January 31st, 2023 | 14:50 CET

E-mobility 2023: The Tesla hunters are coming! BYD, Lucid Motors, Tocvan Ventures. Will the Varta share now also fly?

It Is hard to believe! The Tesla share is once again making a name for itself. Analysts went into the presentation of the annual figures with cautious expectations because there were many negative rumors surrounding Elon Musk's electronics company: Fewer sales? Cars on stockpile? Again, it came as no one had expected it. Elon Musk delivered and simultaneously mocked all the shorties who wanted to push his stock below USD 100 at the turn of the year. This gambit went badly wrong because Tesla was able to deliver even better figures than expected, and there was no stopping the share. With plus 70% in only 4 weeks, the Tesla share belongs to the shooting stars since the turn of the year - the short sellers must have lost their desire completely. But the variety of interesting shares is significant. Where are the opportunities for e-investors lurking?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

BYD CO. LTD H YC 1 | CNE100000296 , Lucid Group Inc. | US5494981039 , TOCVAN VENTURES C | CA88900N1050 , VARTA AG O.N. | DE000A0TGJ55

Table of contents:

"[...] We will trigger indirect creation of 1,665 new jobs nationwide, while directly employing 300 staff - 270 operational and 30 administrative. [...]" Dennis Karp, Executive Chairman, Manuka Resources Limited

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BYD and Lucid Motors - Full speed ahead

At the beginning of the year, investors didn't think too long about who might be the favorites for 2023. In addition to hydrogen stocks, people remembered the e-mobility papers that had come back strongly. They had a hard time in the second half of 2022, as many governments announced cuts in subsidy budgets for electric cars. Only EUR 4500 is still available in environmental premiums in Germany for a motor vehicle of less than EUR 40,000 net list price. The subsidy for plug-in hybrids was even discontinued altogether at the turn of the year.

Nevertheless, the papers of Tesla & Co knew only one direction at the reopening in the new year: Upwards! Last week, Tesla delivered unexpectedly brilliant figures. Thus, Elon Musk's company increased its profit by 12% YOY to USD 12.6 billion, while sales rose by 51%% to USD 81.5 billion. Although the announced sales figures of 1.3 million units were just missed, the announcement to deliver 1.8 million mobiles in the current year was surprising. The Chinese giant BYD has already achieved this figure in 2022 and thus clearly outstripped Tesla. A full 1.86 million electric-powered vehicles (NEVs) were sold, around 209% more than the previous year; only 1.5 million units were planned. BYD is one of the few manufacturers worldwide to have ceased production of internal combustion vehicles as early as March 2022.

The electric newcomer Lucid Motors expects around 6,000 to 7,000 units for 2022. Lucid wants to attack local competitor Tesla in particular. That is plausible because, with its powerful battery and futuristic design, Lucid could give the top dog a run for its money, especially in the United States. Elon Musk, the charismatic boss, made no friends with the hostile takeover of Twitter and is not considered a good employer in Germany either. Many fans of e-mobility are looking forward to an expanded range of products. BYD and Lucid will also be hitting Europe and wooing consumers.

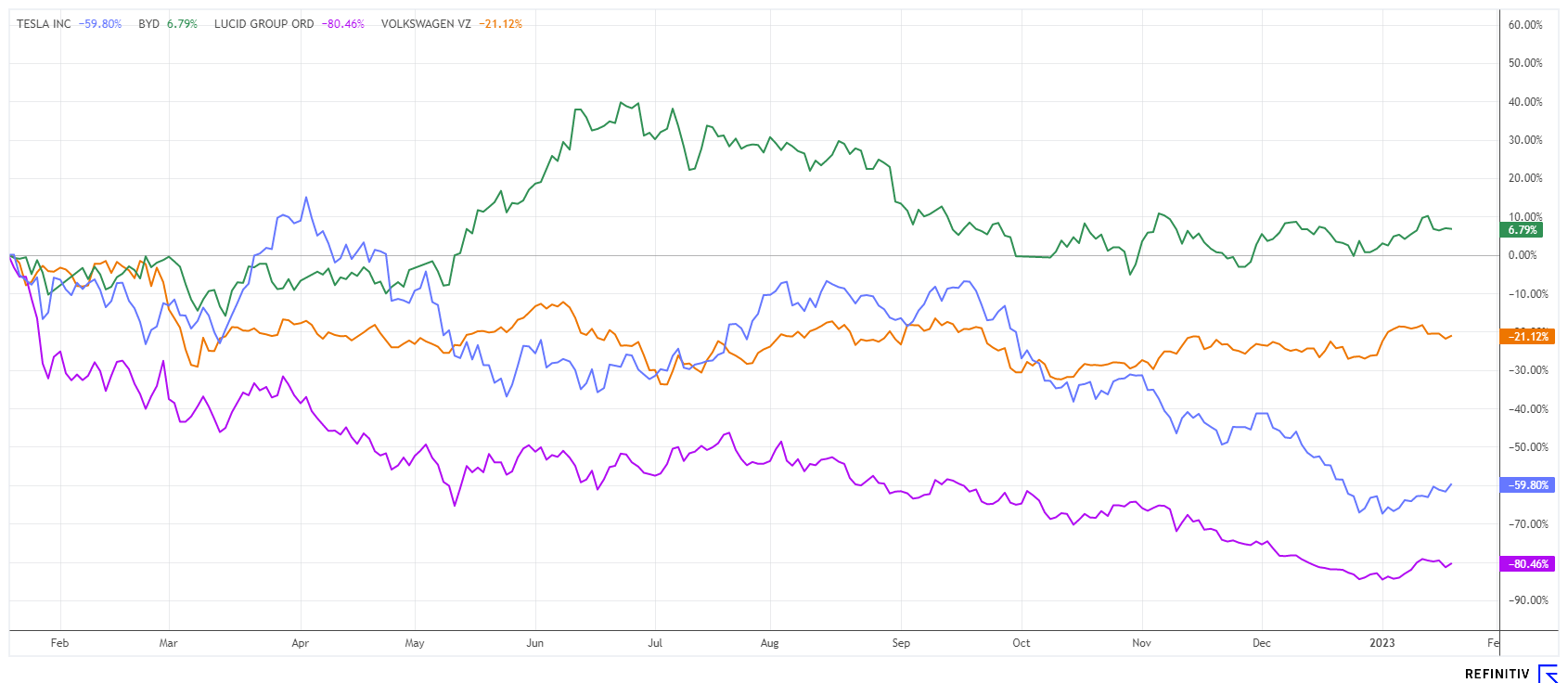

It is interesting to look at recent share price trends. While Tesla crashed in 2022 and lost more than 60% over the year, BYD's stock came back slightly into the plus zone after a brief sell-off. The newcomer within the e-mobility scene, highly praised from all sides, crashed from just under USD 48 to USD 6.30 in 2022. Tens of billions of USD in stock market value vanished into thin air. In parallel with the sharp rise in Tesla's share price, Lucid Motors even managed to double its share price. The race for investor favor has begun again in full.

Varta - Is the lid flying off now?

The share of the Ellwangen-based battery and storage manufacturer Varta has been consolidating since the end of September after several profit warnings. At the end of the year, the share was pushed down to EUR 21.70 after high costs and little ability to pass them on weighed on the budget. Then the management board changed, and the guidance was suspended for the time being.

In the meantime, however, the mood seems to be improving. Last week, ex-AT&S finance manager Thomas Obendrauf came on board as CFO. At the same time, a new cooperation agreement with Sager Electronics from North America was announced. These are all building blocks for a possible turnaround in 2024 because, with four profit revisions, analysts expect average earnings per share of minus 9 cents in the current year.

It is not until next year that sales of EUR 960 million and earnings per share of EUR 0.59 are expected to be achieved again. These estimates contain a lot of optimism, in our opinion. The 2022 annual figures are expected on March 30, but there will certainly be an indication before then. Analytically, Varta is still overpriced, even at EUR 28.50. Banks and brokerage houses assess a medium price target of EUR 27.30 on a 12-month view. Keep watch!

Tocvan Ventures - Always good news from Sonora

Not only e-mobility seems to be golden. Since the beginning of the year, precious metal prices have also continued to march upward. No wonder, because the exuberant inflation rates from 2022 are still having an effect. Thus gold galloped from approximately USD 1,800 to most recently USD 1,950, a whole 7% upward. Silver is still treading water, but historically silver has always followed gold with a small delay.

The Canadian gold explorer Tocvan Ventures (TOC) is also doing well. No sooner had the Company announced that it had begun preparations for a first large-scale assay at its Pilar gold-silver project in Sonora than sentiment improved. Up to 1,000 tonnes of oxide gold material will be sampled from selected surface outcropping areas throughout the project area, focusing on the Main Zone and 4-T Trend. Preliminary column leaching studies returned promising results in terms of gold content. In February, a bulk sample will be collected and prepared for heap leach processing at a private mining operation less than 25km west of Pilar. The Company expects to obtain broad information from the sample, as it should provide a more detailed report on the expected gold grade in the mining ore.

During the so-called "tax-loss season", the share price was still dipping, but in retrospect, it was clear buying prices. Because in only 2 months, the valuation of the property almost doubled. For some strategic investors, this was already a suitable indication to increase their commitment to Tocvan significantly. At the end of last week, a quick private placement was also accomplished at CAD 0.52. This included a half warrant with a subscription price of CAD 0.62 and a term of 18 months. The Company can put the CAD 325,000 to very good use for further drilling in the promising Pilar and El Picacho projects. TOC's share price jubilated at prices above CAD 0.60, which currently values the precious metal deposit at approximately CAD 22.7 million. For the top mining jurisdiction of Mexico, the current geopolitical uncertainty in Europe is providing a prime environment for gold investment. Keep collecting!

Since Lützerath, e-mobility and Greentech are on everyone's lips again. Thus, they will be top investment topics again in 2023. Since the beginning of the year, however, gold has also built up positive momentum. Tocvan Ventures has excellent projects in Mexico, is not expensive and should be able to follow any precious metal trend.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.