October 14th, 2025 | 07:25 CEST

China closes the door – NEO Battery Materials opens a window to profits in the drone market

From November 2025, China will tighten export controls. The export of high-performance batteries and related materials will become significantly more difficult. This political decision is turning the global supply chain for electric mobility and high-tech upside down. While established players outside China struggle, a small Canadian company is catapulting itself into a unique position. NEO Battery Materials has positioned itself in the right place at precisely the right time. For investors, this creates a rare opportunity to profit from a geopolitical turning point.

time to read: 4 minutes

|

Author:

Armin Schulz

ISIN:

NEO BATTERY MATERIALS LTD | CA62908A1003

Table of contents:

"[...] Silumina Anodes® is a ceramic-coated graphite/silicon anode composite material that we plan to produce in Schwarze Pumpe, Saxony. Here, we aim to supply manufacturers of batteries for e-cars with an application-ready drop-in technology that is low-cost, high-performance and safe. [...]" Uwe Ahrens, Direktor, Altech Advanced Materials AG

Author

Armin Schulz

Born in Mönchengladbach, he studied business administration in the Netherlands. In the course of his studies he came into contact with the stock exchange for the first time. He has more than 25 years of experience in stock market business.

Tag cloud

Shares cloud

Current situation

The announcement from Beijing came as a bombshell for the entire industry. From November 2025, stricter export restrictions will apply to high-performance batteries with energy densities above 300 Wh/kg and their key components. Ostensibly, the move is all about national security and protecting economic interests. In reality, however, the measure is aimed at further expanding China's already dominant position in the global battery market, which currently accounts for 70–80% of worldwide production capacity.

It becomes clear that the West is being deliberately slowed down in building its own production facilities. This is likely to become a serious problem for manufacturers in the US and Europe who rely on these high-performance components for electric vehicles, drones, and energy storage devices. Suddenly, their supply chain is no longer secure. It is precisely in this gap between the West's enormous demand and the closing Chinese export gates that NEO Battery Materials finds its immense opportunity.

The drone market: Where performance is everything

While public debate often revolves around electric vehicles, NEO has occupied a more promising niche: the market for performance-hungry drones and robots. Here, it is not the lowest price that counts, but the best performance. AI-powered reconnaissance drones, unmanned aerial vehicles, and combat drones require extreme energy densities and fast charging times to fulfill their missions. Conventional batteries, which are often based on outdated technology, quickly reach their limits here.

NEO's strategy is reminiscent of semiconductor giant TSMC. It does not produce mass-market goods, but rather customized, high-performance battery solutions for demanding customers. The Company sees itself as a kind of "one-stop shop" that develops and manufactures cells according to its customers' exact specifications. While large battery manufacturers such as LG and Samsung focus on vast quantities of standardized cells, they often lack the flexibility for small, highly specialized batches. NEO fills precisely this gap.

Concrete deals prove the strategy

The success of this model is proven not only by press releases, but also by concrete contracts. The first major coup was a multi-year order worth CAD 4.5 million from an Asian drone manufacturer that is already active in the military sector. Specifically, NEO is developing two special battery types for different drone models – ranging from industrial drones designed for heavy loads to models intended for military applications.

Even more significant is the recent multi-year purchase agreement for 50 metric tons of silicon anode material with a North American battery manufacturer in the defense sector. This demonstrates the full potential. NEO not only supplies the raw material, but is also developing the next generation of battery cells for drones and unmanned systems in collaboration with its partner as part of a joint development agreement. "This purchase agreement and JDA represent another important milestone in the commercialization of NEO's silicon battery technology as we expand into synergistic, high-revenue verticals of battery design and manufacturing. By partnering with a North American battery company, we are advancing our mission to build a robust and high-quality North American battery supply chain. For the Western world, our company aims to become the first choice for high-performance battery materials and components for every end application," said Spencer Huh, President and CEO of NEO.

Why NEO is becoming a geopolitical beneficiary

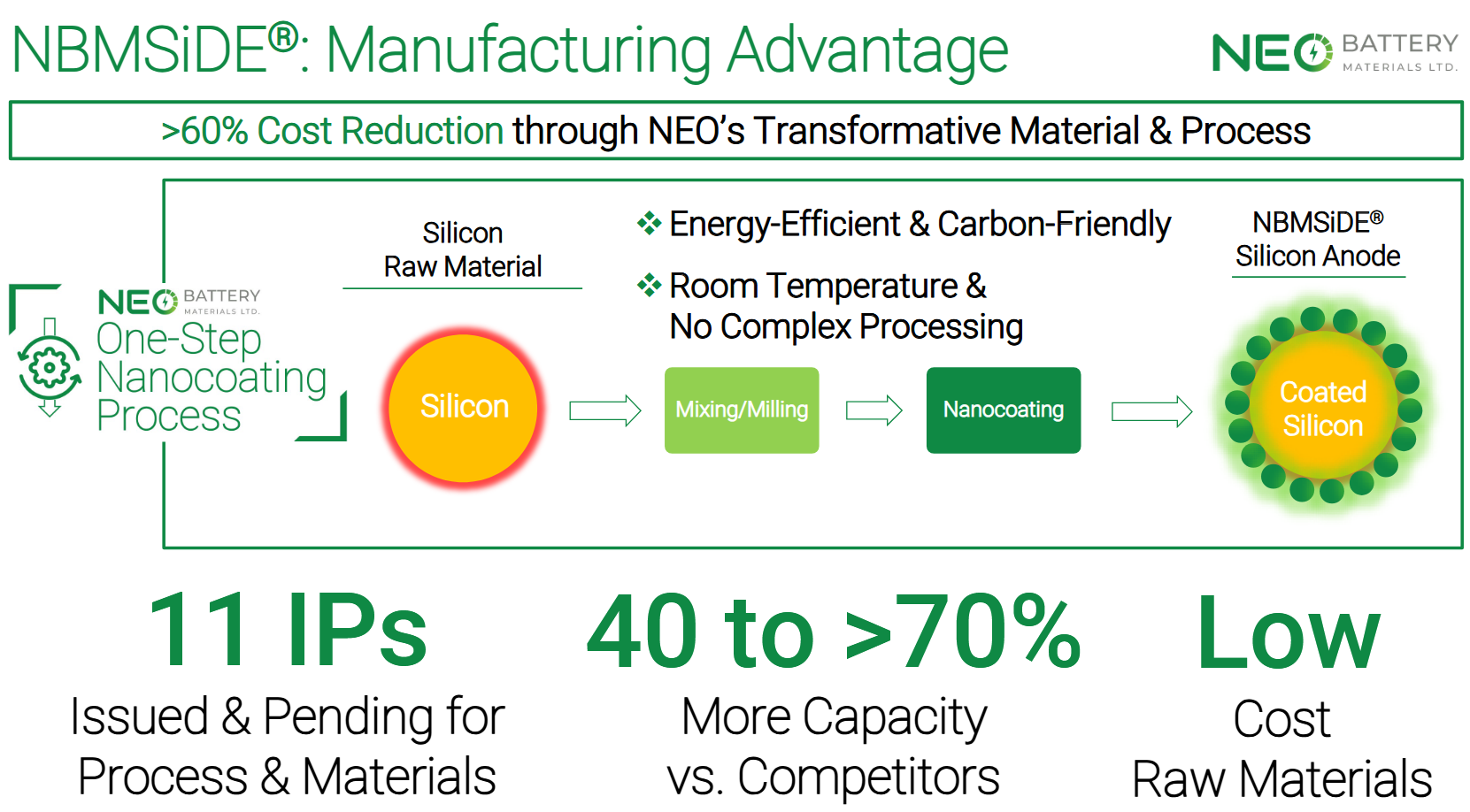

NEO's entire strategy is based on a supply chain located outside of China. The planned acquisition of an already productive and revenue-generating battery factory in South Korea is a brilliant move. Instead of waiting years for a factory to be built, NEO is jumping straight into operational production and generating revenue almost immediately. This factory is operational, already producing electrodes for automotive OEMs, and serves as a platform to bring its own patented silicon anode technology, called NBMSiDE®, into series production.

This technology is another crucial pillar. It promises up to 70% higher energy density and a cost reduction of over 60% compared to conventional solutions. This puts it squarely in the category of high-performance materials, the export of which from China is now becoming more difficult. For manufacturers in North America and Europe, especially in the defense sector, a reliable, non-Chinese alternative is suddenly becoming increasingly critical.

To fully open the doors to the lucrative defense market, NEO has stocked up on top-class expertise. The appointment of Admiral Seung-Sub Shim, former head of the South Korean Navy, and Major General Geun-Young Choi, a former air defense commander, sends a clear signal. These advisors know the procurement processes of defense ministries inside and out. Their network is invaluable for a company that wants to establish itself as the "go-to partner" for security-critical battery solutions.

At the beginning of September, the stock began to climb amid high trading volume. A share currently costs CAD 0.69.

China's export restrictions mark a turning point, forcing the West to end its dependence on Chinese battery technologies and creating strong demand for local, high-quality alternatives. With its strategic focus on vertical integration, high-performance technology, and locations outside China, NEO Battery Materials is uniquely positioned to benefit from this geopolitical upheaval. Investors have the opportunity to back a company that is both technologically and geostrategically in the right place at the right time.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.