August 23rd, 2023 | 07:00 CEST

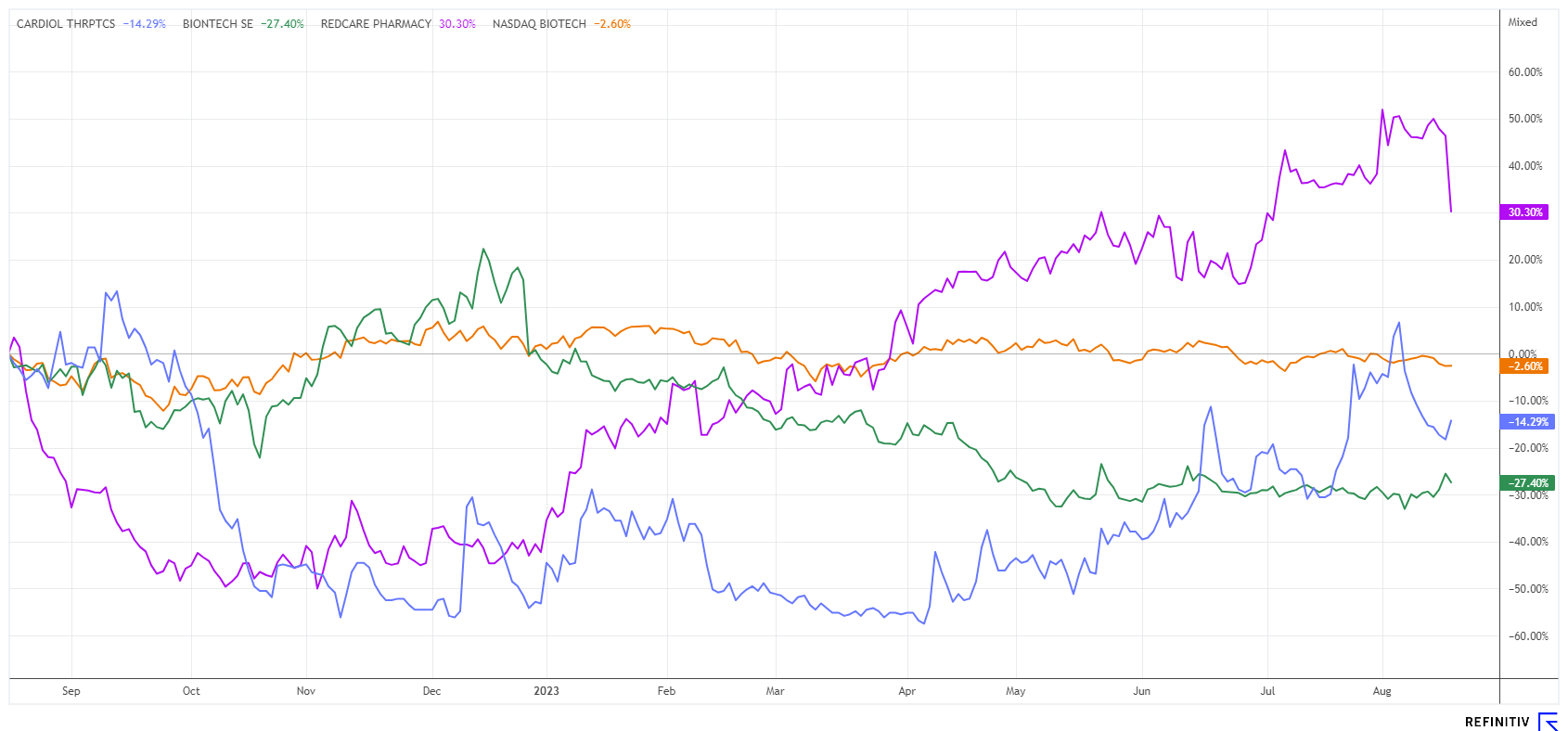

Climate change or just a heat wave? - BioNTech, Cardiol Therapeutics, and Redcare Pharmacy deliver!

Whether this consistently warm summer already documents a pronounced climate change is questionable. The older ones among us remember that there were already very hot summers before and that even in the last 30 years, there was rarely snow at Christmas. However, human life is simply too short for significant conclusions. Therefore, long-term weather records have to be consulted. There will probably be a slight increase in average temperatures, but we will get little information about when the next ice age will hit us. For many politicians, the current weather trends fit perfectly into the chain of arguments in favor of radical legislative proposals. Perhaps, however, the caprices of the weather are only the offshoots of the approaching El Nino. The stock market also follows changing trends; after the flood, an ebb could now be imminent. Selection remains key!

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

BIONTECH SE SPON. ADRS 1 | US09075V1026 , CARDIOL THERAPEUTICS | CA14161Y2006 , REDCARE PHARMACY NV | NL0012044747

Table of contents:

"[...] As a company dedicated to developing treatments for rare heart diseases, we see this as an opportune moment to contribute to the fight against heart disease and make meaningful strides in improving heart health worldwide. [...]" David Elsley, CEO, Cardiol Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BioNTech - This could have been the twist

According to media reports, new Corona vaccines are about to be delivered by BioNTech. In September, new vaccines will be brought to market, adapted to the mutated COVID-19 variants. Since governments are unlikely to seek universal coverage, the vaccines will be sold in single doses. Those who want vaccine protection will obtain it as usual through their primary care physician.

In addition to its cancer pipeline, BioNTech remains a reliable supplier of vaccines. With a good EUR 18 billion in its coffers, the Mainz-based biotech company is ideally positioned to respond to any impending pandemic. For a long time now, the share price of the Corona blockbuster company has been listlessly bobbing along while a wide variety of lawsuits are being filed worldwide due to possible side effects. Subject to timely regulatory approval, there should thus be enough vaccines against the Omicron variants XBB.1.5/EG.5 under the BioNTech-Pfizer label for the 2023/24 vaccination season.

The past hype in the 2021/2022 pandemic years should provide the Mainz-based company with enough impetus for the coming winter. And once the infection figures start rising rapidly again, the share price can quickly go up. A close look will reveal a technical breakout attempt at around EUR 100. With a good book value of EUR 87, the share is fundamentally protected on the downside. Speculators are already collecting again!

Cardiol Therapeutics - Further milestones achieved

More heart-focused is the Canadian biotechnology company Cardiol Therapeutics Inc. (CRDL), which has successfully focused on the research and clinical development of innovative therapeutic methods for the treatment of cardiovascular diseases. The Company's promising product candidate, CardiolRx™ (cannabidiol), is a pharmaceutically manufactured oral solution formulation specifically designed for use in patients with heart disease. Cannabidiol is known to inhibit the activation of the inflammasome signaling pathway, which plays an important role in inflammation and fibrosis associated with myocarditis, pericarditis and heart failure. The Company is currently recruiting subjects for two Phase II studies to further evaluate CardiolRx™. The open-label pilot study in pericarditis is taking place in the United States. Furthermore, Cardiol is launching a placebo-controlled international study in acute myocarditis, one of the leading causes of sudden cardiac death in people under 35 years of age.

"Cardiol is excited to report important milestones related to the Company's ongoing Phase II clinical programs for the treatment of recurrent pericarditis and acute myocarditis," commented David Elsley, President and CEO of Cardiol Therapeutics. Recently, the Company also managed to stay on NASDAQ, which is tied to revenue and capitalization hurdles. CRDL shares have recently shone with nice rises to CAD 1.60, currently consolidating near CAD 1.35. With a market capitalization of only CAD 86.4 million, the stock is now not far from its cash position. Analysts on the Refinitiv Eikon platform issue buy recommendations with an average price target of CAD 4.05. Most exciting!

Redcare Pharmacy - The bone of contention is called e-prescription

Fully underwhelmed is the share price of Europe's leading one-stop pharmacy provider Redcare Pharmacy NV. After good half-year figures, the market is worried that the planned implementation of the redemption of e-prescriptions could bypass the online pharmacies. CEO Olaf Heinrich thinks online pharmacies are not getting enough of the e-prescription pie and wants to take legal action against the German government if necessary.

Meanwhile, the figures for the second quarter confirm the growth trend that the Company has embarked upon. Sales grew by a remarkable 46% to EUR 420 million. The Group achieved an adjusted EBITDA margin of 3.2% in the quarter under review, 5.3 percentage points higher than in the prior-year quarter. In absolute figures, a profit of EUR 13.3 million was reported instead of a loss of EUR 6.1 million in the previous year. In absolute terms, this corresponds to an increase of EUR 19.4 million from EUR -6.1 million to EUR 13.3 million. As of the end of June, Redcare Pharmacy had 10.1 million active customers, an increase of around 8% since the beginning of the year. The Company, formerly known as Shop Apotheke, continues to expect strong growth of 20% to 30% to total sales of EUR 1.7 billion to EUR 1.8 billion. In the medium term, the adjusted EBITDA margin should exceed the 8% mark.

The long-awaited introduction of the e-prescription is causing trouble for online pharmacies and will still have to be examined in court. With EUR 244 million in available funds, Redcare can finance these legal examinations itself. The analysts at Warburg Research recently became somewhat more optimistic about the share price performance of the online pharmacy, with a target price now set at EUR 130. **The share reacted after the previous sell-off with a 7% countermovement to around EUR 107. With a price-to-sales ratio of 1.5, the stock is not too expensive.

**The stock market is now changing horses again. While in the last months, mainly AI and high-tech companies were in demand, it is now again the biotech stocks that have been in the spotlight for a few days. As always, a good and balanced diversification is the best investment advisor for your portfolio.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.