December 12th, 2025 | 06:50 CET

Bitcoin crash or super rally in 2026? Keep an eye on Strategy, Metaplanet, Nakiki, Mara, and Coinbase!

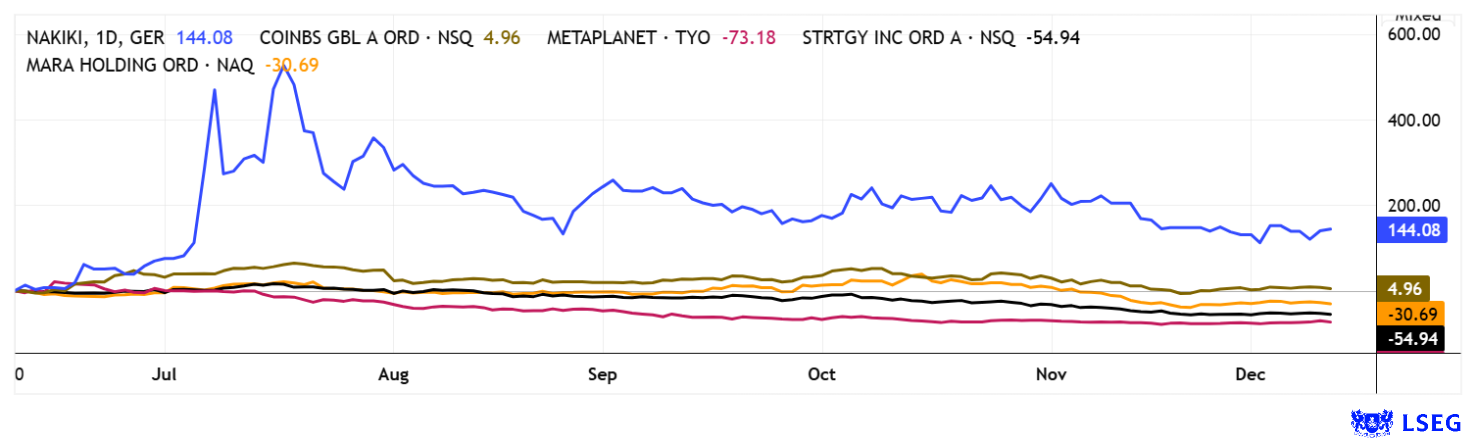

Up and down and down and up! Since Bitcoin reached its interim high of USD 125,965, it has been bouncing energetically. On some days, the swings reach USD 10,000. That is quite remarkable, as 10% fluctuations are more common among small caps or selected Nasdaq tech stocks. From the trading behavior over the past two months, the takeaway is this: either Bitcoin enters a real winter phase with further declines, or volatility continues, depending on whether accumulation or selling dominates. The same applies to BTC asset manager stocks, with the downside here being that there is no longer a premium on Bitcoin, but there is good leverage. A toast to traders or desperate long-term investors! Here are a few tips.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

NAKIKI SE | DE000WNDL300 , STRATEGY INC | US5949724083 , METAPLANET INC | JP3481200008 , MARATHON DIGITAL HOLDINGS INC | US5657881067 , Coinbase | US19260Q1076

Table of contents:

"[...] Most of all we were on a mission to MAKE CRYPTOCURRENCY ACCESSIBLE [...]" Justin Hartzman, CEO, CoinSmart Financial Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Strategy and Coinbase – Completely off track

We had often warned about the risks. Now it has happened. The Bitcoin holding company Strategy has become a 60% loser over the past 12 months, after investors had pocketed over 2,000% gains in the last three years. As always, the postulate of "timing" proves true. Those who were not in from the beginning, like Michael Saylor and his followers, have experienced a rude awakening since July 2025. The price of the BTC high-flyer fell like a stone from a high of USD 457 to USD 173 yesterday, with 63% of its value now wiped out. Even worse, the market capitalization of MSTR shares fell from over USD 120 billion to just USD 52 billion. On top of that, the Company has substantial debt of over USD 8 billion and must cover upcoming bond interest payments from its cash reserves. It is likely that some BTC will need to be sold at this level. A hot potato for gamblers and Bitcoin believers!

Crypto trader Coinbase traded at USD 263 yesterday, a three-month low, and has fallen 40% since its peak in July. What seems strange here is that crypto revenue has been at record levels in recent months, so earnings should also be flowing in nicely. However, with a 2026 P/E ratio of 39.8, the valuation is likely overstretched, especially since investors are willing to pay 8 times revenue for the stock. We are in a different world here!

Nakiki SE – Fortunately, not yet invested

The Nakiki share is currently taking a break between EUR 0.50 and EUR 0.60. But there is news: at the beginning of December, the share capital was successfully increased by EUR 686,000 at EUR 1 per share. The new shares are granted exclusively against contributions in kind in the form of loan receivables. The respective loan amounts correspond to the calculated nominal amounts of the allocated new shares. The subscribers to the capital increase include Bitcoin Hotel LLC, USA, as well as other German and international investors. Bitcoin Hotel LLC is represented by BTC expert Marc Guilliard, who already advises Nakiki strategically on its positioning as a Bitcoin Treasury Company. Marc Guillard was on roadshow in the fall, giving the uninitiated an impressive insight into the world of Bitcoin. This is now followed by the announced bond offering of up to EUR 8 million. The bond (WKN: A460N4) bears interest at 9.875% per annum, with interest payments made twice a year. The net cash inflow will be used exclusively for the dynamic expansion of a valuable Bitcoin portfolio.

The Bitcoin Treasury business model is now being implemented. The bond is scheduled to be listed on the over-the-counter market of a regional exchange on January 22, 2026. Repayment will be made at the end of the five-year term on the same date in 2031 at 100% of the nominal value. The active investment phase will begin after the placement is complete. Hopefully, Bitcoin will then offer attractive entry prices so that shareholders and bond subscribers can achieve long-term success. Various experts predict prices between USD 50,000 and USD 250,000 for Bitcoin itself. There are arguments for both sides. Flip a coin or, if you are a Bitcoin fan, just go for it. The market capitalization of the share is only EUR 3.4 million. Exciting!

MARA Digital Holdings and Metaplanet – What to do when the price of your collectible falls?

With declines of 30% and 70% respectively, MARA Digital Holdings and Metaplanet have also taken a heavy beating. Marathon Digital Holdings (MARA) currently holds around 50,000 to 53,000 BTC in its treasury, which represents a significant increase compared to previous quarters. Metaplanet Inc. owns around 30,823 BTC, according to the latest treasury trackers and official reports. MARA's stock is trading below its pure Bitcoin net asset value (NAV), especially when looking at the BTC value per share in isolation. However, when taking into account the high debt of around USD 3.3 billion, the outlook appears somewhat bleak.

Metaplanet, on the other hand, traded at a significant premium to its BTC NAV until July 2025, as the market priced in strong growth potential. The Japanese company recently secured around USD 119 million through the issuance of preferred shares, with the money to be used for further BTC purchases. One can only hope that low prices will also be used for additional purchases. The advantage for European investors lies in Metaplanet's high trading liquidity. On high-volume days, as many as 10 million shares can flow through the trading books. This makes it easy to buy and sell, which is a prerequisite for traders to react quickly to crypto movements. A close look at the next reporting dates provides insight into the holdings, allowing for recalculation. A market for specialists!

The crypto world has clearly set itself apart from other asset classes over the past 5 years. It is not only the astonishing performance of Bitcoin itself that has attracted enormous attention to the entire sector. Now, in a phase of falling prices, the wheat is being separated from the chaff, and for many follower companies, their business models are now being put to the test. The absurd premiums have disappeared, and what counts now are only profits and a healthy balance sheet.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.