October 3rd, 2025 | 07:00 CEST

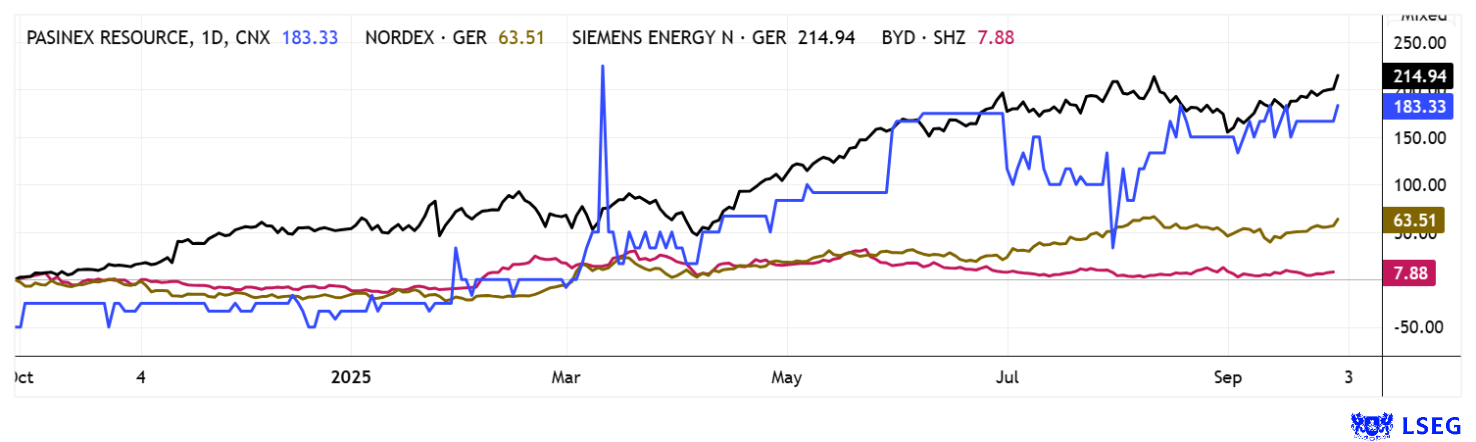

DAX breaks 24,000 – E-mobility booming! Keep an eye on BYD, Pasinex Resources, Nordex, and Siemens Energy

In the third quarter of 2025, the global e-mobility market once again grew strongly: more than 4.2 million new electric vehicles were registered worldwide, an increase of around 28% over the previous year. China remains by far the largest single market, but Europe is also recording double-digit growth rates, driven by manufacturers such as BYD, Tesla, and Volkswagen. At the same time, investment in new battery technology is increasing in order to secure the rising demand in the long term. The raw material zinc is becoming increasingly important, not only for corrosion protection and alloys, but also as a key component in innovative zinc-air batteries, which could represent a cost-effective and sustainable alternative to lithium. This development underscores how closely raw material markets and e-mobility growth are intertwined. Here are a few investment ideas.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

BYD CO. LTD H YC 1 | CNE100000296 , PASINEX RESOURCES LTD. | CA70260R1082 , SIEMENS ENERGY AG NA O.N. | DE000ENER6Y0

Table of contents:

"[...] Nickel, therefore, benefits twice: firstly from its growing importance within batteries and secondly from the generally growing demand for such storage. [...]" Terry Lynch, CEO, Power Nickel

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BYD – Another record month in Germany

The Chinese company BYD ("Build Your Dreams") is now the world's largest manufacturer of electric vehicles and plug-in hybrids and a key driver of the global mobility transition. Founded in 1995 as a battery manufacturer, BYD has developed into a technology group with its own development and production of vehicles, batteries, and semiconductors. The Company is now the market leader in China and is currently expanding internationally.

In Europe, BYD is accelerating its expansion through new distribution partners, investments in local production, and increased fleet cooperation. To circumvent European customs barriers, a plant is currently being built in strategically located Hungary to shorten supply chains and better serve European demand. The new generation of blade batteries with higher energy density and safety for technological advantages gives the Company a certain edge over its competitors. Analysts report new sales records: in the third quarter of 2025, more than 1.5 million vehicles were delivered worldwide for the first time. In September, BYD registered more than 3,000 vehicles on the German market for the first time. With a market share of 2.9% for pure electric vehicles and 6.9% for plug-in hybrids, BYD has established itself significantly. September was the most successful month to date since entering the German market.

At the same time, BYD is continuing to expand its dealer network: over 100 locations have already been secured under contract, with at least 120 planned by the end of 2025 and around 300 by the end of 2026. "The positive feedback from retailers confirms our strategy," says Lars Bialkowski, Country Manager BYD Germany. BYD has arrived and is ready for its next growth phase. BYD shares underwent a 40% consolidation in 2025, but now the sails are set for stormy weather again. Analysts on the LSEG platform see potential of 25% – based on EUR 12.40, corresponding to a price target of EUR 15.50. The previous high from May stands at EUR 17.65. Plenty of room for imagination!

Pasinex Resources – High-grade zinc for the energy transition

Zinc is increasingly becoming the focus of global future technologies. While electromobility is attracting billions in investment from automotive giants and lithium and copper are dominating the headlines, zinc is considered an underrated key metal in the energy transition. Its importance ranges from corrosion protection in steel and infrastructure to zinc-air and zinc-ion batteries, which are considered safe and sustainable alternatives to lithium. Demand is also growing in vehicle manufacturing, as galvanized steel is becoming indispensable in lightweight vehicle bodies. With many high-grade mines depleted and new deposits remaining scarce, the International Energy Agency (IEA) now considers zinc to be one of the critical raw materials for the climate economy.

This is where Canadian explorer Pasinex Resources comes in. With projects in Turkey, the Company is developing zinc deposits of exceptional quality. While the global average is around 10%, Pasinex's ores have a zinc content of up to 50%. Thanks to near-surface deposits, favorable infrastructure, and production costs of less than USD 300 per ton in some cases, potential margins of around 50% can be achieved, which is comparable to highly profitable precious metal projects. Pasinex has set a key course in recent weeks. With the acquisition of the Sarlkaya project near the Pinargozu mine, the Company now controls two high-grade zinc deposits in Turkey. Initial investigations show near-surface zones that can be mined directly, complemented by considerable exploration potential. At the same time, a financing round of CAD 2.15 million is underway, with more than half already subscribed. Pasinex is also strengthening its management structures: Dr. Mehmet Komurcu, a renowned M&A and commodities lawyer with extensive networks in Turkey, Europe, and North America, has been nominated as an experienced expert for the supervisory board.

Pasinex is in a phase of consolidation and expansion. With two high-grade projects under its belt, a clear focus on cost-effective production, and great potential for further discoveries, the Company is excellently positioned to benefit disproportionately from the growing demand for zinc in energy, construction, and mobility. Pasinex now offers an attractive opportunity for investors who want to get in early on a metal of the future with scarce supply and rising demand. The stock is traded in Canada and Germany, with a market capitalization of a manageable EUR 12 million. Stock up!

Pasinex Chairman Dr. Larry Seeley will be presenting at the 16th International Investment Forum (IIF) on October 8 at 4:30 pm CET. It should be exciting.

Nordex and Siemens Energy – Is there still potential here?

The latest price movements at Nordex and Siemens Energy show a clear consolidation. Despite recent increases, Nordex was unable to reach its August high of around EUR 23.40. The research firm Jefferies remains positive with a price target of EUR 25. The wind turbine manufacturer is likely to have had another solid quarter, wrote Constantin Hesse in his outlook on the interim report, which has been available since the end of September. Thirteen out of 15 experts on the LSEG platform recommend buying the stock. However, with an average price target of EUR 23.51, there is only 5% potential from today's perspective. The Hamburg-based company may even exceed the high expectations in its Q3 report at the end of October. We would raise the stop to EUR 21.50 to avoid any negative surprises.

The situation is similar at Siemens Energy. Due to the global SMR euphoria for smaller nuclear power plants, the Munich-based company's gas turbines remain in focus. The share price reached a new high yesterday at EUR 109.90. However, the 22 "Buy" recommendations on the LSEG platform calculate price targets of EUR 96 to EUR 104. Here, too, an exaggeration is already looming. Therefore, caution is advised at the platform edge!

The stock markets keep surging. It is now becoming increasingly difficult to find reasons why this never-ending rally is continuing. International commodity stocks, which endured a five-year bear market, are finally taking off. BYD, the market leader in electric vehicles, has also staged a strong turnaround. Wind power experts Nordex and Siemens Energy are also seeing profits.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.