EVOTEC SE INH O.N.

Commented by Fabian Lorenz on April 3rd, 2025 | 07:20 CEST

Stock set for 100% rally! Evotec, thyssenkrupp, Vidac Pharma - A golden April ahead?

Can shareholders look forward to a 100% price gain soon? If analysts have their way, this could be imminent for Evotec. However, shareholders must first mark an important date in April, as the medium-term share price performance is likely to be decided then. For Vidac Pharma, analysts see even greater upside potential, making the current price weakness an interesting entry opportunity. After all, the biotech company is making operational progress. One of the surprises of the current week is thyssenkrupp. The Company is benefiting from billions being spent in defense and infrastructure. Now, it could also benefit from Trump's tariff policies. Analysts recommend buying.

ReadCommented by André Will-Laudien on April 1st, 2025 | 07:20 CEST

Was that the Trump crash? Nevertheless, steeply upwards with Evotec, Bayer, BioNTech, Defence Therapeutics, or Valneva?

Since November 2024, Donald Trump has driven the markets sharply upward - his controversial new presidency was largely celebrated by investors. Now, his leadership feels somewhat unsettling, with fires seemingly being set again at every corner. The new president is acting more imperiously than ever, with Panama, Canada, and Greenland verbally on the agenda as the next US states. Meanwhile, the US administration is facing a considerable deficit, which is to be addressed by drastically reducing the size of the public sector and introducing tariffs. Unsurprisingly, interest rates are now rising sharply, which is a reason for weaker prices in the biotech sector. However, the sector has done its homework and is emerging from a three-year downturn. Are we now at buying levels?

ReadCommented by Fabian Lorenz on March 27th, 2025 | 07:00 CET

Rocketing prices and takeover speculation! Steyr Motors, Evotec, and Defence Therapeutics!

Steyr Motors is now riding not only the defense wave but also the takeover wave. After the announcement of a cooperation with a Rheinmetall subsidiary, the niche stock has become a shooting star. However, the price has also come back just as quickly. The Austrians now want to grow aggressively through acquisitions. Without takeover speculation, the share price of Defence Therapeutics has already risen by over 60%. The biotech company is still inexpensive, is making progress in monetization, and could become an acquisition candidate. Evotec is currently out of steam. Analysts see significant downside potential and a chance of a turnaround.

ReadCommented by Armin Schulz on March 25th, 2025 | 07:10 CET

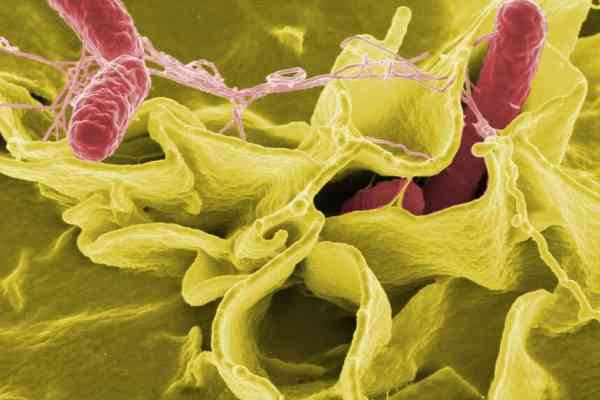

Evotec, NetraMark, Novo Nordisk – From the lab to a golden digital future with artificial intelligence

The pharmaceutical industry is experiencing a revolution that is changing everything! Artificial intelligence is sweeping through laboratories and breaking with old habits. Algorithms scour billions of chemical structures in record time, uncovering hidden treasures of active ingredients. While years used to pass before a drug entered the testing phase, AI models are now picking up the pace. Heavyweights like AstraZeneca are in a neck-and-neck race with start-ups. Who will be the first to crack incurable diseases? The goal is to tailor therapies, revolutionize clinical studies, and save lives. Only those who use AI will remain competitive and be able to offer patients innovative drugs faster. The era of data-driven medicine has begun.

ReadCommented by Fabian Lorenz on March 11th, 2025 | 07:20 CET

Is a 100% rally on the horizon? Evotec, D-Wave, and AI pearl NetraMark

The sell-off in the tech sector continues at the beginning of the week. If sentiment changes, a 100% rally could start. At least, that is what analysts at D-Wave expect. Overall, analysts take a positive view of last year's quantum star. The development of the AI pearl NetraMark is also positive. With its NetraAI platform, the Company aims to revolutionize the development of drugs. The first customers are in place, and the latest study data is promising. Even in the current sell-off, the stock wants to go up. The positive news is currently evaporating at Evotec. The stock is threatening to fall below EUR 6. Are there further write-offs?

ReadCommented by André Will-Laudien on March 3rd, 2025 | 07:35 CET

Biotech: Takeover candidates for 2025! Things are heating up at Evotec, BioNxt, Bayer, and Formycon!

The DAX 40 index is hitting new highs, following a gigantic wave of buying from the US. The rally is already well advanced, but due to ongoing geopolitical upheavals, high-tech and defense stocks are still performing well. In recent weeks, the positive trends have also spread to the biotech sector again. Stocks such as BioNxt have already gained over 150% in the last six months. What is driving this? Formycon has seen a severe price drop, while Bayer and Evotec are slowly getting back on track. Are we going to see takeovers now? What are the triggers for dynamic investors?

ReadCommented by André Will-Laudien on February 27th, 2025 | 07:50 CET

Attention – Biotech is taking off! Evotec, Vidac Pharma, BioNTech, and Novo Nordisk in focus

With new index highs and huge daily trading volumes, the biotech sector has been back in the spotlight for several weeks. At Evotec, the personnel merry-go-round continues, while BioNTech has announced an acquisition in the oncology field. After the big crash in Novo Nordisk shares, the first share buybacks are now taking place, but growth rates have been revised downwards. Vidac Pharma has just completed a roadshow and will present its latest progress at the Sachs Health Science CEOs Forum in Zurich. Share prices across the sector appear to have turned in the last quarter. It is now time for investors to take a closer look again. We offer a few insights.

ReadCommented by Armin Schulz on February 27th, 2025 | 07:30 CET

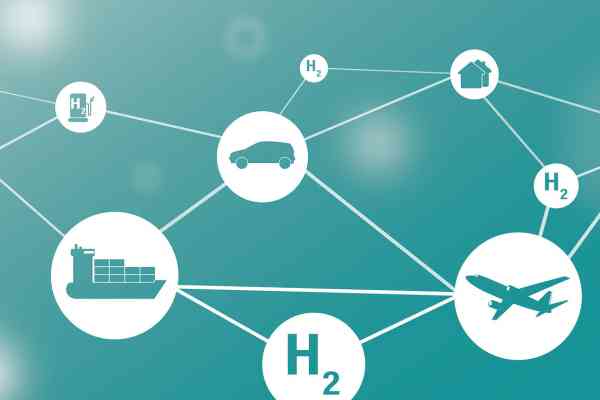

Bayer, BioNxt Solutions, Evotec – Artificial intelligence as a gamechanger in pharmaceutical research

New technologies and innovative solutions will completely transform the future of medicine. To prepare for this as well as possible, hurdles such as bureaucracy, financial issues, and outdated structures must be overcome. At the same time, management must set the course, as development is continuing at a rapid pace – whether through artificial intelligence (AI) in drug research or customized therapies for individual patients. One thing is clear: anyone who wants to keep up here must think differently. But how are companies tackling this in practice? Three examples reveal why flexibility and fresh ideas are crucial right now for staying ahead in the long term.

ReadCommented by Fabian Lorenz on February 26th, 2025 | 07:10 CET

Key Industry: Defense! Will Rheinmetall, Renk & Co. soon turn to dynaCERT? Stock Jump at Evotec?

A bombshell at Rheinmetall! The defense company is considering converting automotive supply plants into defense production. Previously, Hensoldt had already reached out to Continental employees. It seems that defense companies are rushing to aid the struggling automotive industry as a key industry and job engine – or perhaps to replace it. Tanks, howitzers, and other heavy vehicles have one thing in common: diesel engines. To improve the CO2 balance of these vehicles, it would be only logical for Rheinmetall and Co. to turn to dynaCERT. The Company offers a retrofittable, affordable solution for reducing emissions and fuel consumption. Evotec does not have to worry about its carbon footprint. Instead, the share is showing signs of life!

ReadCommented by Fabian Lorenz on February 10th, 2025 | 07:30 CET

BIOTECH stocks in RALLY MODE: Valneva, BioNxt Solutions, Evotec – BUY signal or correction?

After the 50% rally, the stock of BioNxt Solutions is currently consolidating. However, the next buy signal could be generated soon. There will likely be some exciting announcements this year and perhaps even a strategic partnership. The new R&D site in Munich will likely also attract attention for the innovative biotech company in Germany. After the catastrophic year, things have quieted down for the time being at Evotec. Or is it more that the air has been let out? After all, there is a lot of uncertainty about what skeletons might still be in the closet and how things should continue strategically. The stock market does not like that. In contrast, Valneva has had an impressive rally since mid-January. Last week, there was another big announcement. After 50%, is there more potential with the French company?

Read