December 3rd, 2025 | 07:30 CET

Gold, drones, and specialty glass! Just like that, 200% gains out of nowhere with DroneShield, AJN Resources, and Gerresheimer

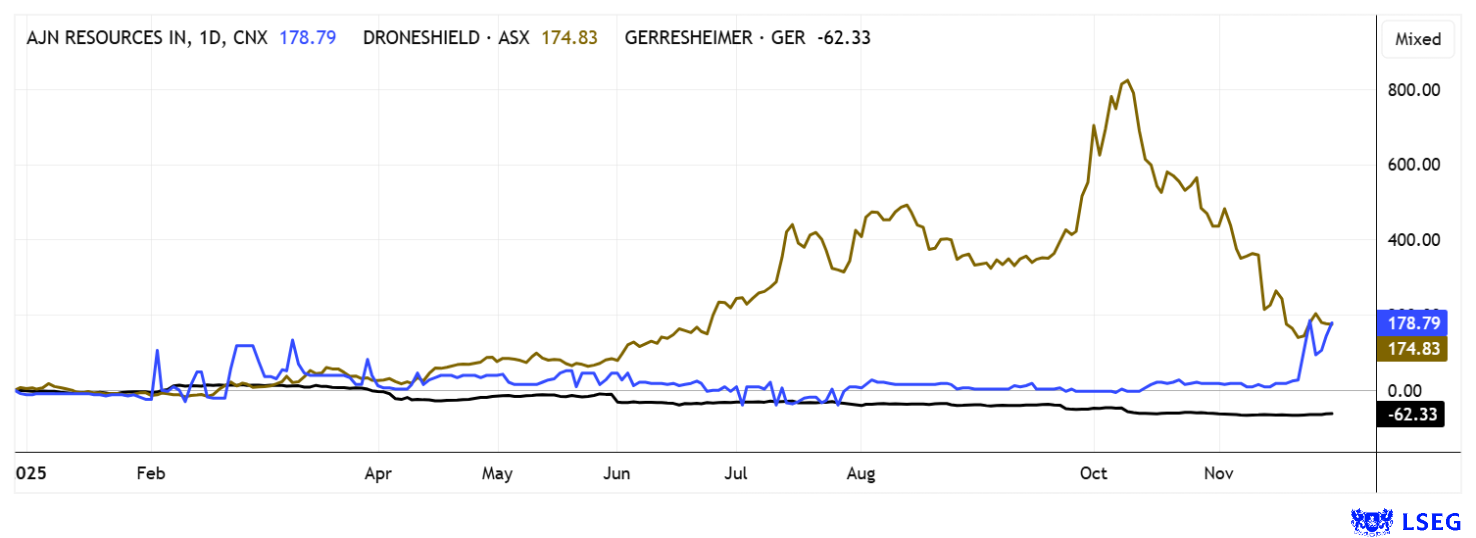

The stock market is showing its volatile side. While AI, defense, and tech stocks are consolidating, gold and silver are skyrocketing. Sector rotation is therefore in full swing at the end of the year. It is time to take a closer look at some notable movements, because every bull and bear market contains the seeds of the next reversal. DroneShield up 1,000% and then down 75%, AJN Resources suddenly up 200% from a standing start, and Gerresheimer, a fallen angel down 60%, a battered member of the German SME sector. We take a closer look at these stocks – where is it worth taking action?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

DRONESHIELD LTD | AU000000DRO2 , AJN RESOURCES INC. O.N. | CA00149L1058 , GERRESHEIMER AG | DE000A0LD6E6

Table of contents:

"[...] We knew the world was rapidly electrifying and urbanising and needing significant amounts of copper to do so. [...]" Nick Mather, CEO, SolGold PLC

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

DroneShield – Rightfully stamped into the ground

"Pride comes before a fall," as the old German proverb says. With the strange drone activity at the EU borders, the Australian company DroneShield came into the spotlight of Brussels politicians. DroneShield's share price initially multiplied in a short period of time because investors were hoping for massive procurement programs. The price rose by a whopping 600% within three months, and by as much as 1,000% since its IPO. Reports of diversions at European airports and the associated damage further reinforced this trend.

Behind the surge were several sales reports and assumptions of further positive development in 2025 and 2026. The announcement of a capacity expansion at the current facility in Australia was certainly also a decisive factor. Less well-known were the extensive option programs that allowed employees and executives to purchase large blocks of shares, which were immediately available for sale. As if there were no future, all purchasers sold immediately after the AUD 200 million sales mark was reached. These events reminded some market observers of previous cases in which similar constructions in other companies had caused considerable discussion. The loss of confidence escalated when it became known that several members of the board, including the CEO, had joined in selling off the cheaply acquired shares. Investors were particularly irritated by the fact that the Company had inadvertently reported supposedly new US orders, which later turned out to be incorrectly classified contract updates. Some analysts now fear that the stock could return to a significantly lower base in the long term.

As expected, the stock market reacted with a crash in the share price from EUR 3.78 to EUR 0.82, recovering slightly yesterday to EUR 1.04. We had reported in several reports on the exorbitant valuation of DroneShield with a 2025 P/E ratio of 40. And now, even 80% lower, the stock is still valued at a P/E ratio of 8. The Australians will not start making a profit until 2030, and until then, money will be burned. Caution is advised!

AJN Resources – Best prospects for gold in East Africa

Gold and silver are in greater demand than ever at USD 4,236 and USD 58.20. As a result, investors are looking for investment opportunities in both producers and exploration stocks. In this scenario, AJN Resources stands out positively with a 200% increase in November. There are plenty of reasons for this. The Company is positioned as a Canadian exploration stock with a strong focus on Africa. Under the leadership of internationally renowned geologist Klaus Eckhof, AJN is pursuing a growth strategy in East Africa, with the Okote Gold project in Ethiopia playing a key role. With a 70% stake, AJN has secured premium access to a project area in the Adola Gold Belt, which is increasingly attracting international capital flows and is considered a structural extension of established gold trends. The license area is located less than 100 km from the country's largest gold mine, Lega Dembi. Due to a favorable geological environment and possible analogies, Eckhof's team suspects a large deposit in the immediate vicinity of the 4.5 million ounces of gold.

To confirm the potential, AJN Resources has mobilized all its resources as part of the ongoing due diligence review at Okote to conduct detailed field surveys and mapping along a 3 km zone where small-scale artisanal mining has been the predominant activity to date. At the same time, a diamond drill program of at least 1,500 m has been launched, which will be targeted based on existing data and new structural analyses. The Company plans to combine the historical results of up to 9 grams of gold per ton with the new drilling and mapping data in order to develop an initial resource estimate in accordance with recognized standards in a next step.

Against this backdrop, AJN has significantly strengthened its financing base and recently completed a larger capital measure than was planned in the early stages of the Okote due diligence. In mid-November, the Company announced the completion of a private placement of CAD 3 million gross, which was realized through the issuance of 30 million units at CAD 0.10 each. After the successful fundraising, the share price exploded in recent days from CAD 0.10 to over CAD 0.38, but then fell back to CAD 0.22. The current market value of CAD 20 million reflects the high expectations for the project, especially since AJN also holds additional exploration licenses for gold and battery metals in Africa. Collect!

Gerresheimer – Why people are getting excited over 3 million

**Specialty packaging manufacturer Gerresheimer is in deep crisis. After several profit warnings in the current year, the management has now been replaced. The new CEO is Uwe Röhrhoff, who took over from Dietmar Siemssen on November 1. Röhrhoff knows the Düsseldorf-based company inside out and will act as interim CEO. Gerresheimer has also announced a change in its supervisory board. Klaus Röhrig succeeds Dorothea Wenzel. The co-founder and co-chief investment officer of the Active Ownership Group (AOC) will be a member of the supervisory board until the next annual general meeting in June 2026. Wolf Lehmann has been responsible for the finances of the MDAX-listed group since September, succeeding Bernd Metzner. In addition, Achim Schalk was appointed to the Management Board on November 1, replacing Lukas Burkhard. According to Gerresheimer, this completes the restructuring of the management team for the time being.

In August, activist investor Active Ownership went on the offensive and explicitly endorsed the planned sale process for the molded glass business. This is linked to a significant strengthening of cash flow with the aim of rapidly reducing debt. At the same time, the BaFin investigations into suspected violations of accounting regulations, some of which were confirmed, had a negative impact. According to the Company, however, this only concerns EUR 3 million resulting from bill-and-hold agreements. The expected EBITDA margin for 2025 was reduced from 20% to 18.5-19%. It remains to be seen, of course, whether these figures will be achieved. Analysts significantly adjusted their target prices. The LSEG platform calculates a 12-month average target price of EUR 34, UBS puts it at EUR 29, and Berenberg at EUR 30. A market capitalization of EUR 915 million is very low for a company with EUR 2.3 billion in revenue. The 2027 P/E ratio is calculated at an average of 5.6. That is far too cheap!

High volatility is weighing on investors' nerves. In balanced portfolios, good diversification is therefore recommended, as this significantly reduces risk indicators. Our peer group today is suitable for risk-conscious investors: AJN Resources stands for a continued high gold price, Gerresheimer is a classic turnaround speculation, and DroneShield is only suitable for traders. The choice is yours!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.