NVIDIA CORP. DL-_001

Commented by Nico Popp on August 23rd, 2023 | 08:40 CEST

Adyen - a warning signal for NVIDIA and Co? Power Nickel as an alternative

Growth is the fuel of the markets. When business is booming, and additional excitement is generated, stocks can turn a small fortune into a large one. For example, those who invested in the shares of the Dutch payment service provider Adyen in 2019 saw their investment more than quadruple by 2022. However, since last week, the stock has been plummeting. We explain why Adyen serves as an example for potential upcoming crashes and specifically targets the chip sector - could giants like NVIDIA be heading for a crash soon? Additionally: What investment alternatives are available?

ReadCommented by Juliane Zielonka on July 20th, 2023 | 06:40 CEST

High-tech as an investment opportunity - how Almonty Industries, NVIDIA and FREYR Battery are profiting from the boom

With KT's Mine Safety DX technology, tungsten producer Almonty Industries is conducting pioneering work in the Sangdong mine in South Korea. The solution enhances worker safety and promotes efficient mining practices, a sign of strong ESG commitment. Due to its high density, comparable to gold, tungsten is used in aerospace, automotive, sports and telecommunications applications. NVIDIA is also going high-tech, building the world's first supercomputer to give companies quick and easy access to AI. Norwegian company FREYR Battery, on the other hand, can look forward to EUR 100 million in EU funding as a non-member. Why? Find out here.

ReadCommented by Stefan Feulner on July 19th, 2023 | 07:35 CEST

Trend stocks in focus - Nvidia, Smartbroker Holding AG, Coinbase

They keep going and going. In the wake of the AI revolution, Nvidia is rushing from high to high. Some of the major players in the crypto sector have also been able to multiply since the beginning of the year. The trend for Bitcoin & Co is just beginning. With a breakout above the mark of USD 32,400, the momentum could increase further. Take advantage of the opportunities that arise and bet on the trend.

ReadCommented by André Will-Laudien on July 12th, 2023 | 07:50 CEST

Prime Day at Amazon! Nvidia, Defense Metals, Infineon - No Artificial Intelligence without metals!

US Treasury Secretary Janet Yellen has concluded her four-day trip to China. The conclusion of the visit is quite positive on both sides, even if Yellen openly admits differences between the two world powers. Relations between Washington and Beijing have deteriorated significantly in recent years over trade and human rights issues, dealings with Taiwan, and a host of other issues. However, the supply situation of strategic raw materials remains an important issue. We examine buying opportunities in the high-tech sector.

ReadCommented by André Will-Laudien on June 21st, 2023 | 08:20 CEST

Financial System 3.0 saved? Deutsche Bank, Defiance Silver and Nvidia - Artificial Intelligence conquers the banking world!

We cannot help but feel a little uneasy when we see the capabilities of Artificial Intelligence, even as mere users, as demonstrated, for example, by ChatGPT. However, Big Data and related analysis tools have been used by large IT companies for years and accompany our daily lives in the background. Currently, the behaviour of financial institutions and the actions of central banks are of particular interest. They must pull out all the stops to smooth out the distortions caused by inflation, war and the interest rate explosion. A tried and tested means in the past was the creation of liquidity, but that is no longer working. Where do the opportunities for investors lie?

ReadCommented by Juliane Zielonka on June 15th, 2023 | 07:25 CEST

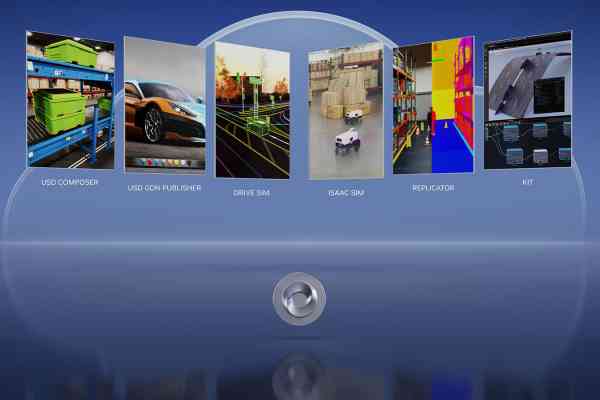

Nvidia, Defense Metals, Uniper - Valuable commodities for trillion-dollar digital market

Digital transformation is critical for industrial companies worldwide to remain competitive and gain strategic advantage. In this context, Nvidia and Hexagon have partnered to provide companies with a comprehensive set of solutions for accelerating industrial digitalization. Defense Metals, on the other hand, secured the supply of essential rare earths for the global energy transition with a successful hydrometallurgical trial and feasibility study. The Wicheeda project in British Columbia strengthens the local energy supply and offers strategic advantages in defence, security and green technology. Uniper, an international energy company, relies on biomass instead of natural gas for energy production. With the construction of a syngas plant in the Netherlands, the Company aims to replace natural gas with sustainable gas in chemical production processes.

ReadCommented by André Will-Laudien on June 7th, 2023 | 08:30 CEST

Billions with Artificial Intelligence? Nvidia, Grid Metals, Deutsche Telekom, Apple - Short sellers spotted!

The stock market is not a one-way street. Some investors have recently experienced this firsthand. Because in the "ups and downs" of sentiment, new trends are constantly emerging. The biotech sector, for example, has been falling for more than a year, and the charts keep reaching new lows. In 2020, cannabis stocks made a splash, with the related index, POT, increasing tenfold since 2018 to about 1100 points. However, yesterday it reached a new all-time low with 45.5 points or a 95% loss. Currently, investors are trying to ride the wave of "Artificial Intelligence" (AI), with stocks like C3.ai, Nvidia, Microsoft, and Palantir all performing well in 2023. A new megatrend is underway here that, according to experts, will continue for several years. How long this boom will yield returns is unknown, but these stocks are currently performing strongly.

ReadCommented by Nico Popp on June 6th, 2023 | 07:00 CEST

AI hype - Keep a cool head now: NVIDIA, AMD, Altech Advanced Materials

Chip stocks are all the rage on the market! The triumph of artificial intelligence (AI) has fuelled their demand. The idea is that the more AI we use worldwide and in everyday life, the more computing power is needed. But is it even worth getting in now? And are the obvious investments always the best? We highlight three of the most exciting AI stocks and take a look at a revolution that only insiders have been celebrating so far.

ReadCommented by André Will-Laudien on June 2nd, 2023 | 08:30 CEST

Is the Artificial intelligence hype already over? Nvidia, Star Navigation and C3.ai with good chances of a correction!

With an eye on rapid technological progress, the EU and the US want to cooperate more in the field of artificial intelligence (AI). "We are determined to make the most of the potential of emerging technologies while limiting the challenges they pose to universal human rights and shared democratic values," the Joint Trade and Technology Council announces. For the accompanying ethics committees, an important issue now comes to the table: what is a machine allowed to do, and what is it not allowed to do? So the current hype could be curbed again somewhat. Have AI values already peaked?

ReadCommented by André Will-Laudien on May 30th, 2023 | 09:00 CEST

ChatGPT, Artificial Intelligence and E-Mobility! BYD, Almonty Industries, Nvidia - 100% performance with strategic metals!

Those aiming to accelerate artificial intelligence, e-mobility, or the energy transition need access to critical metals. The EU and the USA have the extraction of domestic resources on the agenda in order to become independent of the raw materials giants China and Russia. Long approval phases, too little exploration and a lack of investment capital have made this problematic over the last 10 years. Now a law is being prepared to secure the supply of raw materials in the EU. Resourceful investors can position themselves early on.

Read