to commence in November, led by the European Executive Agency for Climate, Infrastructure and Environment. Subsidy payments may go up to EUR 4.50 per kg of green hydrogen. Any entity within the European Union capable of producing a specific quantity of green hydrogen at the lowest cost is eligible to participate. By 2030, the EU wants to produce 10 million tons of green hydrogen and import about the same amount. Germany also offers substantial incentives; Sunfire GmbH from Dresden, for example, received a whopping EUR 162 million in subsidies. We therefore analyze three hydrogen companies.

ReadCommented by Nico Popp on September 4th, 2023 | 07:10 CEST

E-car skepticism and charging station farce: BMW, BYD, dynaCERT

"Is it wise (…) to promote only this one technology without having access to essential battery raw materials?" BMW CEO Oliver Zipse recently expressed a somewhat critical stance towards electromobility in an interview with Handelsblatt. While BMW plans to launch the 'New Class' electric vehicles from 2025 onwards and take the lead in technology, even the BMW CEO acknowledges the strong competition from China. Let's look at what the automotive future could look like and where opportunities may be lurking.

ReadCommented by Juliane Zielonka on September 1st, 2023 | 08:10 CEST

GoviEx, Siemens Energy, Delivery Hero - Which stocks have the greatest growth potential

Seamless energy supply has become a competitive advantage. France, for example, gets 70% of its electricity from uranium. With an outstanding uranium recovery rate of 88% in Zambia, GoviEx supplies the world with this valuable energy source. The Company focuses on the exploration and development of uranium deposits in Africa. Renewables, however, are not quite taking off for them. Siemens Energy is facing significant cost problems in its onshore wind turbine business. Damages to rotor blades and bearings could cost the Company up to EUR 4.5 billion. People always need to eat. Those who prefer ordering food in light of high electricity costs should look at Delivery Hero. Citigroup seems to have better information on the delivery service than current investor sentiment suggests.

Read