October 14th, 2025 | 07:20 CEST

CAUTION: Correction or even steeper rise? 100% with Planethic Group, Novo Nordisk, and Symrise

Does it always have to be "caviar"? As a luxury solution, this fish dish is deeply ingrained in the minds of many investors, but sometimes a smarter, hybrid-strategic mix may suffice. In the current market environment, the latest tariff policy from the White House feels like the flickering echo of a spy from Simmel's novel: unpredictable, tactical, and with far-reaching consequences. The threat of high tariffs on imports from numerous countries is putting supply chains on high alert and forcing companies to rethink their calculations. For investors, this means acting quickly, maintaining flexible portfolio weights, and questioning seemingly "safe" values. Those who favor local procurement channels are likely to navigate more stably. Here are a few ideas.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

PLANETHIC GROUP AG | DE000A3E5ED2 , NOVO NORDISK A/S | DK0062498333 , SYMRISE AG INH. O.N. | DE000SYM9999

Table of contents:

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

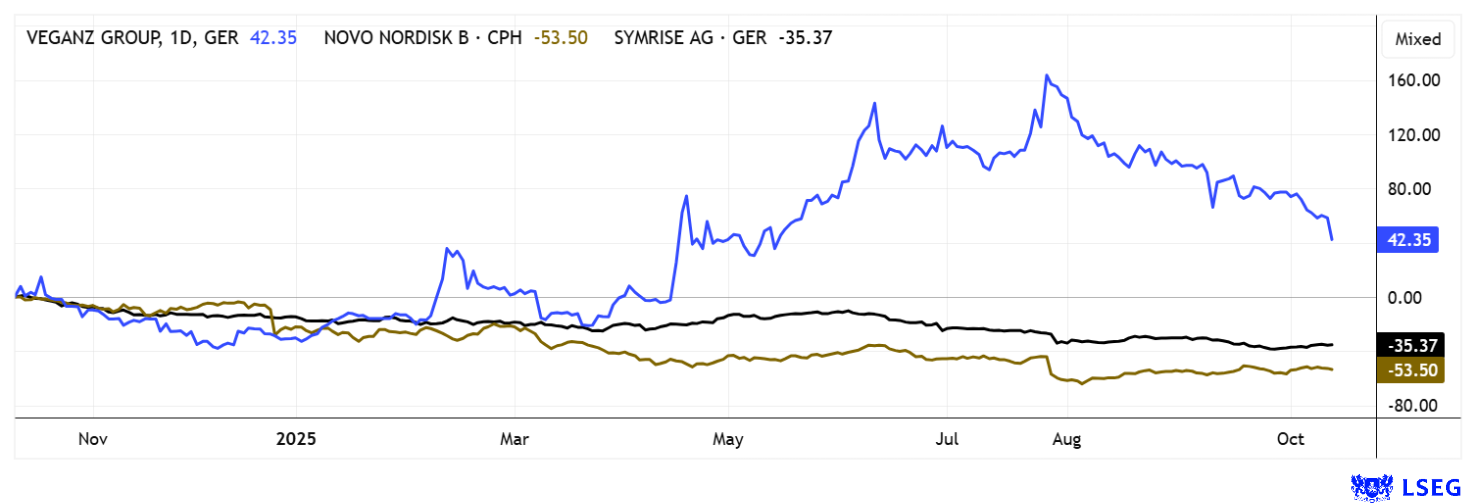

Novo Nordisk – Great excitement ahead of Q3 figures

The tension among obesity experts at Novo Nordisk is currently almost unbearable. After three disappointing earnings reports, the Danish company's share price has not risen significantly. At around EUR 38, the price has at least stabilized. As a reminder, the stock was one of the high flyers among growth stocks in Europe in 2024. In the short term, Novo Nordisk was the heaviest company in Europe with a market capitalization of just under EUR 700 billion. At prices around EUR 49, only EUR 225 billion of that remains. That is not insignificant, but it is not enough to cushion further shock waves in the Company's traditional business segment of weight loss products. Investors are therefore eagerly awaiting the upcoming Q3 figures, which are not officially due to be published until November 5. Many experts believe and hope that the Danes will be able to provide indications of a possible turnaround even before the deadline. Currently, there are still 16 out of 27 positive ratings on the LSEG platform, with an average price target of DKK 461 over 12 months. That is a whopping 25% premium if the outlook is raised again. Although sales are still growing, the pace has slowed; the P/E ratio for 2027 is already falling below 13. On top of that, a dividend yield of over 3% beckons. The stock should already have the worst phase behind it!

Planethic Group – Analysts see opportunity for doubling

The Planethic Group, formerly known as Veganz, has successfully evolved from a traditional supplier of plant-based foods into an innovative foodtech investment company. Founders Jan Bredack and Juliane Kindler laid the foundation in 2011 with vegan consumer products, but since 2017 have strategically focused on building proprietary brands and in-house production. Today, Planethic operates several production facilities, including for cashew-based camembert in Berlin, cheese alternatives in Austria, and algae-based smoked salmon products. The Company's current core product, Mililk® technology, is a 2D printing process for the production of alternative dairy products, exclusively licensed and strategically anchored as an ingenious growth engine.

Planethic now supplies over 28,000 retail outlets across 26 countries, ranging from discounters to organic specialty stores. Following restructuring, the Company achieved revenue of EUR 10.8 million in 2024, with an EBIT loss of EUR 3.9 million. A recent capital increase of EUR 7.1 million provides the financial strength to drive growth initiatives - particularly the expansion of production capacities and the expansion of Mililk® technology in the US, which are key objectives. By 2026, Planethic plans to build a factory with an annual capacity of 60 million liters of oat milk, underscoring its ambitious international growth strategy.

In parallel with its focus on FoodTech, Planethic is strategically selling investments such as OrbiFarm to generate liquidity for core growth. The North American market is served through its partner Jindilli Beverages, with long-term plans to target major clients such as McDonald's. Despite the progress made, reliable delivery volumes remain a challenge and require the further expansion of the Company's own factories. The strategy envisions establishing a total of ten production facilities under its own management, while additional capacity will be outsourced to partners. In July 2025, Planethic acquired machinery supplier IP Innovation Partners Technology for EUR 3 million in shares to strengthen its value chain.

Analysts are optimistic about the Planethic Group: First Berlin sees a clear "Buy" recommendation with a price target of EUR 26 and expects the Company to be in the black from 2027 with EBIT of EUR 0.50 per share and revenue of over EUR 117 million. mwb research currently estimates the fair value of a share at EUR 21.50. As a reminder: The share price has risen from EUR 4 to over EUR 20 since October 2024, and yesterday it was back below EUR 11. With its positioning as a high-growth foodtech company, the planned investments could really accelerate growth! Highly interesting for risk-conscious investors!

Symrise – Sustainability as the key to long-term success

Other companies are also trying their hand at sustainability. Symrise AG, based in Holzminden, Germany, is a leading manufacturer of fragrances and flavors and has an impressive, well-diversified business model. Its product portfolio is broad, covering the food, beverage, cosmetics, and pharmaceutical sectors. This ensures stable sales and reduces dependence on individual markets. Innovation is at the heart of the Company's strategy to meet ever-changing consumer needs. Symrise continuously invests heavily in research and development to create new products and solutions.

Nevertheless, shareholders have not had a rosy time of it, as the share price is currently trading at around EUR 76.8, well below its 52-week high of around EUR 121. Two disappointing earnings reports have put pressure on the share price this year. However, analysts have recently changed their tune. They are now forecasting slight sales growth for the coming year, with earnings per share also expected to rise. On the LSEG platform, the average target price is just under EUR 103, representing a good 34% upside potential for the EUR 10 billion company. Symrise has a clear strategic focus on sustainability and resource conservation, environmental protection, and social engagement. Natural raw materials from over 100 countries are used to ensure quality and sustainability. Another goal is climate neutrality by 2030, which Symrise is consistently pursuing. Short-term risks exist due to raw material price volatility and external disruptions, but the long-term strategy counteracts these uncertainties. The chart pattern is weak, but it has held steady at just over EUR 72 so far. Worth watching!

The capital markets are currently being turned upside down. The hot-headed child, Donald Trump, is making it difficult for investors to keep a clear head. While stocks have already risen significantly, that is no guarantee of an imminent downturn. Strong companies like Planethic are even being rated as clear buys by analysts. Well then!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.