June 17th, 2025 | 07:20 CEST

Cement 2.0: Argo Living Soils makes concrete smarter and more climate-friendly

Global CO₂ emissions are a significant contributor to global climate change. In addition to global transportation and energy use, the construction industry, particularly through concrete and cement, also plays a major role. According to a 2022 study by UNEP, the construction sector accounts for around 37% of global CO₂ emissions. Decarbonizing construction is, therefore, a key task in meeting international climate targets. With the founding of a specialized subsidiary and the use of bio-graphene, Canadian company Argo Living Soils is venturing into the concrete industry and combining ecological innovation with industrial scalability. It is worth taking a closer look because the potential is enormous!

time to read: 3 minutes

|

Author:

André Will-Laudien

ISIN:

ARGO LIVING SOILS CORP | CA04018T3064

Table of contents:

"[...] Having Investors like Robert Friedland and Rob McEwen come in with CVMR and Terra Capital really was terrific. [...]" Terry Lynch, CEO, Power Nickel Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Argo Living Soils Corp. – Green concrete for future generations

Since its founding in 2018, Argo Soils Corp. has specialized in manufacturing and developing organic products. In recent months, the focus has narrowed to industrial innovations in construction. With the establishment of a specialized subsidiary and the use of bio-graphene, the Canadian company is venturing into the concrete industry, combining ecological innovation with industrial scalability. The Company is thus addressing important trends in a sustainable circular economy and is a focus for ESG-oriented partnerships and investors.

Infrastructure in the US – A challenge for decades

Among the current trends in the infrastructure market, the corresponding figures from the North American ready-mixed concrete market are particularly noteworthy. Revenues were estimated at around USD 250 billion in 2024 and are expected to grow at a compound annual growth rate (CAGR) of 4.5% until 2030. Key drivers are infrastructure renewal and rising demand for sustainable building materials. Argo's initiative is in line with this trend and aims to provide environmentally friendly solutions that meet the evolving needs of the construction industry. Concrete production is one of the largest industrial sources of carbon dioxide emissions, accounting for 8% of global emissions. New research and scientific studies suggest that incorporating graphene into concrete offers transformative benefits such as reduced water demand, increased strength and durability, combined with a 20% reduction in greenhouse gases.

Profitable cooperation with Graphene Leaders Canada (GLC)

The recently established research and development agreement with Graphene Leaders Canada (GLC), an Alberta-based company specializing in high-quality dispersions of graphene and carbon nanomaterials, is very promising. The aim is to develop a graphene nanoplatelet (GNP) additive for ready-mixed concrete. The project proposal represents a significant step in the expansion into the green concrete market by the newly formed subsidiary Argo Green Concrete Solutions Inc., which uses Biograph technology to produce stronger, more sustainable concrete products. The announced agreement was expanded a few days later to include the development of solutions for graphene-enriched asphalt. The expanded agreement will leverage GLC's advanced dispersion capabilities in graphene nanoplatelets (GNP) together with Argo's expertise in sustainable technologies to explore the potential of graphene-enhanced asphalt for infrastructure applications. The focus will be on research and development to design and test GNP formulations for asphalt, with independent performance evaluation tests planned. Graphene, a carbon-based nanomaterial known for its exceptional strength, conductivity, and flexibility, offers significant advantages for asphalt applications. Successful results could pave the way for commercial-scale trials. The next few months are likely to be exciting!

Lots of blue sky in an emerging billion-dollar market

The global asphalt market, estimated to be worth around USD 82 billion in 2023, is expected to grow at a compound annual growth rate (CAGR) of 4.5% through 2030, driven by rising infrastructure investment and demand for sustainable building materials. Graphene-enhanced asphalt has the potential to capture a significant share of this market as it offers improved durability and reduced environmental impact, meeting the needs of municipalities, developers, and governments worldwide. Argo is at the forefront of technological development with its partners. The joint projects started in May, with concrete results and a proof of concept expected by the fall.

"We are excited to expand our relationship with Graphene Leaders Canada to explore the transformative potential of graphene-enhanced asphalt. This project builds on our commitment to sustainable innovation and aims to deliver stronger and more environmentally friendly infrastructure solutions that meet the changing needs of the construction industry," said CEO Robert Intile.

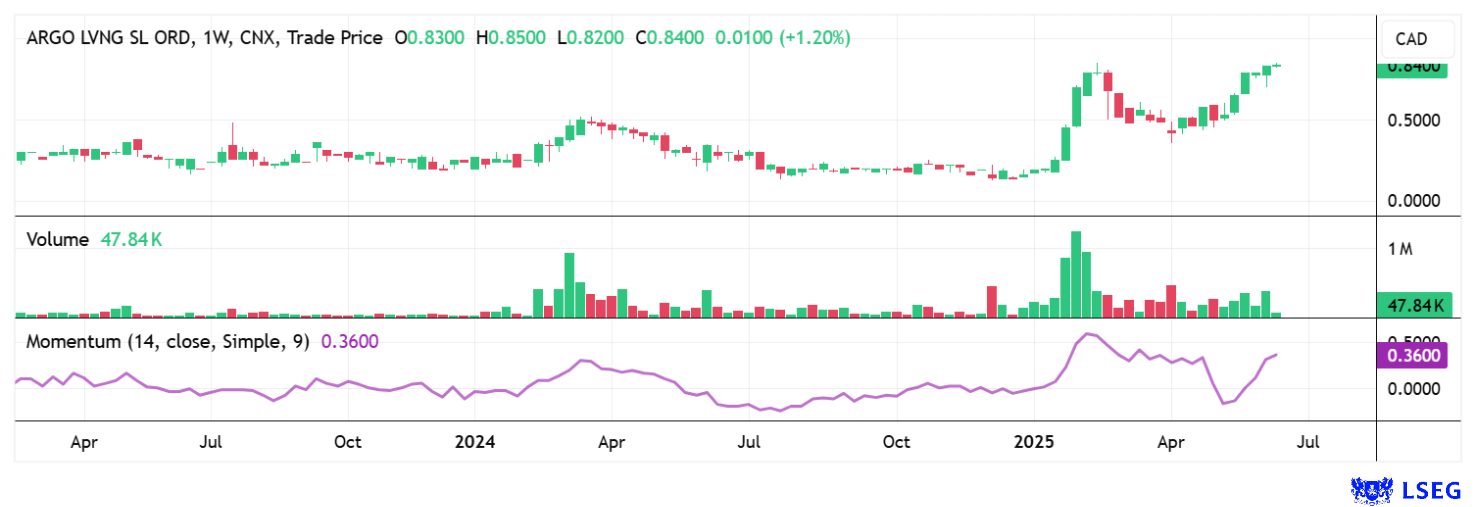

Investors discover ARGO shares

Licensing models and joint ventures with established building material manufacturers are part of Argo Living Soils' expansion strategy. This conserves resources and creates huge growth opportunities. Argo is still quite small - with around 18.3 million shares issued, the Company is currently valued at only approximately CAD 15.4 million. Nevertheless, the share price has already performed extremely well since January. The business approach is relevant to the international climate and, once implemented, will be the focus of important government contracts. Upcoming reconstruction efforts in largely destroyed war zones in Ukraine and the Middle East provide a compelling argument for shaping a better future. For Argo Living, this could be the trigger for a complete revaluation!

Argo Living Soils has undergone a fundamental strategy change in recent months to gain a foothold in the billion-dollar market for sustainable building materials. The Company is not relying on its own production but is pursuing a three-stage, partnership-based model. As a solutions provider, the Company can incorporate its innovations into existing production processes. The stock is becoming a blockbuster in the age of infrastructure renewal!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.