August 5th, 2024 | 07:00 CEST

In the fight against cancer - 100% performance possible: Bayer, Vidac Pharma, Evotec, BioNTech and CureVac

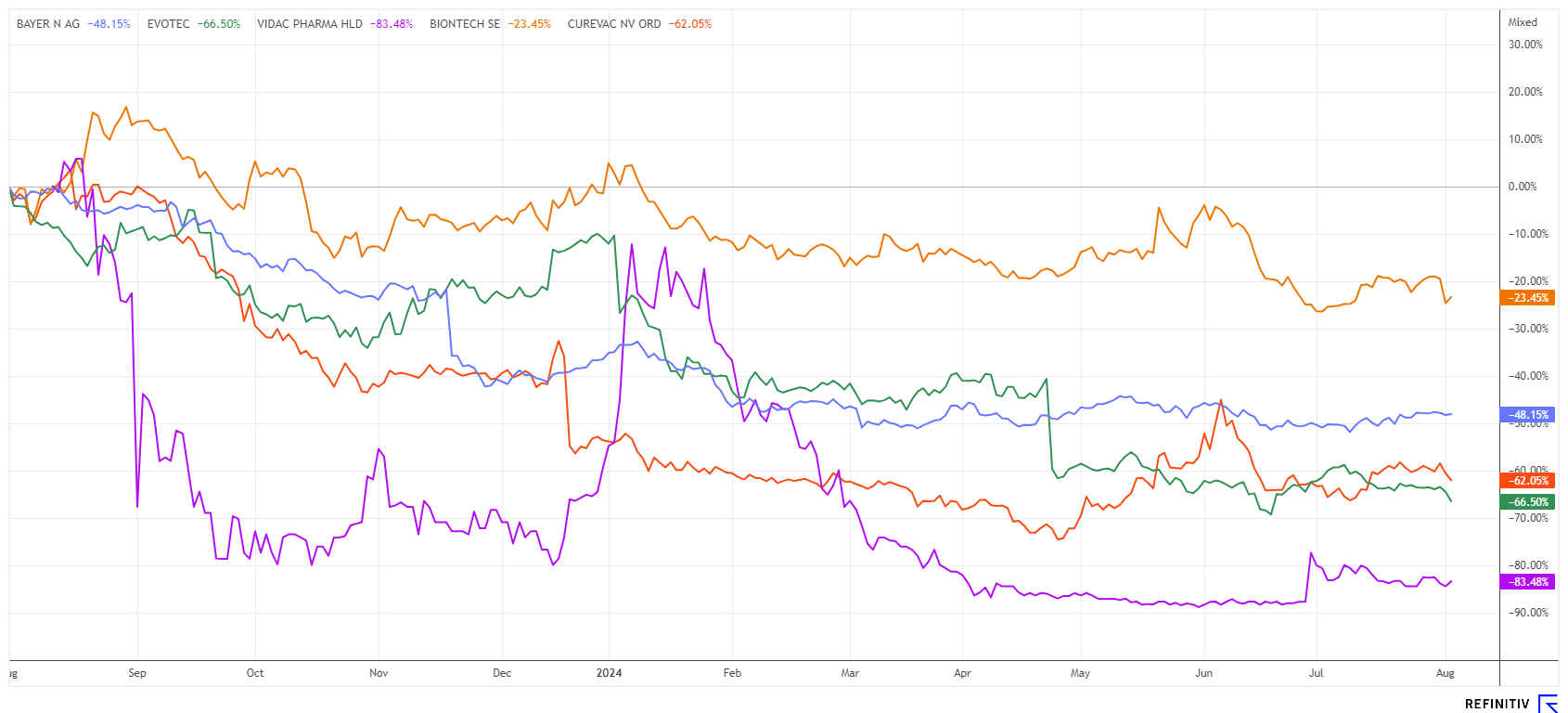

The FED is giving new hope to the Biotech sector with lower interest rates, which are expected to happen as early as September. This is important for the near future, as share prices are lagging dramatically behind the NASDAQ performance in 2024. However, if extensive research can be financed under more favourable conditions, this should also help the stock market prices recover. The business models contain some good news, and selection is now crucial. We assist in selecting attractive stocks and provide entry levels.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

BAYER AG NA O.N. | DE000BAY0017 , VIDAC PHARMA HOLDING PLC | GB00BM9XQ619 , EVOTEC SE INH O.N. | DE0005664809 , BIONTECH SE SPON. ADRS 1 | US09075V1026 , CUREVAC N.V. O.N. | NL0015436031

Table of contents:

"[...] As a company dedicated to developing treatments for rare heart diseases, we see this as an opportune moment to contribute to the fight against heart disease and make meaningful strides in improving heart health worldwide. [...]" David Elsley, CEO, Cardiol Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Bayer and Evotec - The turnaround is delayed

And yet another setback. Just a few days ago, breakout channels had formed, but now there is another downturn for Bayer and Evotec. The Leverkusen-based pharmaceutical giant has been battling for a long time with lawsuits from the US over the controversial weedkiller glyphosate. But now everything is on the table and other news is on its way. Last week, there were positive developments in the healthcare sector. Bayer has submitted a marketing authorisation application to the Food and Drug Administration (FDA) for the drug elinzanetant, intended to treat moderate to severe vasomotor symptoms associated with menopause. In clinical studies, the active ingredient significantly reduced vasomotor symptoms, also known as hot flashes. Further marketing authorisation applications for the drug are still to be submitted. The Company will report on the second quarter tomorrow. Experts are predicting average quarterly earnings of EUR 0.92 per share. Exciting!

The Evotec share had already sniffed at the EUR 10 mark again in July, then slumped to EUR 8.15. We will have to wait another week for the new CEO, Dr Christian Wojczewski, to appear before the cameras. The analysts are not in a very favourable mood. The US investment bank Morgan Stanley is cancelling its "Buy" recommendation, voting "Neutral" and dramatically reducing its target price from EUR 28 to EUR 12. Deutsche Bank is also sceptical, voting "Hold" with a target price of EUR 10. Warburg and RBC are more positive, with target prices of EUR 16. Can the operating business be turned around now? Doubtful. Keep Bayer and Evotec on your close watch list; if it turns, it will happen very quickly.

Vidac Pharma - New results demonstrate strength

Among the biotech small-cap stocks, Vidac Pharma has recently made headlines. The British-Israeli company has recently published promising results of its studies with the promising compound VDA-1275 in several mouse and human cellular organoid models of solid tumours in a scientific article. The paper has been submitted for independent peer review. The associated study demonstrates that VDA-1275 exhibited statistically significant efficacy as a monotherapy and synergistic effects in combination with two standard cancer therapies and also elicited an immunological response.

The most important results of the study were the re-initiation of apoptosis, reduced proliferation of cancer cells, and the reduction of the hyperglycolytic metabolism typical of tumours, which produces the main fuel for the rapid proliferation of cancer cells. VDA-1275 triggers an immunological response by inducing anti-tumour macrophages, inhibiting tumour-promoting macrophages, and promoting anti-tumour memory cells. Overall, survival increased in a statistically significant manner in mice in a colorectal cancer model and showed a synergistic effect in combination with widely used anticancer drugs in a 3D organoid model of human liver cancer.

"These results provide evidence that VDA-1275 could be used as a stand-alone drug or in a combination therapy that could enable more effective and safer treatment of patients with solid tumours. Vidac's small molecules target the abnormal positioning of the HK2 enzyme, which is a central cause of cancer, rather than its everyday, benign use in cell metabolism. This means that our drugs could have fewer side effects," said CEO Max Herzberg.

A recent study by Sphene Capital has put the Vidac milestones on a plausible trajectory and foresees the launch of the drug VDA-1102 in 2027 and 2028. This sets the revenue trigger in the high double-digit range, reaching up to GBP 287 million by 2030. Discounted to present value, this results in a 12 to 24-month price target of EUR 4.90. The share developed into one of the best-performing biotech stocks on the German stock exchange in July. The share price jumped from EUR 0.18 to EUR 0.34 - almost a doubling. But this is likely just the beginning!

BioNTech and CureVac - Now CureVac responds

For weeks, the press has been filled with court dates regarding the dispute between BioNTech and CureVac. Now, the US trial between CureVac and BioNTech/Pfizer has been set for March 3, 2025, by the District Court in Virginia. The lawsuit is based on material patent infringements during the COVID-19 pandemic. The partners BioNTech and Pfizer generated billions in revenue and profits with the globally distributed vaccine Comirnaty, while CureVac claimed patent infringement even back then. The issues are now being negotiated individually and a result is expected in mid-2025.

However, the time for the Tübingen-based company might be quite limited. In order to fill the coffers for the time being, the Company has now received approval from the Federal Cartel Office to sell the licence rights for various mRNA influenza and COVID-19 vaccines to the British pharmaceutical company GSK. The vaccines were developed based on cooperation agreements between CureVac and GSK. Several clinical trials are still ongoing. In return for payments of up to EUR 1.45 billion and a revenue share, the licence will now go to GSK. An advance payment of EUR 400 million will help CureVac financially. It was recently announced that almost one in three jobs will be cut as part of a corporate reorganisation. As a result, the Company in Tübingen intends to concentrate more on research and development.

At EUR 75.50 and EUR 3.17, respectively, neither BioNTech nor CureVac are inviting investors to buy in. The BioNTech share is currently valued at EUR 17.6 billion on the stock exchange in addition to its cash reserves. After a brief technical breakout attempt at EUR 4.45, CureVac has lost around 30% again. Regular monitoring of both stocks makes sense; at some point, the train will leave the station.

The summer break is coming to an end and interest rate cuts are already on the horizon. This could bring about a revival, especially for the biotech sector. Anyone positioning themselves now should be sufficiently diversified across standard and second-line stocks, which reduces risk and creates room for returns.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.