STANDARD LITHIUM LTD

Commented by Fabian Lorenz on October 29th, 2025 | 07:15 CET

BLOODBATH at MP Materials and Standard Lithium! Globex Mining benefits from diversification!

A CRASH has hit in rare earths and other critical metals. The high-flyers of recent weeks are undergoing a sharp correction. The reason: the US and China appear to be moving closer together on rare earths and the broader tariff dispute. Could this mark the end of the rally for MP Materials and Standard Lithium? Both stocks have lost well into double digits from their highs. For investors who still want to benefit from the commodity boom and sleep soundly at night, Globex Mining offers an appealing alternative. The mining incubator holds interests in gold, silver, and many critical metals. In addition, the Company does not undertake risky exploration itself, but secures profit-sharing agreements in promising projects.

ReadCommented by Armin Schulz on October 27th, 2025 | 07:20 CET

China's export lockdown: How you can profit NOW with Almonty Industries, Standard Lithium, and MP Materials

Global dependence on critical metals is becoming a strategic Achilles' heel. China's recent export restrictions on tungsten and rare earths are dramatically exacerbating the supply crisis and driving up prices for raw materials that are essential to the energy transition. In this tense market environment, three companies are positioning themselves as key suppliers outside China, at just the right time to benefit from this historic market shift: Almonty Industries, Standard Lithium, and MP Materials.

ReadCommented by Fabian Lorenz on October 24th, 2025 | 07:00 CEST

CRASH vs. BUYING OPPORTUNITY? Hensoldt, Standard Lithium and Antimony Resources stock review

What is going on at Standard Lithium? The highflyer of recent months saw its stock plunge by as much as 20% this week. What is behind the crash, and is now a good time to buy? Antimony Resources is a newcomer to the commodities boom. Antimony is gaining importance in the defense and semiconductor industries, and the market is largely controlled by China. Antimony has an exciting project in Canada, and its stock is anything but expensive. Hensoldt, on the other hand, is costly. To justify this, the Company's order backlog needs to grow significantly. The next opportunity for Hensoldt to convince investors will come soon.

ReadCommented by André Will-Laudien on October 16th, 2025 | 07:35 CEST

Gold continues to soar to USD 4,200, critical metals in a panic storm! MP Materials, AJN Resources and Standard Lithium

The US government has declared a state of emergency regarding critical metals. Due to disrupted trade policies with China, Beijing is threatening to halt the supply of key metals and rare earths completely. Will the tariff threats from the Trump administration help? It is doubtful, as China clearly holds the upper hand. Western industrial powers have long understood the stakes. Building domestic mining operations takes time and money, but it is urgently necessary. Investors can benefit from the panic scenarios of recent weeks because commodity markets have been lying in wait for years and are now being hit by an immeasurable flood of money. Where should investors position themselves now?

ReadCommented by Armin Schulz on October 15th, 2025 | 07:00 CEST

Volkswagen in a tight spot: Why European Lithium and Standard Lithium are now the more valuable players

The global electric vehicle revolution is facing its biggest test yet. China's looming export restrictions on critical battery raw materials threaten to destabilize Western manufacturers' supply chains from 2025 and increase production costs. But it is precisely these geopolitical tensions that are catapulting independent lithium producers into the spotlight. While established giants are fighting for their security of supply, agile players are benefiting from this power vacuum. The strategic maneuvers of Volkswagen, European Lithium, and Standard Lithium reveal who the real winners of this upheaval will be.

ReadCommented by Fabian Lorenz on October 13th, 2025 | 07:30 CEST

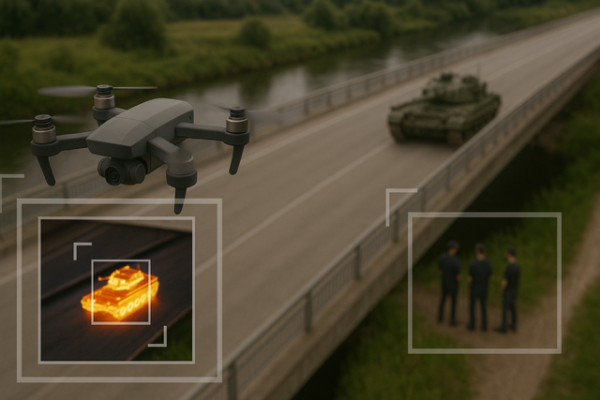

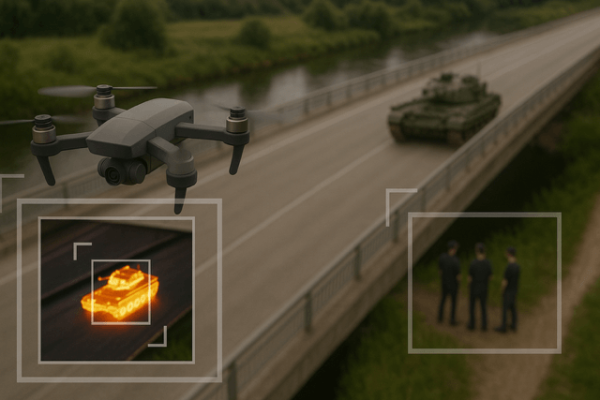

Drone boom and multiplication: Following DroneShield, RENK, and Standard Lithium, NEO Battery Materials shares are taking off!

Missed out on the multiplication of shares such as DroneShield, RENK, and Standard Lithium? Investors can still get in early with NEO Battery Materials. The Company is benefiting from the drone boom and the raw materials conflict between the US and China. NEO Battery Materials has developed advanced battery technology. The first manufacturer of drone batteries has already placed an order. In the future, the Company also plans to offer complete batteries itself. To save time in commercialization, a factory has been leased. This will allow for rapidly increasing sales and profits. The tariff and raw materials conflict between the US and China is likely to give NEO an additional boost. When will the stock take off?

ReadCommented by Fabian Lorenz on October 10th, 2025 | 07:20 CEST

Bombshell at Plug Power! Things are getting "critical" at Standard Lithium and Graphano Energy! Donald Trump is shaking up commodity stocks!

Investors are currently rushing to buy stocks in the rare earths, tungsten, and lithium sectors. The driving force behind this is the US government, which is investing in companies involved in critical raw materials to secure independence from China. Could Graphano Energy be next in line for government participation? In any case, no battery can function without the critical mineral, graphite. Graphano Energy is attractively valued and holds projects in Canada. Standard Lithium is benefiting from the hype surrounding critical metals. After rising more than 60% in four weeks, has a correction now arrived? Plug Power is in the midst of one. This week, the stock fell by over 20%. A capital measure and the surprising departure of the CEO are causing uncertainty.

ReadCommented by Fabian Lorenz on October 7th, 2025 | 07:10 CEST

SHARE PRICE EXPLOSION at Standard Lithium, European Lithium, MP Materials! These commodity stocks are outshining Barrick Mining!

It does not always have to be gold! Barrick has gained around 80% so far this year. The following commodity stocks are outperforming it significantly. European Lithium's share price has exploded by over 100% since Friday. Initially, a share buyback sparked the euphoria, then came the bombshell: Reuters reported a possible US government investment in Critical Metals. European Lithium holds the majority of the Company, which is focused on the exploration of a massive rare earths project in Greenland. The impact of a US entry was already demonstrated by MP Materials this summer, where Apple is also involved. Standard Lithium has gained an impressive 200% in six months. How far will the boom in critical raw materials drive these stocks?

ReadCommented by Fabian Lorenz on September 8th, 2025 | 07:05 CEST

Top news and price target raised! Plug Power, Standard Lithium, and BMW partner European Lithium

In the run-up to the IAA, BMW is stealing the spotlight from other automakers. The focus of attention is clearly on the Munich-based company's "Neue Klasse". If the new electric models are a success, European Lithium stands to benefit - they are set to supply the lithium for the batteries. But this raw materials gem has a second ace up its sleeve: rare earths. The stock is being driven by positive news flow, which is likely to continue. Standard Lithium is also seeing strong momentum. Analysts have recently raised their price targets significantly. In contrast, the alarm lights continue to flash at Plug Power. While revenue is rising and costs are falling, cash burn remains a concern. Nevertheless, analysts are recommending the hydrogen stock as a "Buy".

ReadCommented by Fabian Lorenz on August 21st, 2025 | 07:00 CEST

Up to 300% with raw materials and defense! Standard Lithium, DroneShield, and zinc play Pasinex!

DroneShield's stock has plummeted by around 20% in recent days. However, with a performance of over 300% in 2025, the Australian company remains one of the top performers. The drone defense specialist recently reported on its performance in Q2. Revenue is at record levels, and the order book is full. Will that be enough? Pasinex Resources remains in rally mode. The chances of a continuation are high, as important milestones are coming up and the stock remains favorable. Standard Lithium has celebrated a comeback in recent months, recovering from its brutal crash at the turn of the year. What is next?

Read