The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

Before founding his own company, he held various positions as business editor, fund advisor, portfolio manager and finally as CEO of a listed investment company. He also held several positions on the supervisory board.

He is passionate about analyzing a wide variety of business models and investigating new trends, especially in the areas of e-commerce, fintech, blockchain or artificial intelligence.

Commented by Stefan Feulner

Commented by Stefan Feulner on November 5th, 2021 | 11:22 CET

BioNTech, Sativa Wellness, Merck KGaA - Impressive trend

There is no question that vaccine manufacturers are one of the main winners of the Corona pandemic. The recently presented quarterly figures of Pfizer, BioNTech's partner, show this impressively and suggest that the Mainz-based Company will also announce a sales explosion on November 9. Booster vaccinations are likely to continue this trend. Currently, encouraged by legalization, the cannabis industry is also experiencing a new upswing. Be a part of it from the beginning.

ReadCommented by Stefan Feulner on November 4th, 2021 | 10:33 CET

BMW, Triumph Gold, Klöckner & Co - It is getting more and more expensive

The inflation rate in the eurozone recently rose to 3.4%, the highest level since 2008. Everything is getting more expensive, but the situation is manageable for ECB President Christine Lagarde. Driven by special factors such as the high price of oil and gas and production bottlenecks, prices are skyrocketing. However, an interest rate hike to curb inflation is not on the agenda before 2023, she said. Meanwhile, many listed companies are delivering record figures, benefiting from commodity price increases.

ReadCommented by Stefan Feulner on November 3rd, 2021 | 13:50 CET

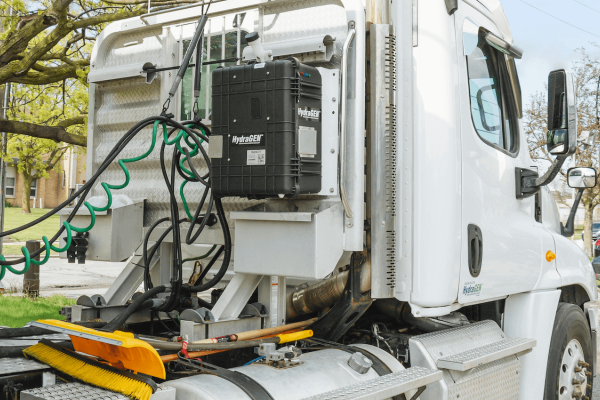

Plug Power, Enapter, SFC Energy - The hydrogen sector is alive

Last year, a strong boom was followed by a harsh correction, which brought even market leaders to their knees with share price losses of over 50%. That hydrogen technology is enormously important for achieving climate goals should be beyond question, even at the current World Climate Conference in Glasgow. The segment has a golden future with regard to the energy transition. Position yourself now and invest in the sector with disproportionately high potential.

ReadCommented by Stefan Feulner on November 3rd, 2021 | 10:16 CET

Valneva, Cardiol Therapeutics, BioNTech - Is the vaccination subscription coming?

The numbers of people infected with Corona have been rising significantly again for weeks. While only about 67% of Germans are fully vaccinated, the pace is slowing noticeably. Meanwhile, the third dose, the so-called "booster" vaccination, has already been started. The Standing Commission on Vaccination (STIKO) has recommended this booster for people aged 70 and over. A decision on whether booster vaccinations should be offered to everyone is likely to be made soon. For vaccine manufacturers, this means recurring revenues.

ReadCommented by Stefan Feulner on November 2nd, 2021 | 11:07 CET

Nel ASA, Water Ways Technologies, Everfuel - Unfortunately, this is the future

Water scarcity is an ever-growing problem for many countries, especially on the African continent. More than two billion people live in water-scarce countries and lack access to clean drinking water and sanitation. In the run-up to the UN Climate Change Conference COP26, scientists and activists are urging policymakers to act and address the looming water crisis. For years, companies in the water industry have been wallflowers on the stock market. Yet this issue, in particular, has enormous potential.

ReadCommented by Stefan Feulner on November 2nd, 2021 | 10:19 CET

Daimler, GSP Resource, Ballard Power - Far-reaching consequences

Exactly six years ago, at the 2015 climate conference in Paris, it was agreed to limit global warming to 1.5 degrees. However, there is a considerable gap between the plan and reality. According to climate protection experts, much more ambitious action plans are needed from countries to achieve the envisaged target. The first step, and not just in Germany, is to achieve climate neutrality from the second half of this century. At the summit in Glasgow, the reins are set to be tightened, with far-reaching consequences for the economy.

ReadCommented by Stefan Feulner on November 1st, 2021 | 13:20 CET

Bayer, MAS Gold, Salzgitter - Positive turnaround

At chemical and pharmaceutical giant Bayer, the mood continues to brighten following the important decision of the European Patent Office. Also, the number season, which has been running for weeks, gives the markets an additional boost with solid figures and forecast increases. New highs in the most critical global stock indices are the result. On the other hand, the high inflation rates are a cause for concern, although they continue to be underestimated by the monetary watchdogs. The still weak precious metals markets could therefore experience a boom in the coming months.

ReadCommented by Stefan Feulner on November 1st, 2021 | 12:30 CET

BASF, dynaCERT, Nikola - These shares will be exciting

From today until November 12, all eyes are on the UN Climate Change Conference COP26 in Glasgow. Nothing less than the future of our planet and a trend reversal towards a climate-neutral economy are at stake. At the top of the agenda is the commitment of countries to reduce emissions. A company that has received little attention in the recent past is waiting in the wings with its patented technology and could soon take off. Be prepared.

ReadCommented by Stefan Feulner on October 29th, 2021 | 14:13 CEST

XPeng, Graphano Energy, K+S - The fear of emptiness

There are shortages in all sectors. In addition to the chip shortage, which is affecting the automotive industry, there are also shortages of metal, plastic, and even packaging material for Christmas presents. Even at technology giant Apple, there is concern about whether the all-important final quarter can be spared supply disruptions due to fragile global supply chains. There is no end to this problem in sight in the longer term; on the contrary, the shortage of raw materials due to the energy transition exacerbates this circumstance.

ReadCommented by Stefan Feulner on October 29th, 2021 | 12:07 CEST

United Internet, TalkPool, Visa - Smart businesses

Communication between people and machines will become one of the central themes of our society in the coming years. Technology and computer systems take over essential everyday life and industry tasks, visibly or unnoticed in the background. Sensors and interfaces enable their operation. These smart technologies can be used across all sectors, from medical or building technology and mobility to accelerating climate change.

Read