The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

Before founding his own company, he held various positions as business editor, fund advisor, portfolio manager and finally as CEO of a listed investment company. He also held several positions on the supervisory board.

He is passionate about analyzing a wide variety of business models and investigating new trends, especially in the areas of e-commerce, fintech, blockchain or artificial intelligence.

Commented by Stefan Feulner

Commented by Stefan Feulner on December 8th, 2021 | 12:53 CET

Tembo Gold, Barrick Gold, Valneva - Sensation on the gold market

Gold mining companies have been in the shadows for months, the gold price is consolidating, and investors are looking for higher-yielding investments such as equities or cryptocurrencies. But behind the scenes, things are bubbling up. Gold producers are sitting on a mountain of cash and looking for interesting takeover targets at current levels. Now, one company has announced a milestone in its history.

ReadCommented by Stefan Feulner on December 7th, 2021 | 11:57 CET

Zoom, Prospect Ridge Resources, Twitter - New start after Waterloo

The stock market led the way in recent weeks and went into a broad-based correction phase. Last but not least, cryptocurrencies were hit last Friday. Bitcoin lost a good 25% of its value within hours, and Etherum also slumped by double digits. Following the price disaster, it is now time to lick wounds and put the right values for the next upward movement anti-cyclically in the portfolio.

ReadCommented by Stefan Feulner on December 6th, 2021 | 11:41 CET

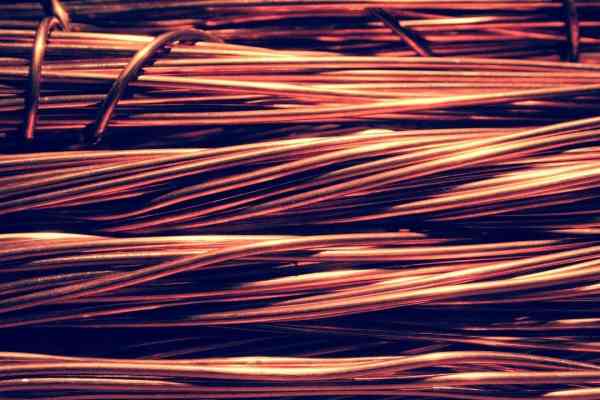

NIO, Nevada Copper, Volkswagen - Business is booming

It is hard to imagine climate change without electromobility. The shift from combustion engines to battery-powered vehicles promises bright growth prospects for the automotive lobby. Despite the rosy outlook, a problem is emerging, one that has been known for years and is likely to become even greater in the future - the shortage of raw materials. Above all, the sharp rise in prices for essential metals is expected to eat into the margins of the automotive industry.

ReadCommented by Stefan Feulner on December 3rd, 2021 | 12:38 CET

BioNTech, Defence Therapeutics, QIAGEN - End in sight?

The federal and state governments have met and decided on a de facto lockdown for the unvaccinated. In the future, only vaccinated and recovered people will be allowed to shop in retail stores. The same applies to cinemas, theaters and restaurants. In addition, the unvaccinated will have to accept contact restrictions. According to the outgoing chancellor, this is an "act of national solidarity" and is necessary to get out of the current difficult situation - hard times, which the Omicron variant has just exacerbated. But according to US strategists, it is precisely the newly emerged mutant that could signal the approaching end of the Corona pandemic.

ReadCommented by Stefan Feulner on December 3rd, 2021 | 11:48 CET

TeamViewer, Water Ways Technologies, Zooplus - Further underwater

The United Nations warns of a growing imbalance in the global water balance with catastrophic consequences. Currently, two billion people live in countries without a secure drinking water supply. By 2050, the number is expected to grow to more than five billion people without adequate access to drinking water. The future belongs to companies that take care of water treatment and offer intelligent systems for water management. The TeamViewer share, on the other hand, continues to be underwater. The latest news is also not very optimistic.

ReadCommented by Stefan Feulner on December 2nd, 2021 | 12:11 CET

Steinhoff, Triumph Gold, JinkoSolar - On a knife-edge

The DAX was on the verge of falling below the 15,000 point mark, which had been successfully tested several times, and the nerves of traders and asset managers were put to the test concerning an impending sell-off in the leading index. Then the market turned around, and the chart picture brightened considerably. Chances for a conciliatory end of the year are still there, partly because on the part of science, at least a little confidence was spread concerning the omicron variant.

ReadCommented by Stefan Feulner on December 2nd, 2021 | 11:02 CET

Bayer, Ayurcann, JinkoSolar - Excellent prospects

"Release the hemp!" cult presenter Stefan Raab called for the legalization of cannabis years ago in a song he produced himself. But not Jamaica, but the traffic light coalition with SPD, FDP and the Greens caused jubilation in the various communities. The release of the drug opens up great opportunities for young companies as well as investors. In contrast to Germany, other countries have already made more progress. Currently, the cannabis sector is in correction mode on the stock market, but the long-term prospects are excellent.

ReadCommented by Stefan Feulner on December 1st, 2021 | 14:49 CET

Nel ASA, First Hydrogen, Plug Power - When will the next hydrogen wave come?

It can be frightening to watch the prices on the stock markets flashing red everywhere in the short term. The number of infections continues to rise worldwide, and a mutant called Omicron is spilling over from South Africa. On the other hand, the central banks continue to pour new money into the markets to promote economic growth. Hydrogen stocks are also correcting sharply at the moment, an opportunity for bold investors to position themselves for the long term.

ReadCommented by Stefan Feulner on December 1st, 2021 | 12:49 CET

Battle for market leadership - SAP, BrainChip Holdings, MicroStrategy

The future is becoming more digital and is taking over almost every area of our lives at an ever-faster pace. Whether blockchains and digital money, smart homes or robotics, the development possibilities are practically endless and the potential gigantic. To achieve visionary goals, a new generation of semiconductors is needed: Chips for artificial intelligence. For this area, the market research institute Gartner estimates a volume of around USD 43 billion for the coming year and growth to almost USD 73 billion by 2025. The battle for the top spot is in full swing.

ReadCommented by Stefan Feulner on November 30th, 2021 | 10:07 CET

RWE, Aspermont, Xiaomi - Regrouping after the sell-off

Omicron shakes the perfect stock market world. After the emergence of a new mutant in South Africa, the stock markets have plummeted. The end of the year-end rally seems to be sealed. The DAX is threatened with falling below the psychologically important mark at 15,000. But, on the other hand, investors are already taking advantage of the low prices again to invest in promising companies at more favorable price levels. Holding the important mark could still lead to belated Christmas presents despite the short break.

Read