December 16th, 2024 | 07:00 CET

Bull's eye in 2025: Nuclear energy and hydrogen! Watch out for Nel, Plug Power, First Hydrogen, Mercedes and BMW

The production of hydrogen using nuclear energy is seen as a promising way to create a flexible energy carrier in a climate-neutral manner. Especially in areas where renewable energy sources are insufficient or a continuous power supply is required, hydrogen demonstrates its strengths. The carbon footprint of hydrogen from nuclear energy is comparable to that of renewable sources such as wind and solar since nuclear power plants operate almost emission-free. Unlike wind or solar energy, nuclear power can generate electricity around the clock because it is not dependent on weather conditions. This helps to avoid so-called dark doldrums, such as the one recently experienced in Germany on Friday. In countries such as France and Japan, nuclear energy is already considered an option for hydrogen production to advance the decarbonisation of industries. Which stocks are coming to the fore as a result?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

NEL ASA NK-_20 | NO0010081235 , PLUG POWER INC. DL-_01 | US72919P2020 , First Hydrogen Corp. | CA32057N1042 , MERCEDES-BENZ GROUP AG | DE0007100000 , BAY.MOTOREN WERKE AG ST | DE0005190003

Table of contents:

"[...] Why should a modular electrolyzer cost more than a motorcycle? [...]" Sebastian-Justus Schmidt, CEO and Founder, Enapter AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

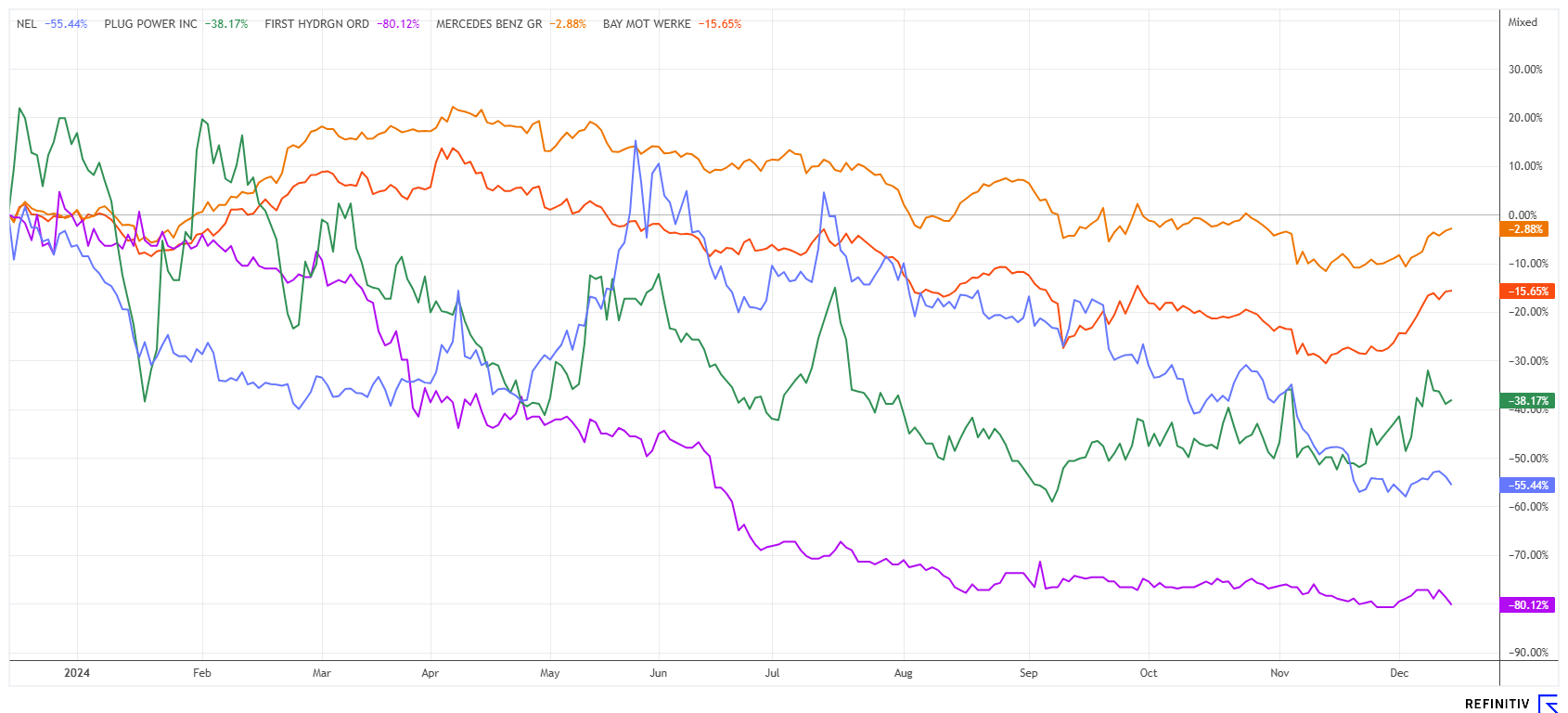

Nel ASA and Plug Power – 3 years of losses, now the turnaround?

The big losers in 2024 come from the hydrogen sector. Nel ASA and Plug Power have been through three years of sell-offs, with valuations still at around 10% of 2021. Whether that is already the starting point for a re-rating in 2025 depends on the flexibility of the business models. When it comes to large investment projects, politics remains in demand. But it is precisely here that Germany is hitting the brakes. As the 'Habeck' ministry announced last week, EUR 350 million that had already been earmarked will not be invested in hydrogen projects after all. The funds were supposed to come from a European Hydrogen Bank program. The idea was to use national funding to transition the industry into a more sustainable future. Now, due to disagreement over the conditions, these funds will be used elsewhere or returned to the federal budget. Green hydrogen was actually at the top of Germany's list of priorities.

In addition to the public investment crunch, private investors are also becoming increasingly hesitant. This is leading to a constant decline in orders, which the ailing balance sheets would now sorely need. Money is becoming scarce and capital increases will likely be necessary again. In terms of chart patterns, neither Nel ASA nor Plug Power are in a typical buy situation, as the stocks are fighting hard at their support lines. On a positive note, however, no new lows were produced in December, and trading volumes are rising significantly again. Nel ASA has already recovered by 14%, while speculation about Plug Power has picked up again since September, with a plus of 58%. The Q3 figures showed a 13% decline in revenue and a loss of over USD 200 million. Fundamentally, there is little incentive, but the general bullish mood in the markets is also attracting turnaround investors.

First Hydrogen – A solution for decarbonisation

Hydrogen from nuclear energy could become more widespread in the coming years. Many countries are stepping up their nuclear energy commitment under the 'NetZero' environmental flag. The industrial group Samsung C&T has already commissioned Nel ASA to supply a 10-megawatt alkaline electrolysis plant to produce hydrogen from surplus nuclear power. The Canadian innovator First Hydrogen also wants to use the 'Hydrogen-as-a-Service' model to supply customers in the Montreal-Québec City region with clean, green hydrogen as a fuel for the first time in the next few years. Several projects are currently being evaluated to advance this topic. In particular, the Company is investigating the potential of producing green hydrogen using electricity from small modular nuclear reactors (SMRs). This is because in the medium term, power grids will no longer be able to keep pace with the increasing demand for energy in the modern age. Several high-tech companies in the AI sector are therefore considering the use of SMRs, which offer a scalable and low-carbon alternative to conventional energy sources.

Nuclear energy is widely recognised by international bodies as a green energy source due to its ability to produce large amounts of electricity with minimal greenhouse gas emissions. First Hydrogen aims to install these SMRs in areas where grid power is limited or non-existent to produce storable hydrogen for filling stations. Once again, First Hydrogen is demonstrating its strong focus on innovative and sustainable energy solutions to accelerate the global energy transition.

CEO Balraj Mann commented: "Nuclear energy, unlike solar or wind energy, provides a constant source of energy for hydrogen production. The cost of electricity from an SMR is around 3.6 cents per kilowatt hour. Large technology companies have recognised the need to secure low-cost energy for the foreseeable future." The First Hydrogen share reacted positively to the latest news and rose from CAD 0.30 to CAD 0.40. This means that the Donald Trump dip has already been erased and the share price can take off again next year. In January 2024, the title was already at CAD 1.70.

Mercedes and BMW – This could be worth a second look

The automotive sector stands out as another loser of 2024, with significant downturns in the Chinese market weighing heavily on the balance sheets of European auto giants. Premium manufacturer Mercedes-Benz saw its earnings halve in Q3 due to declining exports and the general economic downturn. The operating EBIT margin fell from 12.4 to 4.7%. Bavarian competitor BMW also had to accept a significant drop in profits in Q3. The Company earned only EUR 476 million at the bottom line, almost 84% less than in the same period of the previous year. Revenue fell by nearly 16% to EUR 32.4 billion. This marks a disaster for Germany's flagship industry, paving the way for high structural costs as the sector embarks on its necessary transformation.

However, after a sharp drop in November, investors now seem to believe in a turnaround, as both stocks were able to almost completely offset the losses. 13 out of 27 industry experts on the Refinitiv Eikon platform even believe that automotive stocks will perform better in the coming year and issue a 'Buy' recommendation. Assuming the dividend is not cancelled, both premium manufacturers are valued at a P/E ratio of 5.8 to 6.3 in 2025 and will distribute between 6 and 7% to shareholders. These popular quality stocks have rarely been as cheaply priced. At EUR 56 and EUR 79 respectively, Mercedes and BMW are worth a first look for investors with a medium-term horizon. In 2025, the sector could also benefit from a possible industry rotation.

With a plus of over 30%, the S&P 500 enters the new year. This has only happened twice before in history and led to a significant correction in the following period. It remains to be seen whether this will be the case in 2025. After the long dry spell, the bombed-out prices are now offering excellent opportunities. First Hydrogen is innovative and is now valued at only EUR 15 million. A healthy diversification across countries and sectors reduces portfolio risk.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.