January 19th, 2026 | 07:20 CET

Black Monday: Despite Greenland disputes, tariffs, and Mercosur, biotech is on the rise! Bayer, Vidac Pharma, BioNTech, and Novo Nordisk in focus

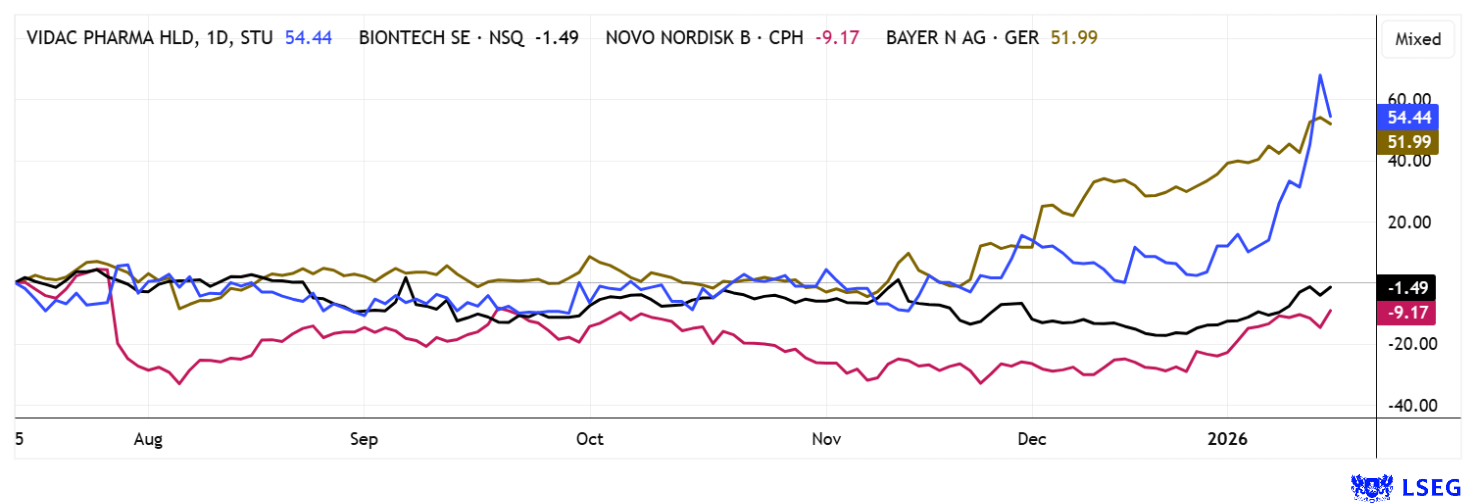

The stock market has had a very volatile start to 2026. Now, due to the unresolved Greenland issue, punitive tariffs are even being reintroduced for European countries that wish to stick with the Danish administration. Questions of international law did not impact the stock market in any of the conflicts of 2025. What usually receives a lot of attention, however, are shrinking margins caused by artificial tariffs. Just as the EU had been patting itself on the back over the Mercosur agreement, the next Trump-style threat is looming. The biotech sector is advancing steadily and with considerable momentum. Can the life sciences leaders outperform the DAX?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

BAYER AG NA O.N. | DE000BAY0017 , VIDAC PHARMA HOLDING PLC | GB00BM9XQ619 , BIONTECH SE SPON. ADRS 1 | US09075V1026 , NOVO NORDISK A/S | DK0062498333

Table of contents:

"[...] Defence will continue to develop its Antibody Drug Conjugates "ADC" and its radiopharmaceuticals programs, which are currently two of the hottest products in demand in the pharma industries where significant consolidations and take-overs occurred. [...]" Sébastien Plouffe, CEO, Founder and Director, Defence Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Bayer's operational turnaround – Pipeline successes and legal prospects

From EUR 21 to EUR 42 in just 12 months. Alongside Siemens Energy, Bayer shares are proving to be a real DAX gem. Now the US Supreme Court has also weighed in, helping the pharmaceutical giant out of its glyphosate predicament. The successful completion of the Phase III "Oceanic Stroke" trial for the anticoagulant asundexian, which proved effective for the first time in a clearly defined stroke setting, was also received particularly positively from an operational perspective. This has enabled the Company to partially rehabilitate a project that seemed to have been written off after failing in another indication. The planned dialogue with the regulatory authorities increases the likelihood that asundexian will become a relevant value driver in the medium term. At the same time, Bayer is strengthening its established pharmaceutical business with the EU approval of Eylea for another ophthalmology indication. The extended treatment intervals of the high-dose variant increase its attractiveness for patients and healthcare systems and should secure its competitive position against biosimilars. At the Group level, this significantly improves the visibility of cash flows.

On the legal front, too, there are signs of relief, at least in the long term, in the never-ending glyphosate saga. The US Supreme Court's decision to accept a glyphosate case to clarify fundamental legal issues opens up a strategic opportunity for Bayer. If the court follows the argument that state lawsuits are limited by federal law, this could substantially reduce the liability risk. Unexpectedly, support from the US government has also come to the fore – who would have thought? Or is Trump perhaps long on Bayer? All in all, this noticeably brightens the Group's risk profile.

Accordingly, analysts have raised their ratings and see upside potential again. With a moderate 2026 P/E ratio of 9.3, there are many indications that Bayer has bottomed out. The doubling of the share price in just 12 months actually calls for consolidation. The 2025 annual figures and outlook will be released on February 25. Those who have been investing since the 1920s could take a little break to calm their nerves. Noteworthy is the analytical upgrade by mwb research with a price target of EUR 54, compared to an outdated LSEG consensus of EUR 36.50. Expect further price target adjustments from other brokers.

Vidac Pharma – In the focus of countercyclical investors

This has now also visibly surprised CEO Max Herzberg. For two years, Vidac Pharma's share price has mostly moved sideways. This is not surprising, as research expenditure had to be refinanced repeatedly, but these investments have nevertheless led to important milestones being achieved. Vidac Pharma has now successfully established itself as a specialized innovator in the field of metabolic cancer therapies and is gaining profile both scientifically and on the capital markets. At the heart of the equity story is a therapeutic approach that specifically targets tumor metabolism, pursuing an alternative path beyond traditional chemotherapy or immunotherapy. The focus on hexokinase-2 as the central switching point of the Warburg effect opens up the possibility of selectively weakening cancer cells while increasing their immune susceptibility.

The recently granted US patents for HK2-modulating agents substantially strengthen this platform and secure long-term access to the most important pharmaceutical market. Particularly relevant here is the breadth of the patent claims, which cover both oncology and other fields of application. This not only increases the strategic value of the pipeline but also its attractiveness to potential partners or licensees. The drug candidates VDA-1102 and VDA-1275 serve as clinical validation of the same scientific logic and reduce the technological development risk.

Now, with progress towards clinical phases, Vidac is moving into a valuation zone where experience shows that strategic transactions are more likely. Analysts are already reflecting this potential, as shown by Sphene Capital's "Buy" recommendation of EUR 4.20, confirmed in November. The significant increase in trading volume since the listing in the electronic Tradegate system last week is also striking. Since the beginning of the year, the stock has exploded from EUR 0.55 to EUR 0.96! That is how returns are made.

Novo Nordisk and BioNTech – Analysts are now upgrading their ratings

The big life sciences stocks BioNTech and Novo Nordisk continue to perform well. Since Christmas, momentum-driven investors have been able to earn between 17% and 26% here as well. Clean technical formations indicate further medium-term appreciation. Whether it will be as much as Bayer or Vidac cannot be reliably estimated at this point. Nevertheless, it looks as if BioNTech and Novo Nordisk have finally broken through. The latter is benefiting from the approval of a higher maximum dose of the weight loss drug Wegovy of up to 7.2 mg semaglutide per week by the British health authority MHRA. With this expansion, the Company is strengthening its position in the growing weight loss market, where it competes fiercely with Eli Lilly's tirzepatide. Additional momentum could come from the new oral Wegovy tablet, which, according to Berenberg analysts, is expected to generate around USD 1 billion in sales as early as 2026. Experts have already raised their target price to DKK 415 in 2025, with Jyske Bank even predicting DKK 475. On Friday, Novo Nordisk was already trading at DKK 388.

BioNTech is increasingly focusing on oncology and plans to publish the results of seven advanced cancer studies this year, five of which are potentially relevant for regulatory approval. The Mainz-based biotech company aims to move away from its declining COVID-19 vaccine business. It still has cash reserves of around EUR 17 billion. Here, too, there are positive analyst ratings, like from Berenberg with a 12-month price target of USD 155. Incidentally, the LSEG consensus is well below this at only USD 136, with the current price at USD 109. Continue to buy both stocks!

After a prolonged consolidation phase, the biotech sector is on the move again. In recent weeks, stocks such as Bayer, BioNTech, and Novo Nordisk have defended important technical support zones and subsequently risen sharply. With the start of the 2026 stock market year, capital is now likely to be increasingly shifted from well-performing technology stocks to attractively valued life science and biotech companies. Among these promising stocks, Vidac Pharma is also increasingly coming into focus. The Company, which is working on novel therapeutic approaches in the fields of oncology and dermatology, is benefiting from the positive sentiment in the sector and its own strong momentum.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.