January 6th, 2025 | 07:00 CET

Biotech-Rally 2025: Evotec, BioNTech, Vidac Pharma, Pfizer and Bayer are on the buy list

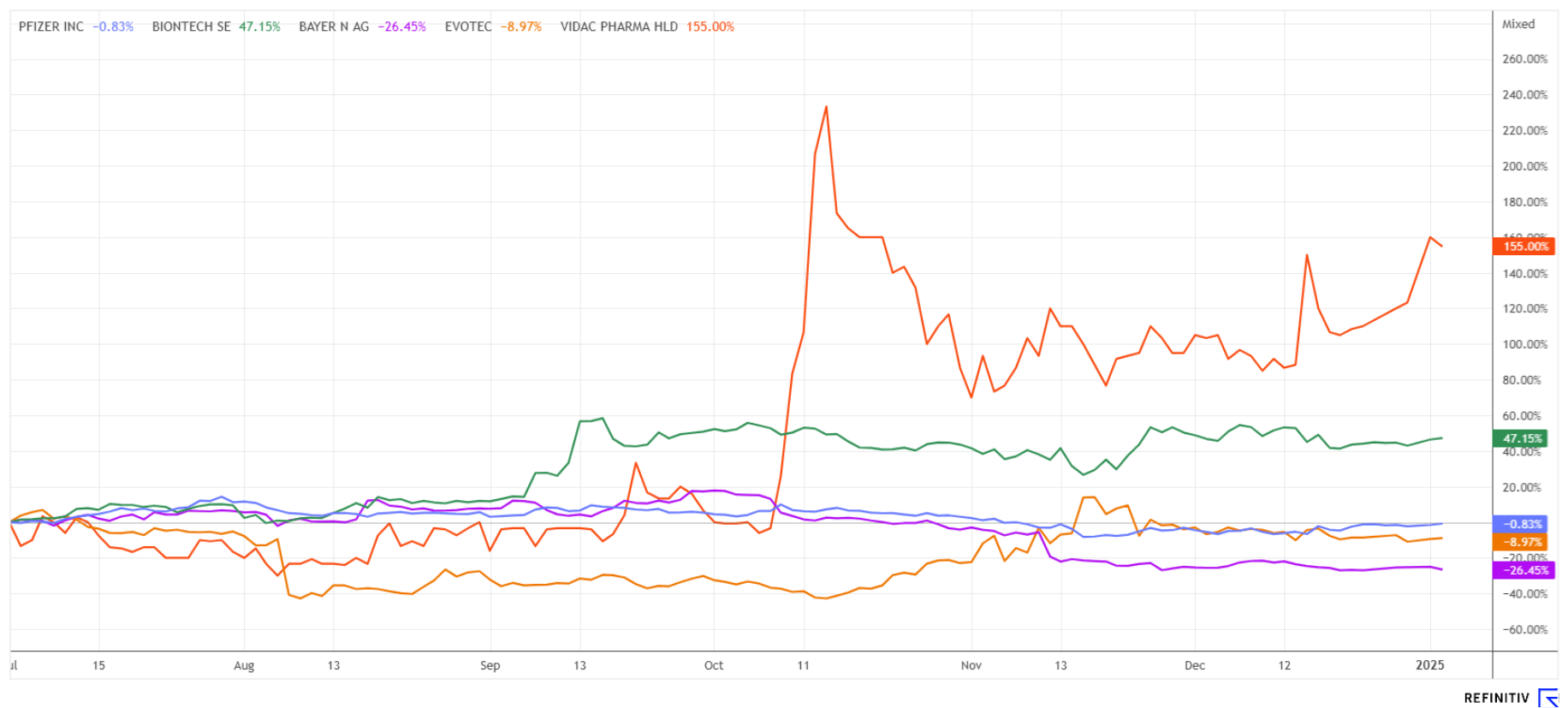

For two years, there was almost no movement in the biotech sector. Not even the trend of falling interest rates that began in 2024 could persuade investors to make larger investments. Meanwhile, AI and high-tech stocks continued to perform well, driving the Nasdaq 100 index up by over 30%. However, in the last quarter of 2024, some bombed-out life sciences stocks saw significant markups, and new takeover rumours also began circulating. Whether the sentiment can continue to rise in the coming weeks is something we will explore further. Let's take a closer look at our top picks for 2025.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

EVOTEC SE INH O.N. | DE0005664809 , BIONTECH SE SPON. ADRS 1 | US09075V1026 , VIDAC PHARMA HOLDING PLC | GB00BM9XQ619 , BAYER AG NA O.N. | DE000BAY0017 , PFIZER INC. DL-_05 | US7170811035

Table of contents:

"[...] Defence will continue to develop its Antibody Drug Conjugates "ADC" and its radiopharmaceuticals programs, which are currently two of the hottest products in demand in the pharma industries where significant consolidations and take-overs occurred. [...]" Sébastien Plouffe, CEO, Founder and Director, Defence Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Evotec and Bayer – Low but highly attractive

Things have gone quiet around the Hamburg-based drug discovery specialist Evotec as the year draws to a close. The stock has lost more than 50% over the course of the year. The trouble began when long-standing CEO Werner Lanthaler stepped down in January. After a few revenue and profit corrections, there was another upward wave above EUR 10 in Q4 due to emerging takeover rumours. The supposed bidder was the US company Halozyme Therapeutics. The Americans are also researching active ingredients and seek to strengthen their position through a takeover. However, the management and supervisory boards quickly rejected the offer. At the start of the year, Evotec shares were trading at EUR 8.45. The annual report will be published on March 27. On the Refinitiv Eikon platform, 7 out of 11 experts are calling for an entry, they expect an average 12-month price target of EUR 11.25, which is still 33% above the current level. With a successful entry below EUR 7.50, Evotec has secured its place on our 2025 biotech selection list.

There is little good to report from Germany's flagship life sciences company, Bayer. The stock has lost a full 45% in 2024 and is trading at around EUR 19, only slightly above its 20-year low. The adversity stems from the USD 70 billion takeover of crop science specialist Monsanto. Bayer has already spent around USD 12 billion on lawyers, lawsuits and damages. Last week, at least a small piece of relief came from overseas. A federal court in Australia has dropped the last pending lawsuit against Bayer over the alleged carcinogenic effects of the glyphosate-based weed killer Roundup. On a positive note, the consensus opinion of many analysts for the Bayer share reached a new low. Only 3 out of 22 analysts currently recommend the share as a "Buy". If that is not the perfect contrarian indicator for an entry, we do not know what is. Speculators should consider buying below EUR 19.25!

Vidac Pharma – Now entering Phase 2 and 3 with vigour

One of the top performers in the last 6 months was the biotech small-cap Vidac Pharma, with a price increase of over 150%. Founded in 2012, the Company is led by Prof Max Herzberg, one of the founding fathers of the Israeli life sciences industry. Vidac Pharma is developing drugs that will help cancer patients by reversing the abnormal metabolism of cancer cells, thus stopping the proliferation of these cells. Despite its modest size, the Company is already in the clinical development phase.

There is currently reason to celebrate. Vidac has received the final report from Beilinson Hospital's Helsinki Committee on its groundbreaking clinical trial for cutaneous T-cell lymphoma (CTCL). The report, which was submitted to the Israeli Ministry of Health, indicates promising results that will enable the Company to proceed with a pivotal Phase 2-3 study. If successful, this would be an important step towards product registration. This clinical trial was conducted under the direction of Prof. Emilia Hodak, one of the key opinion leaders in this field.

CTCL, a rare and debilitating lymphoma, affects patients for years with symptoms including severe skin inflammation and lesions caused by cancerous T-cells circulating in the blood and lymphatic system. There is currently no universally accepted standard of care for CTCL. Vidac's VDA-1102, an innovative topical ointment, blocks the hyperglycolysis characteristic of cancer cells while providing effective and targeted treatment. The Company recently completed an open-label Phase 2a study to evaluate the safety and efficacy of VDA-1102 ointment in adult patients with stage 1 relapsed mycosis fungoides (MF), the most common form of CTCL. 56% of the patients achieved a clinical response, and a complete response was achieved in 22% of the patients by week 8. A partial response was achieved in 34% of the subjects after 8 to 12 weeks, and all study participants remained progression-free during the 4-month study. VDA-1102 showed rapid efficacy and appears to work substantially faster than existing treatments.

The study also suggests that VDA-1102 may have effects beyond the direct treatment area, likely due to its mechanism of action involving T-cell potentiation both directly and by modulating the tumour microenvironment. The convincing results of the Phase 2a study now pave the way for the Company to initiate a comprehensive Phase 2-3 study. Success in these studies could establish VDA-1102 as a breakthrough treatment for CTCL, thus addressing an urgent unmet need in oncology. Vidac's share price is currently between EUR 0.70 and EUR 0.80, and the analyst firm Sphene Capital already published a "Buy" rating with a target price of EUR 4.90 in the summer. If the Phase 2-3 studies also show the expected results, the share price will quickly multiply. Vidac has secured its place on the top favourites list for 2025.**

BioNTech and Pfizer – Settlement payments for COVID-19 vaccines

There is news about our watchlist companies BioNTech (BNTX) and Pfizer (PFE). The vaccine manufacturers have reached multi-million dollar settlements in the US in the dispute over royalties. The equivalent of EUR 1.2 billion will be paid to the US National Institutes of Health (NIH) and the University of Pennsylvania. USD 791.5 million will go to the US agency, while USD 467 million has been awarded to the university. In 2020/21, the Mainz-based company and the US pharmaceutical giant Pfizer launched a COVID-19 vaccine that was partly based on third-party patents. A BioNTech spokesperson emphasised that neither agreement constitutes an admission of liability with regard to the allegations made. The BNTX stock was little affected by this agreement, as the Mainz-based company is still sitting on profits from vaccine sales amounting to over EUR 17 billion. BioNTech remains a solid investment at around EUR 112, even after an interim profit of almost 37% since the initial allocation at EUR 82. Analysts on the Refinitiv Eikon platform expect prices to exceed EUR 130 within 12 months, offering a solid long-term potential for investors with a medium-term horizon.

US partner Pfizer has undergone an extended consolidation over the last 48 months. However, the signs have now turned for the better. Pfizer is a life sciences company that researches, develops, manufactures and markets biopharmaceutical products. Its main focus is on drugs and vaccines in various therapeutic areas, including cardiovascular, metabolic, migraines, and women's health. Pfizer's share price underperformed the entire life sciences sector by 12% in 2024, but its valuation has now reached historically low levels. With a P/E ratio of 9.2 for 2025 and a dividend yield of 6.4%, long-term value investors can no longer make any major mistakes. Trade with limited additional purchases below EUR 26.

2024 will go down in stock market history as a year of losses for life sciences. However, the first turnaround movements occurred in the last quarter. There is still speculation of a takeover of Evotec. The blockbuster stocks Bayer and Pfizer could technically become winners in the upcoming year. Vidac Pharma has already performed very strongly due to good study results, and further upgrades are likely here in 2025.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.