December 27th, 2022 | 06:04 CET

FuelCell Energy, Almonty Industries, SFC Energy - Fatal effects

Even now, commodity prices, which have risen exorbitantly in recent years, are correcting due to fears of a prolonged recession. In the long term, the super-cycles in critical raw materials needed for the energy transition and innovative technologies will likely continue. That is because there is already a threat of supply bottlenecks for the required industrial metals. For investors, this scenario offers a unique opportunity.

time to read: 4 minutes

|

Author:

Stefan Feulner

ISIN:

FUELCELL ENERGY DL-_0001 | US35952H6018 , ALMONTY INDUSTRIES INC. | CA0203981034 , SFC ENERGY AG | DE0007568578

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

Stefan Feulner

The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

He is passionate about analyzing a wide variety of business models and investigating new trends.

Tag cloud

Shares cloud

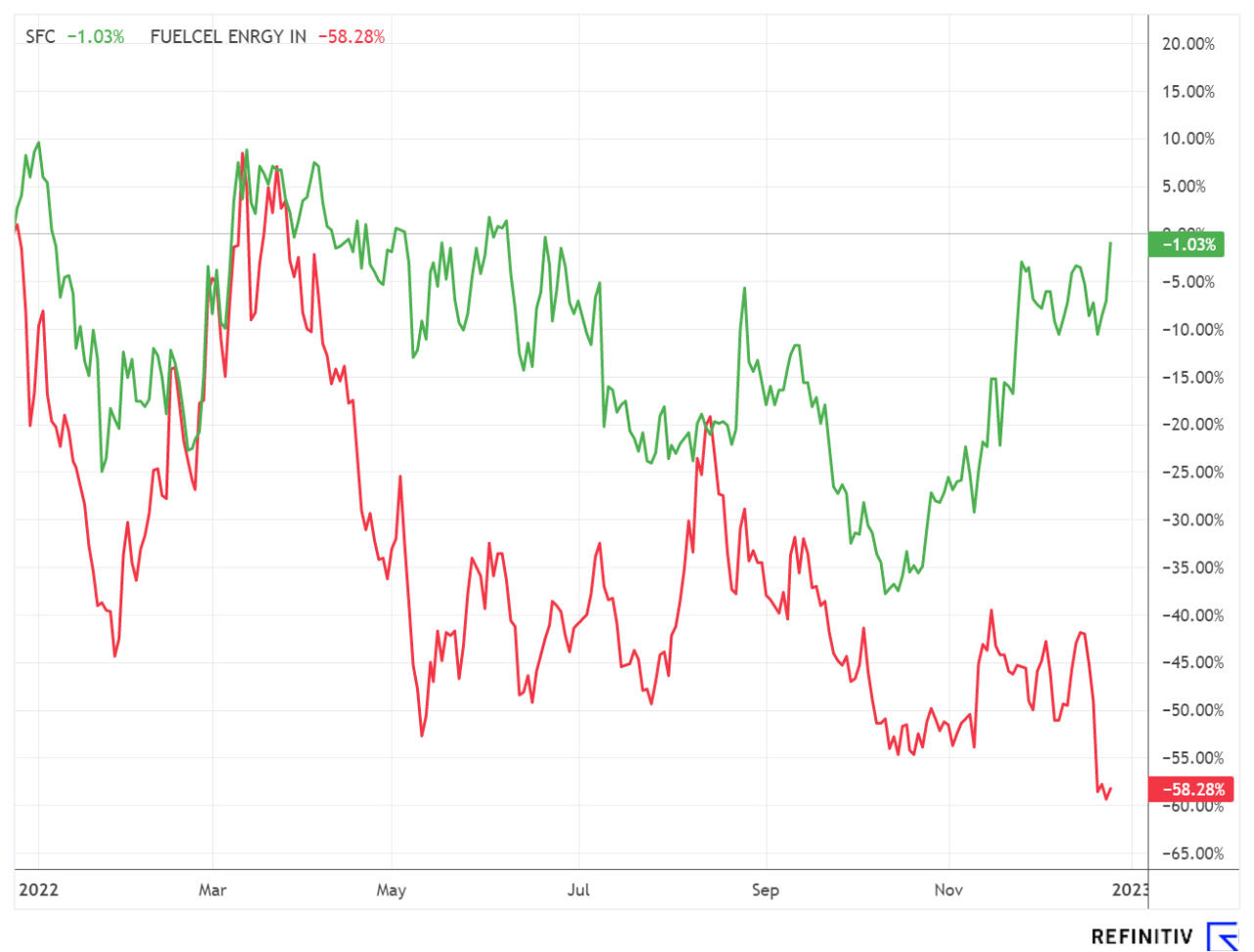

SFC Energy - Reward for extraordinary development

The solid development of one of the world's leading companies for mobile and off-grid energy solutions in the Clean Energy & Clean Power Management business areas, SFC Energy, was rewarded with an upgrade by the German stock exchange at the end of the year. Effective December 27, 2022, the Company from Brunnthal near Munich will move up to the SDAX, which comprises the 70 largest companies by market capitalization and stock exchange turnover in the traditional sectors below the MDAX. Uniper will be removed from the index, as its free float has fallen below 10% in connection with a takeover.

Fundamentally, the situation for SFC Energy continues to look good. Weeks ago, the largest order in the Company's history, worth EUR 15 million, was secured through a strategic follow-up order from Live View Technologies in the United States, which forms the basis for a future presence in the USA. In addition, an initial series production order from a European high-tech component manufacturer for the delivery of power supply systems with a total value of EUR 5.3 million was received.

Dr Peter Podesser, CEO of SFC Energy AG, commented on the SDAX listing: "As a fuel cell pioneer, we stand for the new generation of power generation. After challenging years of development, we are generating sustainable growth and remain technologically focused - with the promotion to the SDAX, we are reaping the first fruits of our labor. Hydrogen and fuel cells are key technologies on the road to climate neutrality, and geopolitical realities are accelerating the transformation. It is, therefore, a strong signal for the entire industry that a new representative of the hydrogen economy is now moving up into a selection index, thus giving the entire industry more attention."

Almonty Industries - Right on schedule

Much has been reported about the scarce raw materials copper, lithium and nickel during the course of the energy transition. In addition, there are other critical metals that are indispensable to our lives in many areas. For example, the lustrous white heavy metal tungsten, the chemical element with the highest melting and boiling point, is found in light bulbs, cell phones, power plants, cars, airplanes and medical technology. Tungsten could receive a considerable boost in demand from electromobility, as the metal is also considered a battery material and could be used in the future as a substitute for cobalt. In addition to Russia, China is responsible for around 80% of the production of this critical raw material. Similar to the frantic search for alternatives in oil and natural gas, the Western world is accelerating the development of alternatives to avoid becoming dependent again.

A lighthouse project to supply the Western nations is currently being built by Woulfe Mining, a wholly-owned subsidiary of Canadian company Almonty Industries. The Almonty Korea Tungsten project is expected to produce 30% of the world's tungsten supply outside China at full capacity. Commissioning of the mine is scheduled for next year, and the mine life is estimated at 90 years. In addition, a 15-year offtake agreement is already in place with the Austrian Plansee Group, which will provide Almonty with a cash flow of USD 590 million. Currently, construction progress is on schedule, and according to CEO Lewis Black, the Company's costs also remain on track despite rising raw material and energy costs.

The market capitalization of Almonty Industries, which in addition to South Korea also mines, processes and ships tungsten concentrate from its Los Santos mines in western Spain and Panasqueira in Portugal, amounts to CAD 129.59 million, with the share price trading at CAD 0.60. Analysts at First Berlin Equity Research see the Company as a clear buy candidate with a price target of CAD 1.70.

FuelCell Energy - Sell-off after the figures

The shares of FuelCell Energy, a fuel cell company that focuses on the development, production and maintenance of direct fuel cell power plants, suffered a severe setback. When announcing the figures for the fourth quarter, the fiscal year of FuelCell Energy ended on October 31, both sales and earnings were below market consensus.

The US company was able to record significant increases in revenues for the fourth quarter, with sales rising by 181% to USD 39.2 million; however, analysts were expecting USD 44.9 million. The Company also fell well short of expectations in terms of earnings per share with a loss of minus USD 0.11, worse than the analyst estimate of minus USD 0.07 per share.

According to FuelCell Energy's CEO and president, the Company is "in a transition phase where we are investing across our business to take advantage of the large market opportunity. The growth investments are reflected in the fiscal 2022 results as we advance platform commercialization and capital expenditures, expand technical capabilities, and expand sales and marketing activities. As we move into fiscal 2023, these investments will increase and accelerate as we allocate capital to plant, equipment and talent needed to increase overall production capacity for our technology platforms."

With cash and cash equivalents of USD 481 million, the Company is well-equipped for further expansion. As such, there could be attractive long-term entry opportunities following the sharp setback in the USD 2.60 area.

The shortage of raw materials is likely to pose significant economic problems, not only because of the accelerated energy transition. Almonty Industries is considered an alternative to China in tungsten production after the completion of the Sangdong mine in South Korea and should benefit due to high demand. FuelCell Energy disappointed with the figures but looks attractive at a discounted level. The inclusion in the SDAX should keep SFC Energy in demand.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.