Comments

Commented by Armin Schulz on March 11th, 2026 | 07:35 CET

BYD's blade offensive, the raw materials frenzy at Power Metallic Mines, and the Volkswagen earthquake: Seize the opportunity now!

The new battleground of the global economy is hidden behind the inconspicuous casing of a battery. The race for electromobility has long since become more than just a battle for the best range. It is a bitter battle for strategic raw materials and technological supremacy that will determine the winners and losers of the next decade. While the hunger for copper, nickel, and lithium is forcing new mining projects, a wide variety of strategies are colliding in this arena. We take a look at the current situation at BYD, Power Metallic Mines, and Volkswagen and analyze the opportunities and risks.

ReadCommented by Nico Popp on March 11th, 2026 | 07:30 CET

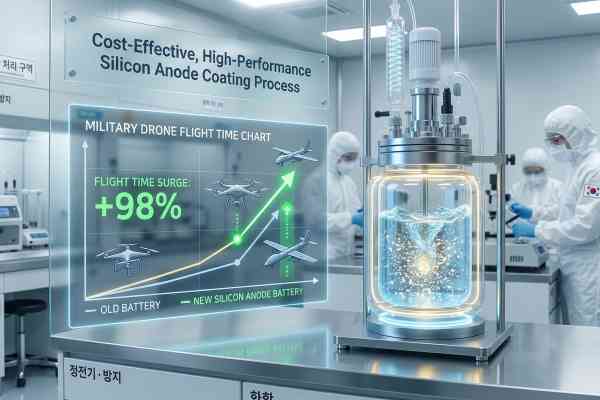

A new drone contender: The potential of NEO Battery Materials, DroneShield, and Amprius Technologies

Energy efficiency and defense capabilities are two sides of the same coin. This is especially true in the rapidly growing drone business, where powerful batteries are crucial. While global demand for batteries continues to rise sharply, according to McKinsey's analysis, the military sector is focusing on a highly specialized niche: maximizing energy density while eliminating dependence on Asian supply chains. The US National Defense Authorization Act (NDAA) for fiscal year 2026 requires that batteries for the Department of Defense be subject to strict criteria in the future in order to end the influence of rival states. In this environment, Amprius Technologies sets the standard with its enormous energy density for long-range drones (UAS). But there is promising competition with its own advantages: NEO Battery Materials' NBMSiDE technology ensures that the batteries in demand can be manufactured independently of China. The technology, which has only been validated in field tests for a few weeks, is entering a market environment in which drone defense is more important than ever. Although the global market leader DroneShield, with its AI-powered defense solutions, is considered the obvious answer to the new threats, drones are increasingly being countered directly by other drones. In this constellation, NEO Battery Materials is coming into the focus of investors.

ReadCommented by André Will-Laudien on March 11th, 2026 | 07:25 CET

Iran, Israel, USA – Investors turn to gold! Buying opportunities for Desert Gold, Barrick Mining, TUI, and Lufthansa

The daily news is not easy to stomach. Wars, conflicts, and human tragedies – who still thinks about traveling at times like these? Or is now precisely the time when people want to switch off and escape for a while? For years, investors have had to live with geopolitical uncertainty. So far, however, this has had little impact on equities, as there are always sectors that receive particular attention in such environments. Gold and silver have weathered the inflation surges since the COVID-19 pandemic remarkably well, while the tourism sector has been more of a roller coaster ride with several loops along the way. But what has worked in recent years is now back on the agenda: buy when the cannons thunder! It may sound lacking in empathy, yet it has consistently increased the wealth of those who accept the world as it is. We once again take a look at gold and the travel sector and prepare for another turbulent ride.

ReadCommented by Armin Schulz on March 11th, 2026 | 07:20 CET

Three trends, one goal: How Bayer, MustGrow Biologics, and BASF are turning the agricultural revolution into a profit opportunity

Three trends are currently driving the global agricultural economy: skyrocketing fertilizer prices, regulatory pressure to preserve biodiversity, and the insatiable hunger of a growing population. As farmers navigate between existential fears and the pressure to go green, a billion-dollar transformation of industry is looming. Old chemistry is reaching its limits, while demand for biological alternatives and precision technologies is reaching an all-time high. Amid this tension between volatility and opportunity, the future of plant production is being reshaped. We take a look at how Bayer, MustGrow Biologics, and BASF are driving this transformation and could benefit from it.

ReadCommented by Nico Popp on March 11th, 2026 | 07:15 CET

Mining comeback in Europe: Solid returns with Group Eleven Resources, Boliden, and Glencore

The European raw materials landscape is undergoing a realignment. For decades, the industry relied on cheap imports from overseas. But those days of largely unchallenged globalization are coming to an end. In order to end dependence on uncertain supply chains and ensure the survival of the industry, the focus is shifting to domestic extraction of critical metals. The European Commission has defined clear goals with the Critical Raw Materials Act and the ambitious RESourceEU Action Plan: By 2030, 10% of the mining and 40% of the processing of critical metals should occur within the EU. In this environment, the European zinc and silver sector is making a comeback. While zinc has historically been in demand primarily in the construction industry, it is now indispensable for the corrosion protection of wind turbines. Silver is even becoming a critical industrial metal due to the tremendous boom in artificial intelligence (AI) and the construction of data centers. Ireland, in particular, is establishing itself as a raw materials region in this phase. The country has one of the world's most productive geological provinces for high-grade base metals and boasts excellent geoscientific data from the Tellus program. Established mining giants such as Boliden and Glencore are setting standards, while up-and-coming explorers such as Group Eleven Resources are shining with spectacular discoveries and offering investors extremely lucrative entry opportunities.

ReadCommented by André Will-Laudien on March 11th, 2026 | 07:10 CET

Scarcity drives prices – Market turbulence continues! Almonty, Shell, and BP are the winners in the current situation

Recent developments in the Middle East have put the commodity markets under considerable strain. Within a short period, the price of oil climbed to more than USD 115 per barrel, reaching a level not seen for several years. This movement is primarily driven by increasing risks to global energy trade following the further escalation of the situation in the Persian Gulf. Particular focus is on the Strait of Hormuz, one of the world's most important energy transport routes. Around 20% of internationally traded crude oil passes through this strait every day, meaning that any disruption immediately affects prices and supply expectations. Yesterday, US President Donald Trump issued a clear warning to Iran not to disrupt international trade routes. Within four hours, the price of oil plummeted by USD 30. Scarcity, yes – volatility, extreme! The same applies to tungsten prices, which have risen by a further 100% since the beginning of the year. We take a closer look.

ReadCommented by Fabian Lorenz on March 11th, 2026 | 07:05 CET

US President Trump and the AI hyperscalers! Siemens Energy, Nordex, and Stallion Uranium shares in focus

Major AI companies in the US are taking on greater responsibility for the energy supply of their data centers. At a recent meeting with President Donald Trump, Microsoft, Alphabet, Meta, and others agreed that the boom should not come at the expense of private households. Siemens Energy is currently benefiting greatly from this. Gas-fired power plants are currently the preferred solution for hyperscalers when it comes to power supply. At the same time, they are all relying on nuclear energy. The required uranium is expected to come primarily from North America. This makes Stallion Uranium shares interesting for investors. A steady stream of news could support the stock this year. At Nordex, the tailwind is currently subsiding. At least the shares appear to be consolidating. Analysts are full of praise, and operations are running smoothly.

ReadCommented by Mario Hose on March 11th, 2026 | 07:00 CET

The “Silver Viper” strikes: How Silver Viper Minerals, United States Antimony, and ConocoPhillips can shake up your portfolio!

Even after a strong 2025, the commodities market in 2026 is more dynamic than ever before, and at the center of this development is a company that has just joined the ranks of top performers. Through smart acquisitions and impressive drilling results in Mexico, Silver Viper Minerals has carved out a position that is causing a stir among experts and investors alike. But while the glamour of gold and silver attracts many, there are strategically important assets operating in the shadow of precious metals, such as United States Antimony, which serve a completely different but essential niche that is becoming increasingly important, especially now in an era of global conflict and geopolitical flashpoints. This field is flanked by heavyweights such as ConocoPhillips, which acts as an anchor of stability in the energy sector. In this report, we highlight why these three very different stocks could be on the move right now in a world of shiny silver, rare metals, and global energy supply, and why they could be an asset to your portfolio.

ReadCommented by Stefan Feulner on March 10th, 2026 | 07:35 CET

Almonty Industries, Glencore, Rio Tinto – The battle for critical raw materials intensifies

The global commodities landscape is approaching a turning point. Export restrictions, geopolitical tensions, and surging demand from the defense sector, the energy transition, and high-tech industries are driving up the prices of strategic metals. Particularly critical raw materials are coming under increasing pressure, while important producing countries are tightening control over their supply chains. Analysts are already talking about a structural revaluation of entire raw materials markets. At the same time, selected producers and trading groups are benefiting from rising prices, new projects, and strategic alliances along the supply chains. For investors, this means that companies that secure access to scarce metals and could play a key role in the new raw materials order are coming into focus.

ReadCommented by André Will-Laudien on March 10th, 2026 | 07:30 CET

Defense, oil, and turbulent times - Silver at USD 150? Investors eye Airbus, Silver Viper, OHB, Rheinmetall, and RENK

The turbulence in the markets is no coincidence. It is not only the extremely aggressive foreign policy of the US President that is pushing other countries into a corner. Direct interventions in foreign state systems are also shifting power balances and global supply chains. China has long since responded to this form of imperialism by terminating international trade agreements for critical metals. With oil prices suddenly surging, new geopolitical issues are naturally coming to the fore, placing both East and West in a difficult position once again. Major oil suppliers in the Middle East are currently unable to meet their production quotas, while Russia remains under sanctions. This leaves the United States and Canada as the primary alternatives - a windfall for producers in those countries, who can now ramp up production at full speed. Silver also appears to have reached a crucial point. The large short positions from January have likely been covered, but industrial demand is now skyrocketing. Investors should therefore take a closer look at promising projects such as Silver Viper, which in the long term could supply customers around the globe.

Read