September 26th, 2025 | 07:15 CEST

BioNxt Solutions – Biotech specialist with significant leverage in mega markets

Modern medicine faces an enormous challenge: More and more people are suffering from so-called diseases of affluence, such as obesity, diabetes, multiple sclerosis, and MASH, the dreaded fatty liver disease. At the same time, there is a growing need for innovative therapies and new dosage forms that make treatments more effective, simpler, and more patient-friendly. This is precisely where BioNxt Solutions comes in, a young biotech company that is addressing several billion-dollar markets with its patented thin-film technology. By enabling the oral administration of important active ingredients such as semaglutide and cladribine, BioNxt is not only opening up new therapeutic avenues but also significantly enhancing the effectiveness of existing drugs. At a time when pharmaceutical giants are investing billions in new solutions, BioNxt could become one of the most exciting future players in the industry.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

Bionxt Solutions Inc. | CA0909741062

Table of contents:

"[...] As a company dedicated to developing treatments for rare heart diseases, we see this as an opportune moment to contribute to the fight against heart disease and make meaningful strides in improving heart health worldwide. [...]" David Elsley, CEO, Cardiol Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Disease profiles with billion-dollar potential

Diseases such as diabetes, obesity, multiple sclerosis (MS), and MASH, formerly known as fatty liver disease, are becoming increasingly widespread in industrialized countries. The causes include unhealthy lifestyles, overeating, and increasing exposure to pollutants. MASH in particular is emerging as the next major growth field in the pharmaceutical industry. According to Data Intelligence, the market for corresponding drugs is expected to grow from around USD 7.9 billion in 2024 to over USD 30 billion by 2033, representing an average annual increase (CAGR) of around 18%. In addition, the markets for multiple sclerosis therapies (from USD 21 billion to nearly USD 39 billion by 2032) and diabetes drugs such as GLP-1 agonists, which already generate over USD 29 billion in annual revenue, are expanding strongly. This creates enormous opportunities for companies that develop innovative solutions for drug delivery.

BioNxt's platform technology as a game changer

BioNxt Solutions is positioning itself precisely at this interface. The Canadian biotech company is working on a patented thin-film technology that delivers drugs into the body via the oral mucosa. This process offers several advantages: higher bioavailability, meaning more of the drug reaches the target tissue, resulting in lower doses. It also improves treatment compliance, as patients can simply take their medication via a dissolvable film instead of injections or tablets. In addition, there are many new areas of application: the same platform can be used for MS drugs (cladribine), GLP-1 agonists (semaglutide), and other substances. Semaglutide, known from Novo Nordisk's weight loss injections, remains particularly exciting. In the future, it could be administered orally by BioNxt, an innovation with considerable market potential. In parallel, the Company is advancing "BNT23001," a new form of administration for MS therapies that promises significantly faster drug absorption.

In addition to its ODF technology, BioNxt is working on a second, potentially groundbreaking platform for cancer medicine. In this case, an initially inactive active ingredient is activated in the cancer tissue by a tumor-specific enzyme, which largely spares healthy cells. An additional mechanism ensures that unused active ingredient residues are returned to the tumor, which has increased efficacy many times over in preclinical studies. This approach opens up new opportunities, as numerous existing chemotherapeutic agents could be adapted for this method. Even substances that were previously rejected due to excessive toxicity could thus be reused and made clinically relevant.

Market environment and strategic levers

While Novo Nordisk, with its market capitalization in the billions and proven GLP-1 products, has long played a central role in the global metabolism market, Evotec relies on a business model as a research service provider and partner to large pharmaceutical companies. BioNxt, on the other hand, combines both worlds: it is developing an independent technology platform that offers licensing potential and produces clinically relevant product candidates. This could enable the newcomer to rise to a similar league in the long term, but with significantly higher return potential in the early stages. The boom surrounding MASH and obesity recently triggered a wave of acquisitions in the industry, such as Roche's USD 3.5 billion acquisition of 89bio to secure access to FGF21 analogues. This trend suggests that even significantly smaller technology providers such as BioNxt could become sought-after partners for large pharmaceutical companies. Although BioNxt is still in an early stage of development, the combination of patented platform technology, diverse fields of application, and a rapidly growing market environment makes the Company an exciting addition to any biotech portfolio. If the current projects are successfully brought to clinical trials and approvals, partnerships with industry giants or even a takeover could be on the cards.

Capital market positioning strengthened with expert Terry Lynch

The Company is currently strengthening its capital market presence by uplisting to the US OTCQB segment and expanding its investor relations activities. This move is intended to improve access to institutional investors and increase the stock liquidity - a strategic step on the way to the next phase of development. Furthermore, management is relying on the expertise of capital markets expert Terry Lynch as an advisor, supported in the short term by IR experts Rob Grace and Blaine Ruzcki. For investors, this broader foundation strengthens confidence in the Company's long-term story.

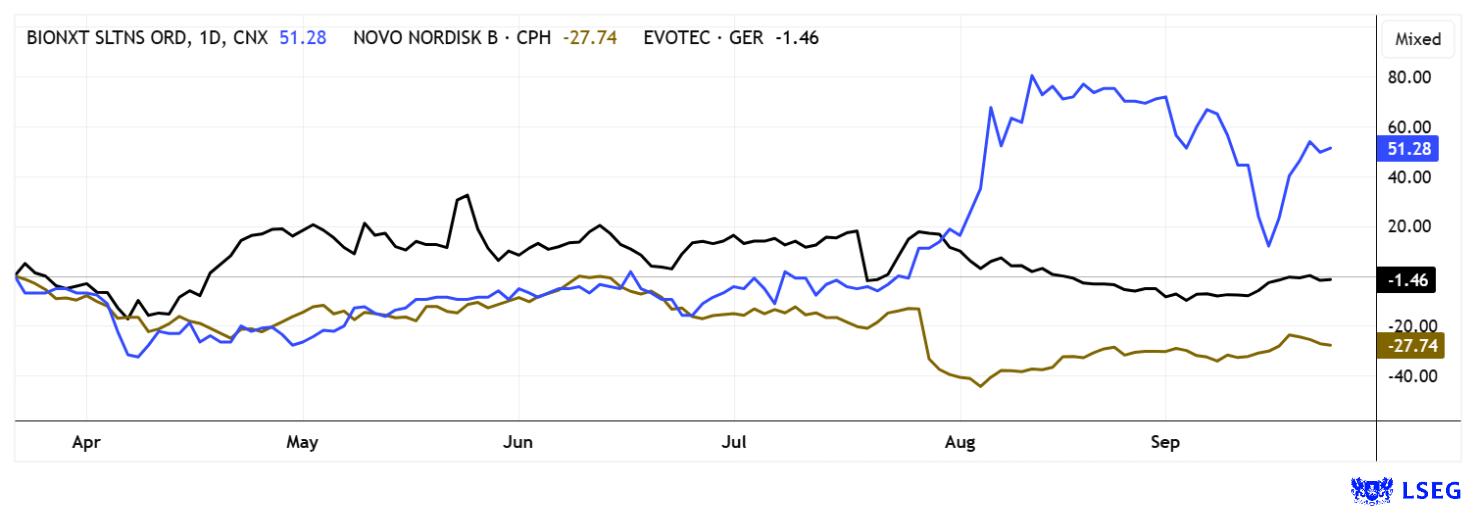

The return comparison reveals potential

BioNxt Solutions is an up-and-coming innovator at the intersection of several megatrends. Those who get in early are not just investing in a biotech company, but also in a potentially disruptive platform technology for the medicine of the future.

Operationally, the focus remains on innovative drug delivery platforms and active ingredients, with a clear expansion strategy in Europe and global ambitions in the healthcare sector. The chart has finished consolidating – now it can continue its upward trend!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.