May 5th, 2025 | 07:20 CEST

Biotech is back with artificial intelligence! Evotec, NetraMark Holdings, Bayer, and BioNTech

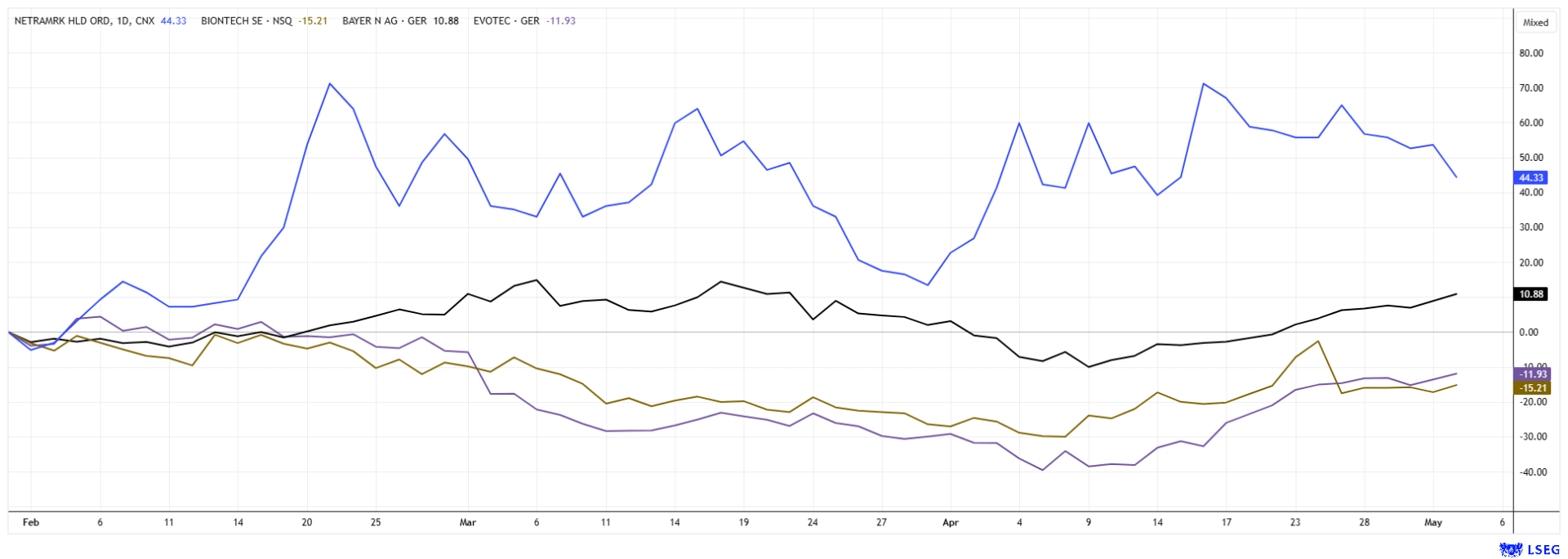

Artificial intelligence has arrived in health research! Whenever large volumes of data need to be analyzed, patterns recognized, or results condensed, immense computing power is required. The goal is to detect complex structures, automate processes, and make real-time decisions. The use of AI in medicine and pharmaceutical development is making good progress because time and high validation capability are key here. Some companies have already recognized the signs of the times and are working hard on the new technologies. On the stock market, this is often the starting signal for significantly higher valuations. Evotec, Bayer, and BioNTech are well-known European players, while Canadian company NetraMark Holdings has seen its share price increase sevenfold since fall 2024. What is behind this surge?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

EVOTEC SE INH O.N. | DE0005664809 , NETRAMARK HOLDINGS INC | CA64119M1059 , BAYER AG NA O.N. | DE000BAY0017 , BIONTECH SE SPON. ADRS 1 | US09075V1026

Table of contents:

"[...] Defence will continue to develop its Antibody Drug Conjugates "ADC" and its radiopharmaceuticals programs, which are currently two of the hottest products in demand in the pharma industries where significant consolidations and take-overs occurred. [...]" Sébastien Plouffe, CEO, Founder and Director, Defence Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Evotec – Recently reported to have fallen sharply

Pharmaceutical drug researcher Evotec is currently realigning itself. The Company intends to focus on high-quality services and therapeutic areas and reduce its project portfolio by around 30%. The Hamburg-based company wants to become more efficient and increasingly rely on automation and artificial intelligence. Evotec intends to gradually divest itself of its investments and focus on the two pillars of drug discovery and preclinical development in the future. By 2028, the Company aims to save more than EUR 50 million through this focus and various cost-cutting measures in addition to its ongoing cost-reduction program. Evotec wants to accelerate growth again after a disappointing performance last year.

According to its current outlook, Evotec aims to achieve average revenue growth of 8 to 12% per annum between 2024 and 2028 while maintaining an EBITDA margin of 20%. The revenue guidance for 2025 is currently EUR 840 to 880 million, following EUR 797 million. The Company currently cooperates with 500 active partners, with the top 10 partners generating around 38% of revenue. At the end of April, another milestone payment of EUR 75 million from BMS was made. Evotec's share price recently touched the lows of summer 2024 at around EUR 5.20. Since then, however, it has risen sharply, with investors likely betting on good news for the first quarter on May 6. The most recent entries are a good 25% in the profit zone, and the stop price can be confidently raised to EUR 6.95. Still interesting for speculators!

NetraMark Holdings – On the path to success

Big Data and AI can analyze large amounts of data from electronic health records, genome data, and patient registries to identify analogies and patterns. This makes it possible to identify suitable participants for clinical trials more quickly and accurately. This significantly shortens recruitment times and improves accuracy. Costs can also be reduced significantly, meaning that investments in AI can pay for themselves very quickly. Canadian technology company NetraMark Holdings Inc. (AIAI) develops innovative solutions for the pharmaceutical industry using Generative Artificial Intelligence (Gen AI). The results to date point to a quantum leap, as the new NetraAI 2.0 platform addresses one of the most pressing challenges in clinical research: finding the interface between efficacy and feasibility.

NetraMark signed a global agreement with Worldwide Clinical Trials, a global full-service contract research organization (CRO), in April. This strategic partnership introduces a new service offering for Worldwide's customers based on the NetraAI 2.0 platform. This agreement combines three decades of clinical excellence with NetraMark's advanced NetraAI platform. Leveraging Worldwide's global clinical operations, scientific rigor, and therapeutic expertise in conjunction with NetraAI increases trial efficiency and delivers regulatory insights from even the most complex data sets. Under the agreement, NetraMark's AI technology will initially be used for Phase 2 clinical trials in neuroscience and oncology, as well as selected Phase 3 clinical trials. CEO George Achilleos knows what he is talking about, as a high percentage of all clinical trials fail in Phase 2 and 3 in particular.

The AIAI share price is currently trading at a solid CAD 1.44. This brings the approximately 80.2 million shares to a market value of CAD 113 million. This would now be sufficient for a listing on the NASDAQ, and investors should expect continued strong momentum. NetraMark is well-positioned in the fields of AI and drug development, and its medium-term growth prospects are excellent!

Click here for the latest interview with CEO George Achilleos and Lyndsay Malchuk on THE MARKETS ONLINE platform.

Bayer and BioNTech – Artificial intelligence on the rise

Bayer and BioNTech are also heavily committed to integrating artificial intelligence into drug research. Bayer is driving the transformation of the healthcare and nutrition industry by using state-of-the-art AI technologies to ensure faster product development and improve manufacturing and delivery. "AI has the potential to improve the lives of millions of people. We have begun to harness the transformative power of AI, and the best is yet to come," says Bijoy Sagar, Chief Information and Digital Officer. The Leverkusen-based company's shares have made a promising start to 2025, finally regaining the EUR 24 mark on Friday. First-quarter figures are expected on May 13, and the excitement is building. The share price is undergoing a noticeable turnaround. Raise the stop price for your holdings to EUR 22.85.

BioNTech already began strengthening its AI capabilities in 2023. The goal: revolutionizing cancer therapy through personalized medicine. Modern data analysis will play a central role in this. With the acquisition of AI specialist InstaDeep, the Mainz-based company has taken a decisive step toward massively expanding its expertise in cancer research. The use of advanced AI models should enable drugs to be developed more quickly and precisely in the future, allowing them to better respond to the genetic characteristics of each individual patient. BioNTech shares have already rallied 50% from EUR 80 to EUR 120. This allowed the stock to partially recoup lost ground from 2021/22. Nevertheless, the profits from the COVID pandemic will remain history for now. BioNTech generated more than EUR 20 billion in surplus with vaccines in two years, and the Company still has a good EUR 17 billion in its coffers. Today, the Q1 figures are coming in with a quarterly estimate of minus EUR 2.27. BioNTech now has the chance to surprise on the upside. Follow the momentum!

The use of AI in clinical research and drug development is still in its infancy. NetraMark Holdings is accelerating this development and can look forward to high growth rates thanks to its special focus. The stock's rally is likely to continue soon. Evotec, Bayer, and BioNTech have also recently delivered positive chart signals!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.