July 3rd, 2025 | 07:20 CEST

Desert Gold's ingenious move: How the untapped gold anomaly and upcoming PEA could significantly enhance your portfolio

What if there were a vast, largely unexplored area right next to some of West Africa's most productive gold mines? And what if strong gold traces had already been found on surface, but no drill had ever been set up there? Desert Gold Ventures is now seizing this opportunity with the Tiegba Project in Ivory Coast. The deal is more than just a new exploration field. It is a strategically astute move with the potential to fundamentally transform the Company. Investors looking for exceptional opportunities in the commodities sector would be well advised to take a closer look.

time to read: 5 minutes

|

Author:

Armin Schulz

ISIN:

DESERT GOLD VENTURES | CA25039N4084

Table of contents:

"[...] The transaction offers benefits to all parties: Shareholders now have three promising projects in their portfolio. [...]" Bradley Rourke, President, CEO and Director, Scottie Resources Corp.

Author

Armin Schulz

Born in Mönchengladbach, he studied business administration in the Netherlands. In the course of his studies he came into contact with the stock exchange for the first time. He has more than 25 years of experience in stock market business.

Tag cloud

Shares cloud

Tiegba: A sleeping giant awakens

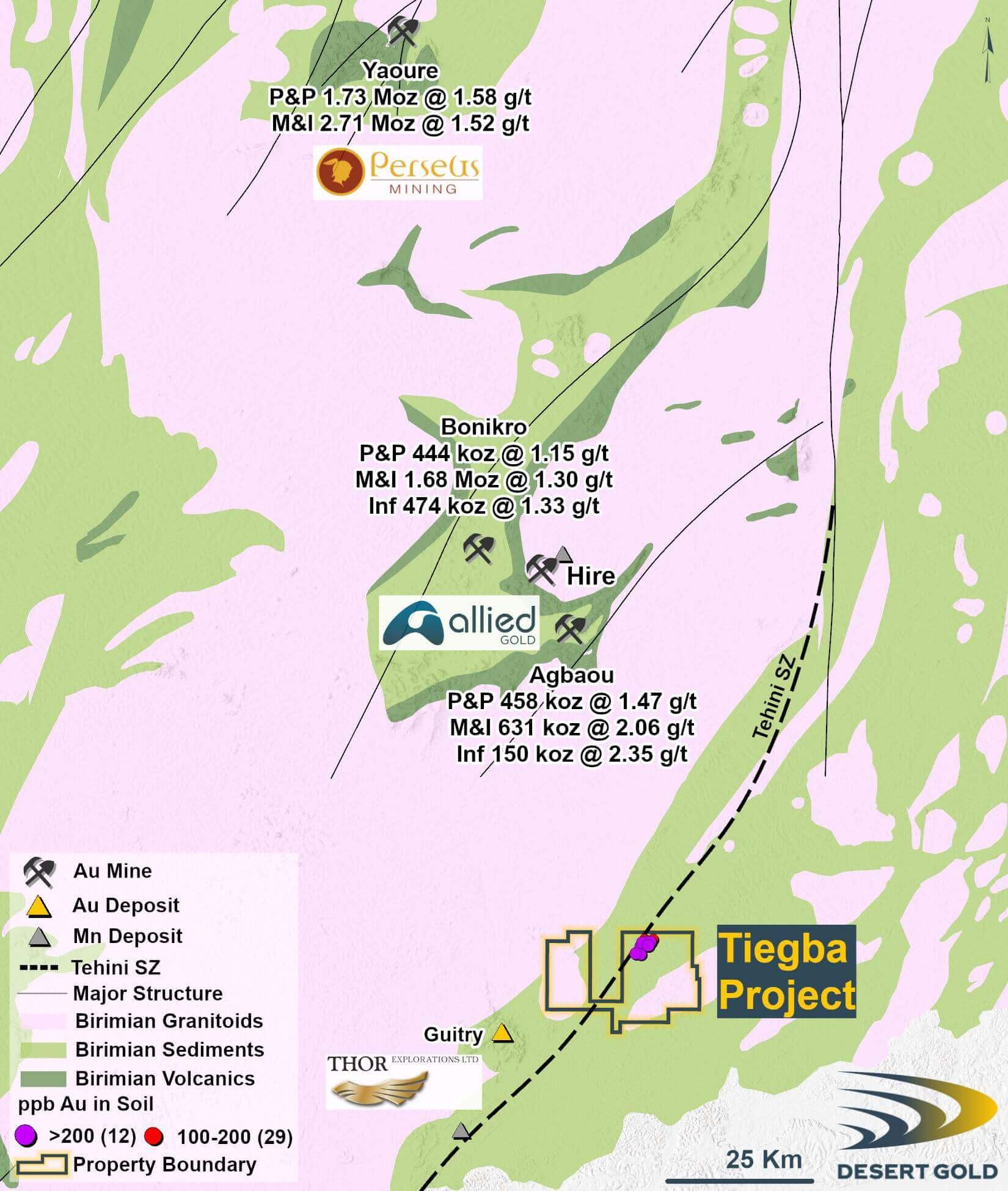

At the heart of the new project is a massive gold-in-soil anomaly in Côte d'Ivoire. It covers an impressive area of 4.2 km long and 2.1 km wide in the high-grade Birimian gold belt. Historical data, originally collected by Newcrest Mining, reveal high values, with peaks exceeding 900 ppb gold and dozens of samples ranging from 50 to over 200 ppb. Such concentrations are significantly higher than what is typical for this region. What makes this anomaly unique is that it has never been drilled. A site visit by the Desert Gold team in March 2025 confirmed the findings as "in situ" – meaning the gold likely originates from the underlying rock and has not been transported from elsewhere. The anomaly is located along the regionally significant Tehini Shear Zone, a geological structure known to host gold and which is also being successfully explored on neighboring properties. Tiegba is also in excellent company. Within reach are multi-million-ounce deposits such as Agbaou (Allied Gold), Bonikro/Hire (Allied Gold), and the major Yaouré mine (Perseus Mining). The geology is similar to that of the well-known Bonikro-Agbaou district, featuring promising calc-alkaline intrusions and structural contacts - classic traps for gold mineralization. Despite these promising signals and the strategic location, systematic exploration has only been carried out on less than 20% of the 297 km² concession area. This is where the considerable upside potential lies.

The deal: Clever, inexpensive, forward-looking

How do you secure a project like this? Desert Gold opted for an option agreement with Flower Holdings, a local private company. The terms are remarkably favorable and demonstrate skillful negotiation. Desert Gold will pay a total of USD 450,000, of which USD 150,000 will be paid immediately and the remainder in two further installments, and will issue 1.5 million common shares, also in three tranches. Upon fulfillment, the Company will receive 90% of Tiegba. Flower will retain 10%, contribute this free of charge until the feasibility study is completed, and receive an additional 1% net smelter royalty (NSR). It is important to note that Desert Gold has secured a right of first refusal on this NSR and the remaining 10% should Flower wish to sell. Operational control will remain with Desert Gold during the option period. This deal is not only financially attractive, but also strategically smart. The Ivory Coast has established itself as one of the most stable and investor-friendly mining jurisdictions in West Africa. Fast approvals, good infrastructure, growing gold production, and the presence of global players such as Barrick Mining and Endeavour Mining speak for themselves. For Desert Gold, Tiegba represents a welcome diversification away from its sole focus on Mali. It transforms the Company from a single-project explorer in Mali into a regional player with two promising footholds in West Africa. This reduces the specific country risk and significantly increases the attractiveness for potential partners or buyers.

The roadmap: Fast and cost-efficient to the goal

Given the clear geological signature, Desert Gold is committed to a rapid, cost-efficient exploration program. The goal is to define drill-ready targets within a few months. The plan includes:

-

Geological precision: Targeted trenching, detailed geological mapping and prospecting to verify mineralization directly in the rock, and collect samples.

-

Geophysical verification: Airborne magnetic and IP resistivity surveys over the entire area to reveal the underground structural architecture and promising zones.

-

Validation & expansion: 3,000 m of infill and expanded ground sampling to better define existing anomalies.

The required budgets are manageable. The first steps to define drill targets are expected to cost only about USD 100,000. An initial drilling program of approximately 3,000 m is likely to cost around USD 200,000. These funds are already covered by the exercise of outstanding warrants, which gives the Company planning security and avoids dilution through an immediate capital increase. A major advantage is the experienced team. The geologists and managers can seamlessly apply their knowledge from Mali to Tiegba, as the geological conditions are similar and the cultural environment is familiar.

Perfect timing: More than just a new project

The launch of Tiegba comes at an extremely favorable time for Desert Gold:

-

Mali PEA nearing completion: The long-awaited preliminary economic assessment (PEA) for the flagship SMSZ project in Mali is expected soon. With gold prices currently at record highs, economic indicators such as NPV and IRR are likely to be particularly attractive. This study serves as a key valuation anchor and a potential price driver.

-

Gold price tailwind: The high gold price not only dramatically improves the economics of the Mali project, but also increases the implied value of undiscovered resources in the ground, not only at the SMSZ project, but also at the new Tiegba Project. It makes exploration successes even more valuable.

-

Operational synergies: While Mali is currently in its rainy season, which lasts until October, the team can focus fully on preparations in Côte d'Ivoire. No waste of resources, just optimal utilization.

-

M&A horizon expanded: With two projects in two attractive West African countries, Desert Gold is becoming significantly more attractive to potential acquirers. The proximity to Allied Gold in Tiegba or to majors such as Barrick and B2Gold in Mali offers concrete points of contact.

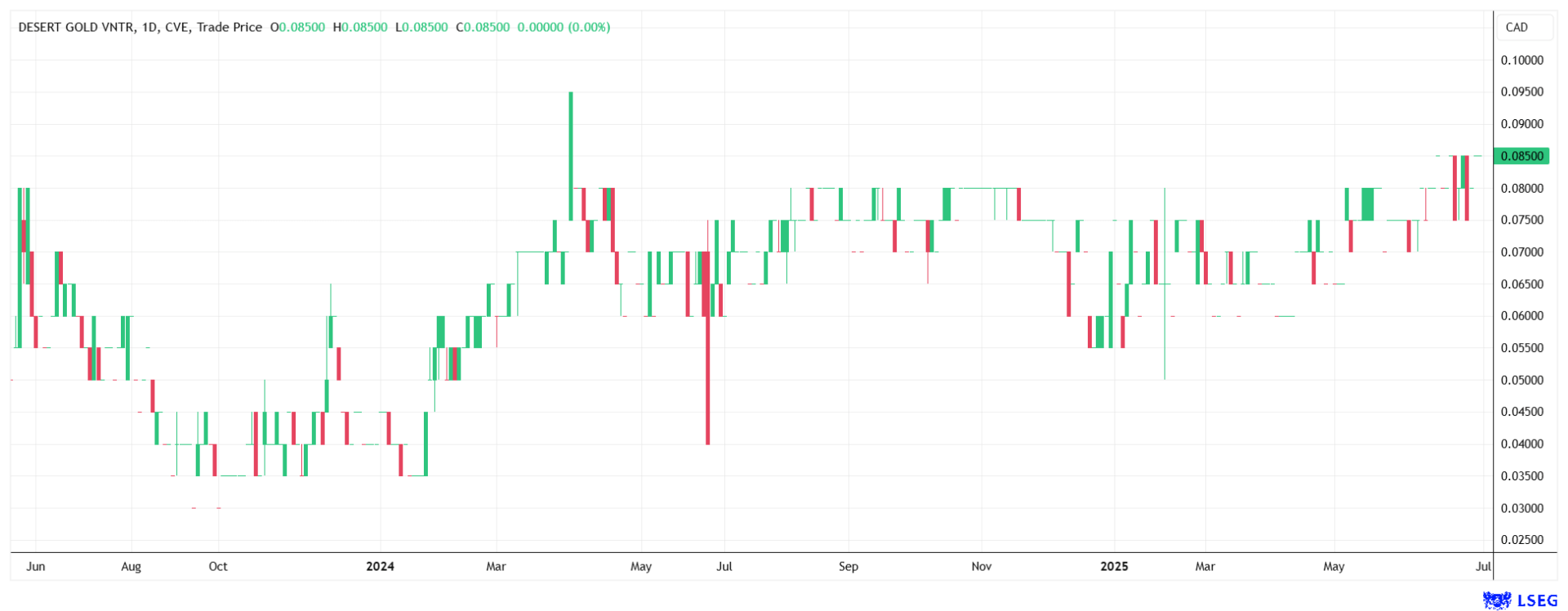

Analysts at GBC Research already see considerable upside potential, which is further supported by Tiegba and the Mali PEA. The price target is CAD 0.425. Against this backdrop and compared to large gold producers, the current market capitalization of around CAD 20.5 million at a current share price of CAD 0.085 appears very attractive.

Desert Gold Ventures offers more than just a new exploration project with the Tiegba deal. It represents a combination of a rare geological opportunity, a vast, high-grade and undrilled anomaly in a prime gold belt, with a financially and strategically cleverly negotiated acquisition in a first-class jurisdiction. The clear, low-cost work plan is aimed at rapid proof of concept. This step also comes at the perfect time, flanked by the upcoming Mali PEA and the tailwind of strong gold prices. For risk-aware investors who understand the leverage potential of early-stage exploration successes and believe in the strategic vision of a diversified West African player, Desert Gold represents a fascinating, albeit speculative, opportunity. The market does not yet appear to have priced in the full extent of this combination of opportunities. It is worth following developments closely.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.