October 21st, 2025 | 07:45 CEST

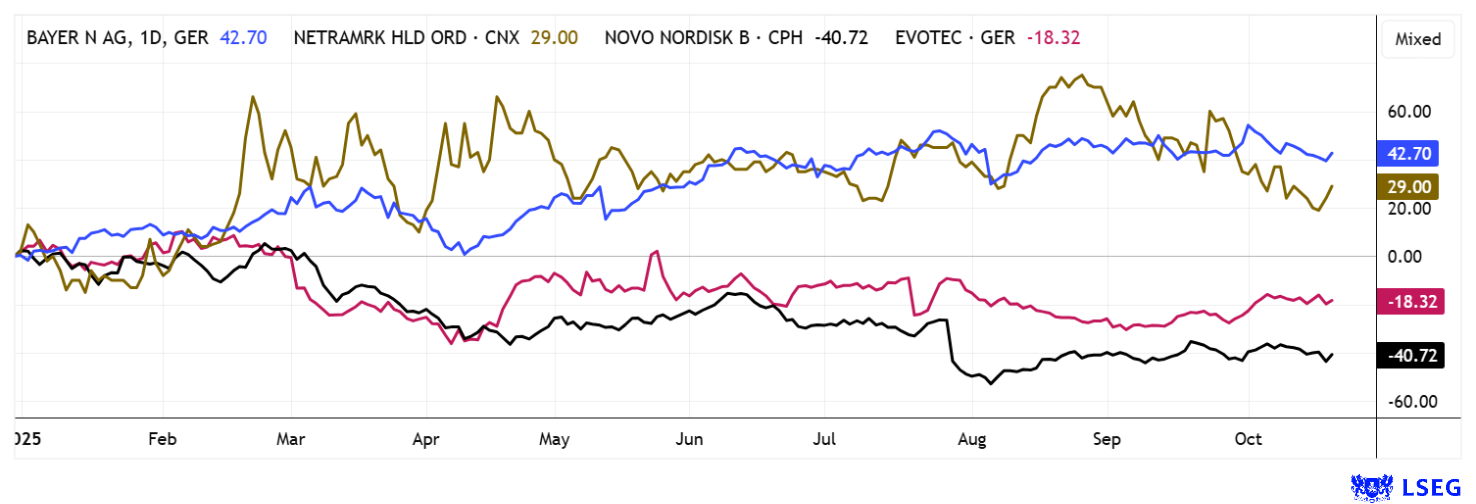

AI boom and DAX fireworks! Another 100% with NetraMark, Bayer, and Novo Nordisk

Savvy investors are already taking notice! Artificial intelligence is revolutionizing drug research and radically reducing development costs. Algorithms are discovering molecular patterns that even the most experienced researchers would overlook, thus accelerating the path from laboratory to patient. Whether in oncology, rare diseases, or metabolic disorders, big data-driven models now enable more precise drug predictions and more realistic simulations of clinical outcomes. Those who understand AI can profit handsomely from the next biotech boom. You just have to muster the courage to finally get involved!

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

NETRAMARK HOLDINGS INC | CA64119M1059 , BAYER AG NA O.N. | DE000BAY0017 , NOVO NORDISK A/S | DK0062498333

Table of contents:

"[...] In Canada, there is $1.75 of debt for every dollar of disposable income - and that was true even before the pandemic. [...]" Karim Nanji, CEO, Marble Financial

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Bayer – The hangover continues

November 11 marks both the start of Carnival and Bayer's Q3 reporting day. The Leverkusen-based company has been somewhat more confident in recent quarters as the wave of glyphosate lawsuits gradually subsides and restructuring in the pharmaceuticals division slowly takes shape. The share price is still hovering around EUR 27.50, waiting for the next catalysts. These could come from the latest AI developments within the Company, and investors will be looking to the next outlook to see how things will progress in this area. The Leverkusen-based company is currently investing a total of EUR 1.2 billion in its AI strategy. In the pharmaceuticals segment, Bayer is working with ConcertAI to use AI to accelerate oncology clinical development. In the agriculture division, Bayer is cooperating with Iktos to develop new, sustainable crop protection solutions through AI-assisted molecular design. Large data models are also being used in radiology: together with Rad AI, Bayer is expanding its Calantic™ platform with intelligent analysis and workflow tools. Bayer, in partnership with EY US, also launched the generative AI solution "E.L.Y." for agronomy applications. Analysts on the platform are once again somewhat more optimistic. Seven out of 22 experts predict that Bayer shares will recover to EUR 28.50, but no more than that.

Medicine meets AI – NetraMark enters a new era of precision medicine

Canadian company NetraMark is increasingly regarded by industry insiders as a pioneer in the use of explainable artificial intelligence to revolutionize medical research. Using its advanced NetraAI 2.0 platform, the Company aims to set new standards in precision medicine. The goal is not only to analyze complex patient data, but also to translate it into understandable, clinically relevant patterns. This involves creating so-called NetraPersonas, groups of patients with similar biological characteristics and responses to therapy. By leveraging this technology, treatment strategies can be tailored more precisely, significantly improving clinical trial success rates.

NetraAI 2.0 demonstrates its potential particularly in the field of rare and difficult-to-treat diseases. In collaboration with the renowned Mayo Clinic, NetraMark is currently focusing on research into glioblastomas, one of the most aggressive forms of brain tumors. By analyzing proteomics data from cerebrospinal fluid, the aim is to identify previously unknown biomarkers in order to better understand relapses and develop new therapeutic approaches. In addition, the platform also supports pediatric cardiology studies, helping to define patient groups for L-citrulline treatments. This ability to deliver both transparency and explainable results clearly sets NetraMark apart from other AI providers. Strategically, the Company works closely with regulatory authorities such as the FDA to accelerate approvals and establish standards for explainable AI in medicine. International collaborations with research institutions further strengthen NetraMark's global market position. Analysts see enormous growth potential in the combination of medical expertise and machine learning. Following a 25% consolidation, the market capitalization currently stands at CAD 114 million - a real bargain compared to peers in the sector!

At the International Investment Forum on October 8, CEO George Achilleos' presentation drew a large audience; his outlook for the coming months can be found here.

https://www.youtube.com/watch?v=5eyecoSqGxE

Novo Nordisk and Evotec – What do the analysts say?

Opinions are divided on Novo Nordisk and Evotec. After three consecutive profit warnings, the Danish company has recently seen a return to calm, with management expressing confidence that margins will be back on the rise by the end of 2025. Analysts promptly reacted to these statements and recalculated their figures. The result: 17 out of 29 experts are now giving the Company the thumbs up again with an average 12-month target price of DKK 456. Yesterday, the share price jumped over 5% to DKK 360 in a positive market environment, leaving room for further gains of around DKK 100, or 25%. Investors who were recently stopped out may want to consider repurchasing. The highly anticipated Q3 figures will be released on November 5.

Experts have not yet given up on Evotec, but the price targets have been adjusted sharply downward again in recent weeks. In 2023, management could have accepted a takeover offer at EUR 11.50, but it was rejected. The market now expects revenues of only EUR 780 million, reflecting a significant downward adjustment in forecasts. It is no surprise the stock has remained depressed after the sell-off over the past three years. The share price currently stands at EUR 6.65, and the 12-month consensus line of EUR 9.26 is not impossible to achieve, as the Hamburg-based company continues to offer substantial technology through its drug discovery platform. Perhaps another "big fish" will soon make its way to the North Sea?

Artificial intelligence is establishing itself as a key factor in medical progress, from drug discovery to patient communication. NetraMark impresses with data-based models that identify disease patterns more quickly and optimize clinical processes. Evotec uses AI to deepen partnerships with pharmaceutical giants and expand its pipeline of precision therapeutics. Bayer is relying on digital platforms to streamline research and approval processes, which could leverage efficiency potential. Novo Nordisk remains a heavyweight in the obesity segment, and after a temporary 70% correction, the prospect of a turnaround is now attracting interest.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.