January 27th, 2025 | 07:40 CET

Biotech - Here we go! 100% opportunities for Evotec, BioNxt, Bayer, Formycon, and Novo Nordisk!

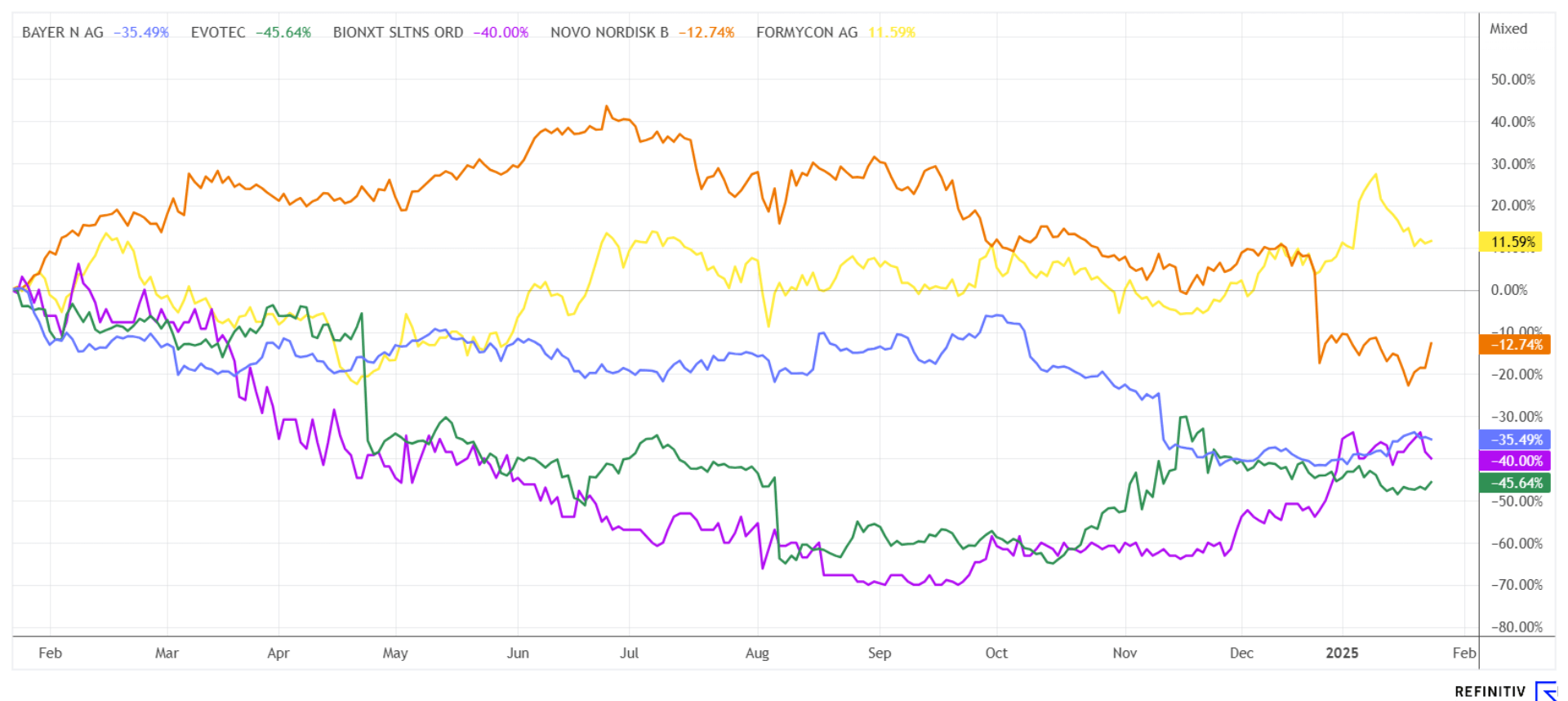

Last week, the DAX 40 index reached a new all-time high of 21,520 points. At first glance, this sounds odd because half of the stocks are languishing at multi-year lows. However, the driving forces are the heavyweights SAP, Siemens, Allianz, Airbus, and Deutsche Telekom. They are pushing the index upward daily, putting ETF fund managers under pressure as they have to adjust the weightings accordingly. However, the more capital flows into the leading stocks, the more investors are looking for lagging stocks that could successfully turn the chart around due to operational turning points. We select a few opportunity stocks.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

EVOTEC SE INH O.N. | DE0005664809 , Bionxt Solutions Inc. | CA0909741062 , BAYER AG NA O.N. | DE000BAY0017 , FORMYCON AG | DE000A1EWVY8 , NOVO NORDISK A/S | DK0062498333

Table of contents:

"[...] As a company dedicated to developing treatments for rare heart diseases, we see this as an opportune moment to contribute to the fight against heart disease and make meaningful strides in improving heart health worldwide. [...]" David Elsley, CEO, Cardiol Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Novo Nordisk – Back in demand after halving

After a correction of almost 50%, investors have recently seen positive signs from the crowd favorite Novo Nordisk again. The specialist in weight-loss pharmaceuticals published positive topline results from its Phase 1b/2a clinical trial of amycretin last week. The share price, which had been depressed for weeks, picked up with a price increase of over 10%. Of course, the depressed margin due to competing products remains, but investors are now banking on a broader diversification of the Danish supplier.

Different signals are still coming from analysts. While the drug Amycretin is meeting with positive reactions from experts, CagriSema's expectations are somewhat disappointing. Analysts' assessments range from skeptical to optimistic and reflect a broad spectrum of opinions. Goldman Sachs takes a positive view and leaves the "Buy" vote with a target price of DKK 875. The analysts said the study data on Amycretin convinced with promising weight loss. Jefferies, on the other hand, remains cautious with a target price of DKK 515 and rates the share as "Underperform". The data from the Redefine-2 study on the drug CagriSema were not sufficient, in the analysts' view, to justify higher price targets. JP Morgan is the most optimistic, with an "Overweight" rating and a price target of DKK 1050. The share price recorded a promising turnaround last week at DKK 622 or EUR 83.70. Technically, things could start here again. Start building initial positions because, above DKK 670, it will likely move quickly.

BioNxt Solutions – Munich biotech location in focus

Canadian-based BioNxt Solutions is an innovative life sciences company specializing in next-generation drug delivery technologies. It focuses on diagnostic screening systems and the development of pharmaceutical agents. The Company's proprietary platforms target important therapeutic areas, including autoimmune diseases, neurological disorders, and longevity. With research and development activities in North America and Europe, BioNxt is driving regulatory approvals and commercialization, with a focus on European markets. The leading development program in the portfolio is the Company's sublingual cladribine product for the treatment of multiple sclerosis (MS). Here, things could really get down to business in 2025 with a production partner. BioNxt's developers expect that the Company's cladribine product will offer a significant advantage over the tablet form for patients suffering from dysphagia (difficulty swallowing).

Further progress has been made in the choice of location. The Company is relocating its R&D activities to the innovative Gen-Plus Contract Research and Development Organization (CRDO) in Munich, which will commence operations on March 1, 2025. The new laboratory environment offers BioNxt access to cutting-edge technologies and strategic opportunities for scientific collaboration in Europe's biotech hub. Management expects the Company's ongoing projects to accelerate significantly as a result, particularly in the areas of drug delivery systems, therapeutics for neurodegenerative diseases, and next-generation biomedical technologies.

Access to state-of-the-art equipment and analytical tools will enhance BioNxt's ability to develop innovative solutions and optimize its research results. This facility is able to reduce preclinical research times and improve formulation accuracy. When looking at the turnover of BioNxt shares in Germany, it now looks like a quick comeback. After bottoming out in the fall of 2024 at prices between EUR 0.11 and 0.13, the stock is now trading again at an appealing EUR 0.25 to 0.30. A CAD 3 million capital raise has now been completed. Last Friday alone, around 470,000 shares changed hands. The BNXT train is back on track!

Evotec, Bayer and Formycon – Positive operating signals

With a small move above the EUR 8 mark, the Evotec share has recently attracted attention again. Short positions are still relatively high, but the operational news is improving. The Hamburg-based drug specialist announced that, together with Yonsei University and the Korean biotechnology company Zymedi, it will receive a USD 4.5 million grant from the Korea Institute of Advanced Technology (KIAT). The project aims to develop first-in-class biologics for the treatment of severe lung diseases such as asthma and idiopathic pulmonary fibrosis (IPF). The project will focus on the preclinical development of novel anti-inflammatory and antifibrotic antibodies targeting tRNA synthetases.

Dr Thomas Hanke, EVP & Head of Academic Partnerships at Evotec, explains: "Our technologies and platforms in the area of fibrosis and lung diseases perfectly complement the expertise of our partners." The under-explored tRNA synthetases provide a novel approach to drug discovery. The consortium is working to develop antibodies with a novel mechanism of action that can inhibit the progression of asthma and IPF. Both diseases significantly burden patients and urgently require new treatment approaches. Evotec is contributing its world-class antibody generation technologies and integrated preclinical platforms to the collaboration, while Zymedi is contributing its expertise in translating the biology of tRNA synthetases into innovative drugs. Evotec shares jumped 5% but were sold off immediately. Nevertheless, keep the stock on your watch list; the EUR 8 mark is still a tough nut to crack.

Bayer was able to impressively leave the lows of December behind it at EUR 18.40. The share price has already hit EUR 21.50 again. While Bayer's Finnish partner Orion reached a new 52-week high, things seem to be progressing relatively slowly for the Leverkusen-based company. There is also a big question mark over expiring patents. Formycon, the developer of biosimilars, has received EU-wide approval for an ophthalmic drug. The active ingredient FYB203 is intended to compete with Bayer's successful product Eylea, which generates billions in sales for the Leverkusen-based company. The drug is designed to treat severe retinal diseases, such as diabetic macular edema and so-called neovascular age-related macular degeneration, in a similar way to the Bayer product. The latter is considered the most common cause of blindness in older patients. Formycon's shares shot up 20% in January but corrected again immediately. Bayer should finally switch to upward mode after overcoming the EUR 21.50 mark. Analysts on the Refinitiv Eikon platform expect an average price target of EUR 26.80 over a 12-month horizon, which is still a 30% potential. Collect!

The stock market's upward valuation is entering the next round. The biotech sector has not performed well over the last two years. However, individual stocks suggest that the major correction may now be over. It is time to enter selectively!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.