ROYAL HELIUM LTD.

Commented by Stefan Feulner on March 4th, 2021 | 09:03 CET

NIO, Royal Helium, Xpeng - the fierce battle for raw materials!

The market price is determined by supply and demand. Due to the global climate programs of politics, the pressure increases and the demand grows enormously in the coming years. Raw materials such as rare earth metals, lithium, helium, copper or even silver will become extremely scarce commodities. There is a threat of drastic price increases. In recent years, significant investments in raw material projects have been neglected. To provide more supply, it will now be a race against time. In any case, the producers will profit.

ReadCommented by Nico Popp on February 15th, 2021 | 10:00 CET

Linde, Royal Helium, Siemens Healthineers: Which stocks are stepping on the gas?

When it comes to commodities, most investors think of tangible elements, such as copper and gold, or at least liquid substances, such as crude oil. But gases are also a lucrative business. Companies such as Linde have been proving for years that investors can make money from gases. We present business models around gas that are rock solid and anything but volatile.

ReadCommented by Carsten Mainitz on February 1st, 2021 | 07:20 CET

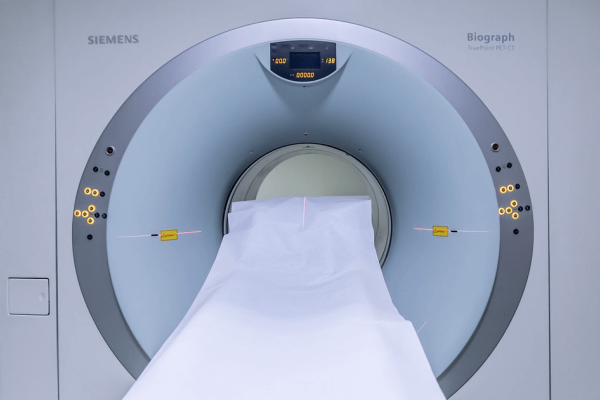

Royal Helium, Siemens Healthineers, Eckert & Ziegler - Is helium coming after hydrogen?

Hydrogen as an investment topic is on everyone's lips. No other chemical element has such a large occurrence in the universe (outside the earth's crust). But it could also be lucrative to look at the second most abundant element in the universe: helium. Helium has the lowest melting and boiling points of all elements. It is used in low-temperature technology, especially as a coolant for superconducting magnets, e.g., medical technology for MRI (magnetic resonance imaging) equipment. We present investment ideas associated with helium, ranging from the noble gas extraction to its use in certain products. Which stock has the most potential?

ReadCommented by Stefan Feulner on January 25th, 2021 | 07:35 CET

BYD, Royal Helium, Bayer - it's getting tighter and tighter!

Who will prevail in the battle for the crown in the electric car business? According to experts, the innovation leader Tesla has a technical lead of two to three years. In contrast, the Chinese government supports domestic carmakers such as BYD, NIO and Xpeng with financial injections to achieve climate policy goals in the country. The first winners are already in place. Because of the arms race, there is an extreme demand for the necessary raw materials. In the next few years, there is a threat of severe scarcity and thus dramatically rising prices.

ReadCommented by André Will-Laudien on January 20th, 2021 | 09:44 CET

Royal Helium, Air Liquide, Carnival: Competence in Gas!

In 2020, hydrogen was the stuff dreams could be made of. Of course, only for the investors willing to take risks and ready to increase their bets every day. All the chips were on the table by year-end, and the hydrogen celebrities had completed rises of 1,000-1,500%. Since the beginning of this year, the top shooters have been staggering at lofty heights - and since yesterday, we have been taking note of the fact that the Norwegian NEL can fall from time to time. Presumably, the speculative investor in 2021 is now looking for a new wave that can be ridden - so far, it has not yet shown itself. Still, theoretically, it could also be gas, environmentally friendly, and available in abundance. Why not?

ReadCommented by Nico Popp on January 11th, 2021 | 08:50 CET

NIO, Royal Helium, Linde: Here come the long-runners of tomorrow

Anyone who bets on trending stocks on the stock market knows the problem: it's hard to chase the prices and get in after significant price increases. But sometimes the market is just crazy and tends to exaggerate. Despite rocketing rises, some stocks keep climbing. Investors with great courage nevertheless jump at the chance, as in the case of the hydrogen share NEL, which has rushed from record to record. Those who pay more attention to risk look to second-tier stocks that are yet to make a chart breakout. The important thing here is that the associated investment story also has something to offer - such as with the Chinese electric car pioneer NIO.

ReadCommented by Stefan Feulner on December 29th, 2020 | 10:50 CET

BYD, Royal Helium, Xpeng - Take advantage of this opportunity!

Be honest, would you have believed in such a rise in electric cars 5 years ago? The era of internal combustion engines seems to be over; lithium battery-powered vehicles like Tesla, BYD, Nio and in the near future, Apple are having a hard time keeping up with the orders. It goes unnoticed that the important light metal lithium is becoming increasingly scarce. The drastic excess demand for the second most common element in the universe after hydrogen looks similar. The advantage, this trend has not yet been noticed on the capital market. Take advantage of this opportunity!

ReadCommented by Carsten Mainitz on December 23rd, 2020 | 09:01 CET

Linde, Royal Helium, BASF - Explosive news this year?

A wide range of applications is leading to increased demand for various gases and chemical compounds. Hydrogen is a prominent example, and the shares of companies in this sector are booming. Investors should also take a look at industrial gases and helium. Helium is used in medical technology and in the production of high-tech products. We present three promising companies.

ReadCommented by André Will-Laudien on December 16th, 2020 | 10:33 CET

DOW, Henkel, Royal Helium - Chemistry learns sustainability

The chemical sector is entering a new era. Value chains are being reshaped as sustainability, along with economic and geopolitical shifts, new technologies, and changing consumer demands challenge the bottom line and future profitability of companies. Covid-19 has led to even greater complexity and caused significant shifts in supply and demand. However, sustainability factors and ESG criteria also offer growth and differentiation opportunities for companies that redefine their value chains and business models, adapt to the circular economy, seize the opportunities of digital technology, and upskill their employees to the best of their abilities.

ReadCommented by Stefan Feulner on December 1st, 2020 | 10:14 CET

Royal Helium, Xiaomi, Nikola - Everything off with hydrogen?

What a shock! Instead of the liberation blow comes the disillusionment for the Company Nikola, which has been under the accusation of fraud for months and wants to build trucks with fuel cell technology. Due to this news, the whole industry corrected yesterday. Hydrogen technology is a definite future trend. However, the partly overambitious turnover and profit targets for the next years have to be confirmed first. Many things remind us of the new market at the turn of the millennium.

Read