April 8th, 2025 | 07:20 CEST

Gold defies the crash – Tocvan Ventures with historic results

The US government's imposition of punitive tariffs on a total of 185 countries caused global stock markets to falter. The German leading index, DAX, alone lost around 17% of its value since the announcement, leaving the psychological mark of 20,000 points far behind. Once again, gold has proven to be a safe haven, regaining the USD 3,000 per ounce mark after a brief pullback. Due to the escalating trade wars, rising inflation, and unrelenting geopolitical tensions, the precious metal is likely to continue its upward cycle. As the underlying commodity gains strength, gold stocks present massive upside potential. Tocvan Ventures, in particular, has recently made a name for itself with impressive gold discoveries.

time to read: 2 minutes

|

Author:

Stefan Feulner

ISIN:

TOCVAN VENTURES C | CA88900N1050

Table of contents:

"[...] As we look at four or more zones in more detail from the beginning, investors can expect a continuous news flow that will underscore our vision of the Holy Grail project as a giant opportunity. [...]" Nick Luksha, President, Prospect Ridge Resources

Author

Stefan Feulner

The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

He is passionate about analyzing a wide variety of business models and investigating new trends.

Tag cloud

Shares cloud

Tocvan Ventures in an ideal position

The mining area in Sonora is known for its wealth of various minerals and metals. Mexico's second-largest state is located in the northwest of the country and is particularly known for its copper mines. In addition to copper, gold, silver, and molybdenum, other minerals are also mined in Sonora. Naturally, global mining giants such as Agnico Eagle, Fresnillo, First Majestic Silver, Coeur Mining, and Alamos Gold are active in the region. In the midst of this illustrious circle, Tocvan Ventures is developing Gran Pilar and Picacho, two advanced-stage gold-silver projects with significant potential.

The Gran Pilar project is currently the focus of development, with 27,000 meters of drilling having been carried out to date. Tocvan Ventures owns 100% of the rights to a prospective area of over 21 square kilometers and a majority interest of 51% in an area of 1 square kilometer. Colibri Resources holds the remaining minority interests.

Historic results

The results, published at the end of March, were historic and a milestone in the history of the Canadian company. Earlier this year, ten core drill holes totaling 1,167.5 meters were drilled in the Tocvan-majority-owned Main Zone. The best absolute values were 3.0 meters, grading 21.6 g/t gold, 209 g/t silver, and 6.7% lead. Another intercept of 3.8 meters returned 2.8 g/t gold, 38 g/t silver, and 2.3% tin. The broader anomalous zone extends from surface to a vertical depth of 64.9 meters, with an average grade of 1.2 g/t gold (JES-25-108).

The key highlight, however, is that this marks the first high-grade gold mineralization discovered at the southern end of the Main Zone corridor along the North Hill Trend, thereby establishing a new trend. Another advantage is that the mineralization starts just a few meters below surface, making it easily accessible for the upcoming trenching efforts. This opens up another area where the Company can define mineralization as potential feed material for the planned pilot mine.

Tocvan Ventures CEO Brodie Sutherland explains the latest results and business developments in a detailed interview

Pilot plant and further milestones

Further significant steps are planned for the current year, which could boost the current market capitalization of CAD 47.04 million. Tocvan Ventures is planning to develop a pilot plant on Pilar in addition to further drilling. An approval and operating strategy is currently underway that shows a scenario in which up to 50,000 tons of material could be processed. In addition, the initial resource estimate (PEA) is planned for the second half of the year.

Conclusion

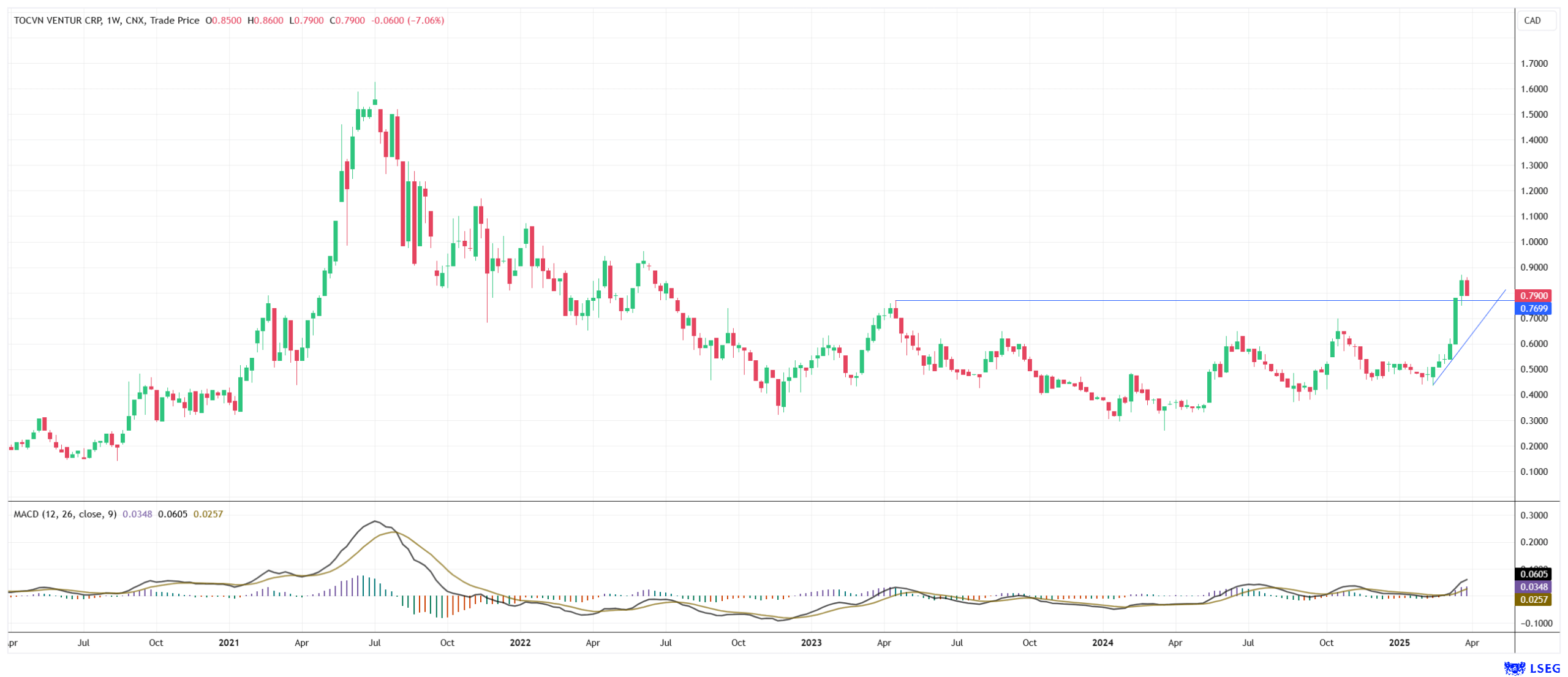

Due to the strong news flow in recent weeks and a positive market environment for precious metals, Tocvan shares have gained over 63% since the beginning of the year. Due to the current weakness in the broader market, a brief setback to the horizontal support area at CAD 0.77 is conceivable. However, if drilling results continue to impress, a renewed upward move toward the all-time high of CAD 1.67 could be triggered.

The discrepancy in the Company valuation compared to the peer group is important. While the comparable company, Minera Alamos, has a market capitalization of almost CAD 159.35 million and an average grade of 0.65 g/t gold, the average grade for a bulk sample at Tocvan Ventures is 1.9 g/t gold and 7 g/t silver. The market capitalization is less than one-third by comparison.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.