February 9th, 2026 | 07:15 CET

Missed out on a 1,000% rally? Antimony Resources with significant upside potential! Following in the footsteps of MP Materials and Almonty!

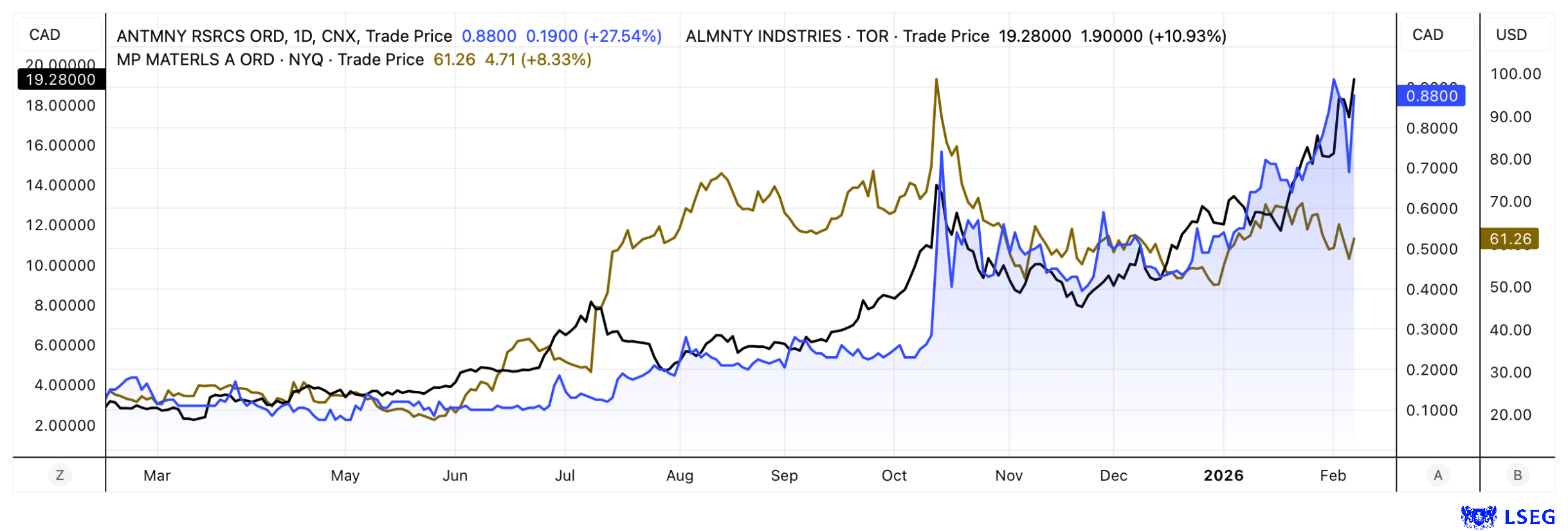

Almonty Industries has gained over 1,000% in recent months. MP Materials has gained over 500%. Both companies produce critical metals such as tungsten and rare earths. Both have further price potential, but are also valued in the billions. Antimony Resources is currently worth around just EUR 50 million. While Antimony Resources is still at an earlier development stage, accelerating government support in the US and Canada could significantly shorten the path to production. If this succeeds, Antimony Resources should also be able to multiply its value.

time to read: 3 minutes

|

Author:

Fabian Lorenz

ISIN:

ANTIMONY RESOURCES CORP | CA0369271014 , MP MATERIALS CORP | US5533681012 , ALMONTY INDUSTRIES INC. | CA0203987072

Table of contents:

Author

Fabian Lorenz

For more than twenty years, the Cologne native has been intensively involved with the stock market, both professionally and privately. He is particularly passionate about national and international small and micro caps.

Tag cloud

Shares cloud

Critical raw materials and Trump's billions!

Western countries will not be able to change their vulnerability to blackmail through China's supply of critical raw materials in the short term. They have neglected this strategically important issue for too long. However, the US not only seems to have recognized the seriousness of the situation, but is also going full throttle to change it. Since last year, direct investments in raw materials companies and support for projects have repeatedly caused a stir and led to price jumps. Then came the next bombshell in early February. US President Donald Trump announced plans to build a strategic US reserve for critical minerals. The "Vault" project is set to start with USD 12 billion. The US government plans to provide USD 10 billion through the Export-Import Bank. The remaining USD 2 billion is to come from the private sector. The aim is to create a buffer that gives companies access to important raw materials in the event of a crisis and reduces dependence on Chinese-dominated supply chains. The metals are likely to include the lesser-known antimony. It is officially considered a critical mineral, not only in the US. This means that Antimony Resources is likely to have a very exciting future ahead of it.

From niche metal to strategic factor

Antimony Resources is currently developing what is likely the largest antimony deposit in North America. The Bald Hill project is located in New Brunswick, Canada. Like the US, Canada has recognized the urgency and opportunities for its own country and is currently providing significant tailwinds for the raw materials sector, especially the critical minerals industry. The government sees this as a lever for competitiveness, energy sovereignty, and economic growth. Specifically, this is being done through financial incentives (including the expansion of the Clean Technology Manufacturing Investment Tax Credit to additional critical metals) as well as targeted support programs and infrastructure financing along the value chain. At the same time, projects are being supported to get through the approval process more quickly.

High-grade deposit for efficient mining

Antimony Resources intends to take full advantage of the positive environment and is moving full steam ahead with the Bald Hill project. CEO Atkinson recently reported on the Phase 2 drilling program in 2025, which will cover over 8,000 meters. This brings the cumulative drilling performance in the concession area to more than 13,800 meters. As with the initial drilling, 75% to 80% of the hits were again high grade. Due to the high grade, the plan is to start production with lean structures and thus lower capital requirements compared to the competition. The next step is to implement a 10,000-meter drilling program to produce a robust resource estimate.

https://youtu.be/6bjeA5Be2F0?si=tSxilHEv5C6Vvt04

New antimony deposit discovered

Shortly after Donald Trump announced his plans for the Vault project, Antimony Resources announced the discovery of further massive antimony deposits (stibnite mineralization). In the Marcus Zone (West), the resource has been further delineated, and mineralization has been exposed in bedrock over a length of 25 meters. The deposit was discovered while preparing a drill line for the 2026 exploration program in the main zone. The Marcus Zone will now be further explored through trenching and sampling.

In addition, the start of the drilling program in the main zone was reported. Two drill rigs are already in operation to better define the area. A third drill rig is expected to be added shortly. Drilling is planned over a length of 600 meters and to a depth of at least 300 meters. This data will then be used to calculate an initial resource estimate.

Conclusion: Valued at EUR 50 million and with potential for growth

Almonty and MP Materials have gained up to 1,000%. Both have further upside potential, but are now also billion-dollar companies. Antimony Resources is currently valued at around EUR 50 million. Of course, it is still in its infancy and therefore has a different risk profile, but this also means there is the chance of a multiple increase.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.