The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

Before founding his own company, he held various positions as business editor, fund advisor, portfolio manager and finally as CEO of a listed investment company. He also held several positions on the supervisory board.

He is passionate about analyzing a wide variety of business models and investigating new trends, especially in the areas of e-commerce, fintech, blockchain or artificial intelligence.

Commented by Stefan Feulner

Commented by Stefan Feulner on January 14th, 2022 | 11:44 CET

BioNTech, Defence Therapeutics, PAION - Seizing the momentum

The Corona pandemic brought biotechnology to the forefront of society's consciousness, especially since the first vaccines were created in German laboratories. However, the biotech spectrum is much broader than pandemic vaccine research. In addition to research in medicine, the sector is playing an increasingly important role in environmental protection, agriculture and the ongoing climate change.

ReadCommented by Stefan Feulner on January 13th, 2022 | 12:45 CET

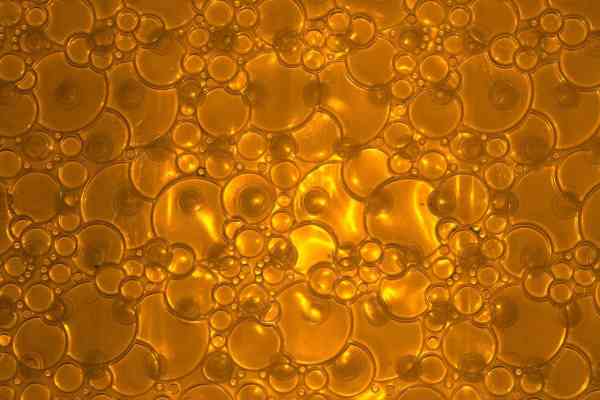

TeamViewer, Saturn Oil + Gas, BP - Target price USD 100

Oil prices continue to rise. A barrel of Brent currently costs USD 84.32 and is thus on the verge of breaking through a double top formation from the highs of 2018 and 2021. A breakout would generate a fresh buy signal, the target range of which already lies beyond the USD 100 mark. Underpinned by an easing of the Corona situation and an unexpected onset of winter in the US, a new 10-year high at USD 122.88 could even beckon. The primary beneficiaries of this inflationary development are once again the oil producers.

ReadCommented by Stefan Feulner on January 12th, 2022 | 12:54 CET

Tilray, Ayurcann, Aurora Cannabis - When will the boom 2.0 come?

About five years ago, the boom of cannabis stocks started. Companies like Aurora Cannabis, Canopy Growth and Tilray were able to multiply within a few months. However, the boom was followed by a quick end on the stock market. With corrections of 90% in some cases, the exaggerations were harshly corrected. However, the cannabis market is still in a strong growth phase. The legalization in many countries and the cannabis 3.0 wave promise the companies enormous growth leaps in the next few years. Thus, the steep rise seen at the time could be repeated, at least to some extent.

ReadCommented by Stefan Feulner on January 11th, 2022 | 11:20 CET

Steinhoff, Aspermont, Bayer - Crazy speed

In terms of digitization, Germany lags light years behind other countries. Most of the big Internet success stories were written in the USA with Facebook, Google, Amazon and Apple. Yet new developments are coming faster and faster, and the digital transformation continues unabated. Down Under, the next success story is currently being built: The transformation of a venerable publishing house into a digital media company. The next big step is on the horizon, which should bring great potential for investors with the help of new shareholders. But the story is still in its infancy.

ReadCommented by Stefan Feulner on January 10th, 2022 | 11:56 CET

Steinhoff, Almonty Industries, MorphoSys - Closer and closer to the goal

Will the crisis-ridden international retail group Steinhoff have a happy ending after all? Now that the settlement is likely to be successfully put to bed at the end of January, the highly indebted company's survival is at stake, and it is now striving to gold-plate its well-performing subsidiaries. At Almonty Industries, on the other hand, the signs are pointing to growth. The mega project in South Korea will make the Company one of the most important players in the production of raw materials for the energy transition, with significant upside potential.

ReadCommented by Stefan Feulner on January 7th, 2022 | 10:38 CET

JinkoSolar, Triumph Gold, Palantir - At attractive levels

The precious metals sector was one of the disappointments on the capital market last year. Gold mining stocks are still stuck in a correction despite historically low interest rates and rising inflation. Yet business in the mining sector is booming. Producers are sitting on high cash reserves and beckon with attractive dividend yields. Many shares in the tech sector have also corrected and currently offer attractive entry levels.

ReadCommented by Stefan Feulner on January 6th, 2022 | 10:25 CET

BYD, Tembo Gold, Deutsche Bank - Tesla has the competition breathing down its neck

The sales figures for the electric car manufacturers for the full year 2021 are out. Tesla remains the global leader, but its market share is shrinking. In China, BYD retains its place in the sun and plans to continue growing strongly next year. While everyone is talking about electromobility due to climate targets, the precious metal gold is currently living a shadowy existence. However, due to the current figures with rising inflation and growing debts of the states and companies, this should change soon.

ReadCommented by Stefan Feulner on January 5th, 2022 | 11:10 CET

Avoiding penalties with Bayer, MAS Gold and BASF

According to the "Allianz Global Wealth Report", global financial assets have grown strongly. Private households alone had gross financial assets of over EUR 200 trillion worldwide in the past year, representing an increase of almost 10% compared to the previous year. The reason for the high savings rate was mainly the uncertainty surrounding the Corona pandemic. Now, with punitive interest rates and rising inflation, there are renewed threats to citizens' assets. One way out would be to invest in precious metals and build up long-term equity positions, primarily in the value sector.

ReadCommented by Stefan Feulner on January 4th, 2022 | 07:10 CET

BYD, CoinAnalyst, JinkoSolar - Ambitious targets

What awaits investors in 2022? Will shares of vaccine makers such as BioNTech and Moderna continue to run upward, or will the massive overvaluation be reduced over the course of the year? Will industry leader Tesla keep its place in the sun? And what is next for cryptocurrencies and NFTs, which rose like a phoenix from the ashes last year? The new year offers many opportunities. Stay tuned and bet on the winners starting now.

ReadCommented by Stefan Feulner on January 3rd, 2022 | 08:57 CET

Nel ASA, dynaCERT, Plug Power - The resurrection of hydrogen stocks

The past year 2021, was anything but a successful one for stocks from the hydrogen and fuel cell sector. After a brilliant boom in the decade's first year, the signs pointed to correction. However, given the energy transition and the importance of hydrogen fuel cell technology, this sector, in particular, could experience a resurgence in the new year. The German Federal Ministry of Economics, led by Green Party politician Robert Habeck, released EUR 900 million for the "H2Global" funding instrument.

Read