June 5th, 2025 | 07:10 CEST

Almonty shares are unstoppable! Tungsten price hits 12-year high! Are analysts too conservative?

The commodity stock of the year is poised for its next leap: Almonty Industries. Yesterday, the tungsten gem surged above EUR 2, reaching a new all-time high. However, this is likely a stopover on the road to revaluation. Analysts continue to see 80% upside potential. There are both short- and long-term price drivers: Tungsten appears to be overtaking rare earths in terms of desirability and scarcity. China is limiting exports and driving the price to a 12-year high. The US is alarmed and buying tungsten on a large scale. Almonty is the direct beneficiary. Experts are calling the latest deal with a US defense contractor "unprecedented." Almonty is about to bring the largest tungsten mine outside of China into operation, plans a NASDAQ listing, and aims to add molybdenum to its portfolio. Are the analysts' estimates too conservative? Will a complete takeover follow?

time to read: 3 minutes

|

Author:

Fabian Lorenz

ISIN:

ALMONTY INDUSTRIES INC. | CA0203981034

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

Fabian Lorenz

For more than twenty years, the Cologne native has been intensively involved with the stock market, both professionally and privately. He is particularly passionate about national and international small and micro caps.

Tag cloud

Shares cloud

Tungsten prices explode, and the US secures capacity

Reports from the Critical Minerals Institute (Link) highlight the critical situation for tungsten and, at the same time, the opportunity for Almonty shareholders. The institute reported on this in its latest series of events. Tungsten is now eclipsing traditional critical metals such as gallium, cobalt, and rare earths. Tungsten attracted a full house and more questions from the audience than any other topic.

Concentrate prices up 26% since January to a 12-year high

The price trend can no longer be ignored. After Beijing tightened export restrictions in April, Chinese concentrate prices – the country accounts for 80% of global tungsten production – shot up to a 12-year high. Since January alone, they have risen by 26% to around USD 20,400 per tonne.

Tungsten alert in the US and no futures market

Since tungsten is essential for defense equipment and electronic components, there is now a sense of alarm in the US and likely throughout the Western world. For example, the US Defense Logistics Agency plans to purchase up to 4.5 million pounds of tungsten metal this year, 50% more than last year. The situation is expected to tighten even further due to the US Congress's directive. Starting in 2027, suppliers to the US Department of Defense will no longer be allowed to source tungsten from China or Russia.

As there are no functioning futures markets for tungsten, minimum price clauses are now used in practice. Almonty Industries, for example, recently signed a purchase agreement for concentrate from its new mine in South Korea with US defense contractor Tungsten Parts Wyoming. The minimum price is USD 235/mtu, while the upside potential is unlimited. The Critical Minerals Institute calls the deal "unprecedented." It shows that tungsten producers have the upper hand.

Almonty: Super tungsten mine comes at the right time

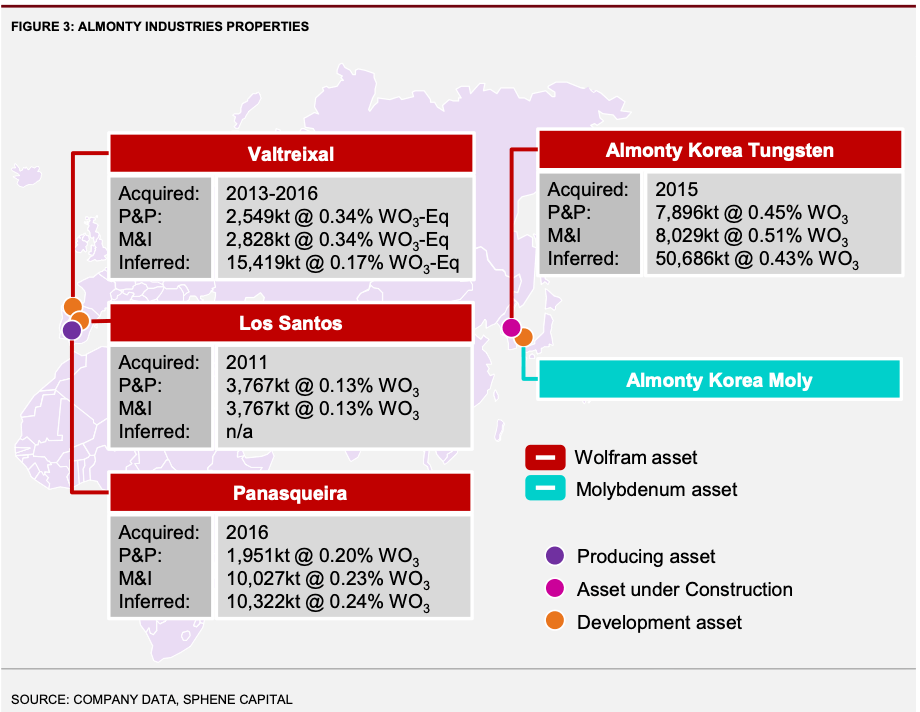

The situation makes it clear that Almonty is finishing its Sangdong mine in South Korea at precisely the right time. After years of development, the mine is scheduled to start production this summer and ramp up to an annual output of 4,600 tons within 12 months. This should cover up to 40% of non-Chinese global production. Incidentally, the total resource is estimated at 50 million tons. With an average tungsten content of 0.43%, Sangdong is also high-grade. By comparison, the content at Almonty's profitable Panasqueira mine in Portugal is 0.14%.

Price drivers: Mine opening, NASDAQ listing, molybdenum

In addition to geopolitics, Almonty shares also have "organic" price drivers. First, of course, is the opening of Sangdong. Analysts at Sphene Capital expect Almonty's revenue to skyrocket to CAD 483.4 million by 2027. Earnings per share are then expected to be CAD 0.51 per share. This already shows that the stock is still not expensive at just over CAD 3. In addition, analyst estimates are likely to be based on lower tungsten prices. And Almonty has another ace up its sleeve: molybdenum. This rare heavy metal has been discovered in the immediate vicinity of the Sangdong mine. Here, too, a supply contract has already been signed with a global corporation at a minimum price. Once in full production, 5,600 tons of molybdenum are expected to be mined annually.

In the short term, the relocation of the Company's headquarters to the US and the upcoming NASDAQ listing – the exact date is not yet known – will also likely drive the share price further. This could also give rise to takeover speculation.

Analyst target too low?

Sphene Capital recommends Almonty shares as a "Buy" with a price target of CAD 5.40 Click here for the link to the study. This would still give new investors a chance of an 80% gain. But it does not have to stop there. The analyst estimates should have room for improvement. The study was prepared when tungsten prices were still significantly lower. In addition, revenues and profits from the molybdenum project will likely be added.

Conclusion: Revaluation far from complete

Overall, Almonty shares still appear attractive. There are many arguments in favor of rising prices: The commissioning of Sangdong and the NASDAQ listing are expected to catapult the Company into a new league in the short term. The expansion opportunities for the mine in Portugal and the molybdenum project, for example, should further boost medium-term revenue and profit forecasts.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.