BYD CO. LTD H YC 1

Commented by Stefan Feulner on March 29th, 2022 | 11:25 CEST

BYD, Meta Materials, Salzgitter AG - Unabated rise

Inflation is rising relentlessly and is likely to last far longer than predicted by the monetary authorities at the beginning of the year. The Russian war of aggression in Ukraine and the resulting sanctions have caused extreme price increases for energy and raw materials. Trade flows and supply chain relationships have also been severely impaired. Uncertainty about further economic developments remains high, but the price increases due to the escalation of the Russia-Ukraine conflict are only partially reflected in the inflation rate to date. As a result, the industry can expect higher costs in the coming months. By contrast, producers of various materials are benefiting.

ReadCommented by Armin Schulz on March 28th, 2022 | 13:44 CEST

Infineon, Edison Lithium, BYD - Raw material shortage for electric cars

The shift from combustion engines to electric cars poses new challenges for production. An electric vehicle requires significantly more chips, more copper and more raw materials such as nickel and lithium for the batteries. Most recently, the nickel price climbed to over USD 100,000 per ton, partly due to the sanctions against Russia. But the price of lithium is rising. The demand for batteries is still significantly higher than the supply after the rethinking of the automotive industry. Today, we highlight two problem areas and look at an electric vehicle manufacturer.

ReadCommented by Stefan Feulner on March 21st, 2022 | 12:13 CET

BYD, First Hydrogen, Continental - Hydrogen and e-mobility: Shares with huge potential

Germany must become more independent in terms of energy supply in the future. The war between Russia and Ukraine in the middle of Europe ruthlessly demonstrates how much the Federal Republic of Germany is at the mercy of fossil fuels. Now, at the latest, it should be apparent to every skeptic that the expansion of renewable energies and the transformation in the transport sector must proceed all the more quickly. The opportunities for the companies involved are enormous.

ReadCommented by Carsten Mainitz on March 15th, 2022 | 13:21 CET

Volkswagen, Edison Lithium, BYD - Important and expensive raw materials

The electromobility industry is growing rapidly, and automakers are accelerating their electric strategy. However, this requires the necessary resources such as cobalt, copper, lithium and nickel. Increased demand is meeting a more than scarce supply. The result is sharply rising prices. The primary beneficiaries are the producers, who can expect growing sales and profits in the coming years.

ReadCommented by André Will-Laudien on March 14th, 2022 | 13:23 CET

The battery sensation: Varta, BYD, NIO, Power Nickel: Shares down, oil price above USD 150?

Since the invasion of Russian troops in Ukraine, the changes in the world are now clearly noticeable. Above all, it is tragic that thousands of people have died, and millions are once again forced to flee their homes. There is despair and compassion all over the globe because most nations have been blessed with peace for decades. The standard of living has also increased significantly in 95% of regions. Now, time seems to be running backward again: raw materials, food and everyday necessities are becoming dramatically more expensive, leading to substantial inflationary spurts sector by sector and pushing the level of prosperity back again. But it also shows: We humans must become more independent of fossil energy and advance alternative technologies. We show you shares that are in line with this trend.

ReadCommented by Carsten Mainitz on March 11th, 2022 | 11:35 CET

Saturn Oil + Gas, BYD, Bayer - Winning with strong companies

When oil futures were trading in negative territory even for a short time at the outbreak of the Corona pandemic in the spring of 2020, many experts assumed that the black gold would remain at a low level in the long term. Only JPMorgan spoke at that time of a possible supercycle and prices over USD 100 per barrel. The analysts cited the supply shortage due to the swing towards green energy production as the reason. Due to the Ukraine crisis, supply has once again been drastically reduced, which is likely to fuel oil prices in the long term.

ReadCommented by Nico Popp on March 3rd, 2022 | 10:44 CET

BYD, Nevada Copper, Mercedes-Benz Group: Price shock also at the charging station

The fact that prices at gas pumps are constantly rising is nothing new for drivers. But with the price shock now also looming at charging stations, it is a new experience for many e-car drivers. Providers of charging infrastructures, such as EnBW, Tesla, Enel and Stadtwerke München, have raised their prices in recent months, in some cases significantly: The kilowatt-hour has become between 8% and 82% more expensive. What will happen now?

ReadCommented by Armin Schulz on February 28th, 2022 | 12:43 CET

Alibaba, Hong Lai Huat, BYD - Asia as a safe haven for investments?

The war in Ukraine is causing falling stock indices on both sides. The sanctions against Russia will be extensive; even Nord Stream 2 has been stopped for the time being, although Olaf Scholz did not want to name the pipeline for a long time when it came to possible sanctions. Many countries are calling for Russia to be excluded from the SWIFT system. However, this would mean that many countries would be harming themselves, as energy imports from Russia would no longer be affordable. The war will have losers on both sides. Investors who still want to make their money work for them can take a closer look at companies from the Asian region. China is neutral in the showdown. Which stocks offer opportunities?

ReadCommented by André Will-Laudien on February 24th, 2022 | 09:41 CET

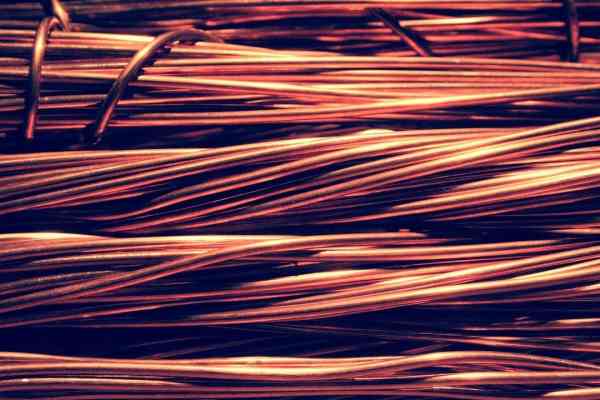

BYD, Nio, Nordex, Phoenix Copper: Nothing works without copper!

Electromobility is becoming increasingly crucial for the energy transition in transportation. And with it, the research and development of drives, batteries and power-saving components. However, in addition to electricity storage, vehicle cabling and the fitting of high-tech components are also coming to the fore. Today, an electric vehicle requires 3 to 4 times as much copper as it did 20 years ago. Still, the earth's deposits are exhaustible, and copper, in particular, is pretty much stretched to the limit. A spot price of just under USD 10,000 per kilo clearly shows how the markets are processing this situation. A current conflict, such as Ukraine, provides additional fuel and further rising prices! Where are the opportunities?

ReadCommented by Nico Popp on February 17th, 2022 | 13:21 CET

BYD, Edison Lithium, Rock Tech Lithium: Investing in the Saudi Arabia of electromobility

Ever since this year's Super Bowl, it has been clear that the future of mobility will be electric. What does one have to do with the other? Advertising space during mega-sports events is in high demand. This year, seven companies from the sector advertised e-cars and accessories, including BMW with a spot featuring Arnold Schwarzenegger. Other companies that spent up to USD 6.5 million for 30 seconds of advertising included Polestar and Nissan. But e-cars are not yet a foregone conclusion. The technology poses challenges for suppliers and raw material producers. We present three companies that are well placed to score points with their products despite adverse conditions.

Read