November 27th, 2024 | 07:00 CET

Biotech in focus! The 2025 blockbusters: Pfizer, BioNTech, Nyxoah, Valneva or Evotec - Who will take off?

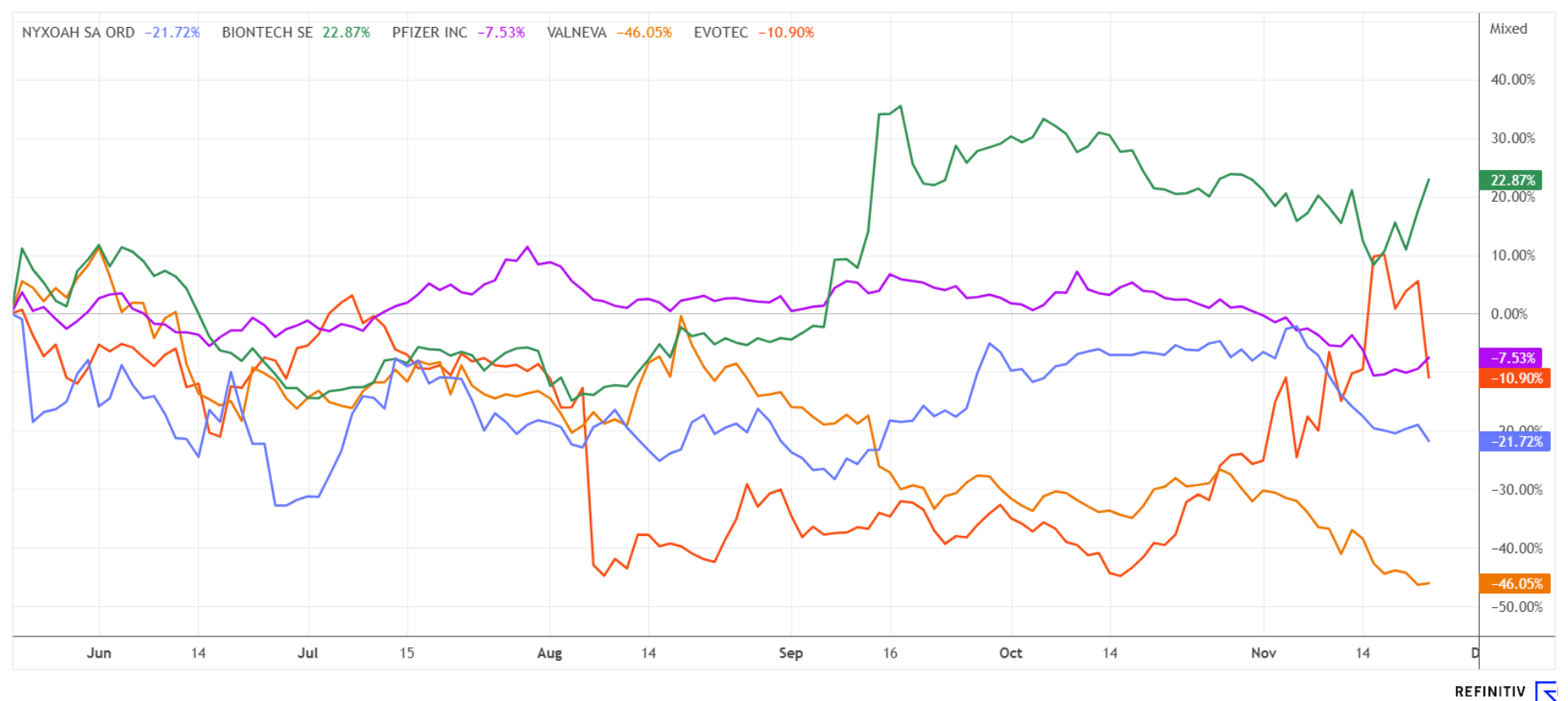

The Q3 figures have now been processed. In the shadow of the tech giants on the Nasdaq, biotech stocks are currently being neglected. However, it is important to note that as pressure on the international economies increases, so does the likelihood of interest rate cuts by the central banks. Many investors have been underweight in biotech for quarters, prioritizing other sectors. All of this could be reversed in 2025. An early positioning with the most important protagonists seems promising. We are picking the best opportunities for you from the "Advent calendar."

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

NYXOAH SA | BE0974358906 , PFIZER INC. DL-_05 | US7170811035 , BIONTECH SE SPON. ADRS 1 | US09075V1026 , VALNEVA SE EO -_15 | FR0004056851 , EVOTEC SE INH O.N. | DE0005664809

Table of contents:

"[...] Defence will continue to develop its Antibody Drug Conjugates "ADC" and its radiopharmaceuticals programs, which are currently two of the hottest products in demand in the pharma industries where significant consolidations and take-overs occurred. [...]" Sébastien Plouffe, CEO, Founder and Director, Defence Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BioNTech and Pfizer – Now it is getting political

BioNTech and Pfizer have long been criticized for their approach to the educational work on COVID-19 vaccines. Now, further headwinds are looming from the US because US President-elect Donald Trump has appointed a vaccine skeptic to the cabinet, of all people. Vaccine stocks such as BioNTech, Pfizer and Moderna have lost considerable ground in recent days. The nomination of Robert F. Kennedy Jr. as US Secretary of Health is no surprise, but it is causing uncertainty among investors. As press agencies quote the new president, Kennedy will "end the epidemic of chronic diseases and make America healthy again". Sounds promising! For far too long, citizens have been confronted with deception and disinformation regarding public health.

Nevertheless, in Europe, the new coronavirus vaccines are currently being delivered to doctors' offices, and analysts are keeping their fingers crossed in anticipation of a severe flu season. Goldman Sachs, for example, has issued a "Buy" recommendation for BioNTech with a 12-month price target of USD 137. Harry Gillis, an analyst at Berenberg, has also issued a "Buy" recommendation with a target price of USD 130. The Company is currently trading at USD 113, so there is potential for around 18%. On November 15, a new 52-week low of EUR 23.33 was reached for cooperation partner Pfizer. On the Refinitiv Eikon platform, 12 of 27 analysts have issued a "Buy" recommendation with a median price target of USD 32.15. The stock is currently trading at around USD 25.50, which already offers a dividend yield of over 6% at this level.

Nyxoah SA – There is still something going on in December

The medical technology company Nyxoah SA from Belgium is waiting for the FDA to approve its flagship product, Genio®. The Company has successfully raised over USD 100 million in 2024, securing its financial footing. Investors agree: Genio® could really take off in 2025! Genio® is an innovative, patient-focused treatment for obstructive sleep apnea (OSA). The disease causes repeated disruptions in breathing during sleep which can cause concomitant illnesses such as depression, diabetes or even heart attacks and strokes. The Company has spent years developing the Nyxoah Genio® technology, which is based on neurostimulation. In Germany, its largest market, the product is already being used successfully in many ENT clinics. The Belgians are currently building a sales team for the US so that they can start commercialization as soon as the FDA approval is granted.

Now is a busy time for the Company. On the one hand, Nyxoah is attending the German Equity Forum in Frankfurt, and on the other, the 36th Piper Sandler Annual HealthCare Conference is on the agenda on December 4. The Company's presentation will be webcast on the same day at 6:00 PM CET. A live audio webcast of the presentation will be available online on the Company's website at www.investors.nyxoah.com. The share price could benefit significantly from a positive outlook to 2025/26. Stay tuned!

Evotec and Valneva – At rock bottom

We have had Evotec on our radar for months, as it has shown significant movement between EUR 5 and 10 recently. As a reminder, in 2021, the Hamburg-based company's shares were still trading at just under EUR 45. At the end of 2023, there was a scandal involving longtime CEO Lanthaler, who had speculated with his own shares without issuing an ad hoc announcement. The events have still not been fully explained, but the Company also suffered a major setback after a cyber attack. There are currently increasing signs that financial investors are taking notice of the stock. In addition to a 9.2% stake by Triton, Halozyme Therapeutics had also made an offer of EUR 11 per share. However, this offer was withdrawn last week and Evotec corrected again by more than 20% downwards. Stay actively engaged here; there will be more takeover attempts, and short sellers will have to cover them at some point. Therefore, the stock should not come under much more pressure in the current environment.

There has been a lot of bad news recently from the vaccine manufacturer Valneva. Although the Company was able to raise around EUR 61 million from institutional investors over the summer, investor sentiment remains lukewarm. This is because the figures were disappointing again. After nine months, the French-Austrian biotech company's revenues rose modestly from EUR 111.8 million to EUR 116.6 million, yielding a net profit of EUR 24.7 million. Adjusted EBITDA improved noticeably to EUR 48.6 million, compared to minus EUR 46 million in the previous year. Valneva has now raised its revenue targets for the full year. Total revenues are estimated at between EUR 170 and 180 million, with investments in research and development of EUR 60 to 75 million. The market launch of the first chikungunya vaccine in Canada and Europe is progressing, with further possible approvals in Brazil and the UK imminent. Despite these stable forecasts, the share price continued to lose ground in November. At EUR 2.01, a new 4-year low was even reached last week. The Company went public at EUR 4.90 in 2022. The overall performance is disappointing, even though the P/S ratio has now fallen to around 3. Keep an eye on the value, even lower levels are possible!

Despite all the stock market euphoria in 2024, the biotech sector has so far failed to fully convince. Neither blockbuster companies like BioNTech nor Pfizer are really getting out of the low, and Evotec and Valneva are struggling with unique issues. An exception is Nyxoah, which has gained over 70% in the last 12 months. The Company's flagship product, Genio®, is expected to receive approval in the US soon. This would put the sights back on the highs of around USD 20.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.