The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

Before founding his own company, he held various positions as business editor, fund advisor, portfolio manager and finally as CEO of a listed investment company. He also held several positions on the supervisory board.

He is passionate about analyzing a wide variety of business models and investigating new trends, especially in the areas of e-commerce, fintech, blockchain or artificial intelligence.

Commented by Stefan Feulner

Commented by Stefan Feulner on February 10th, 2022 | 12:34 CET

Standard Lithium, Yorkton Ventures, Deutsche Bank - The new favorites

For many years, shares of banks and financial service providers underperformed the overall market. With the end of the ultra-loose monetary policy of the central banks and several possible interest rate hikes due to continued high inflation, stocks are benefiting disproportionately and sometimes break through their downward trends that have prevailed for years. In addition to high energy costs, the blame for the enormous price increases lies with the further rise in raw material prices. Because of the demand side due to the energy transition, lithium, in particular, is rushing from high to high.

ReadCommented by Stefan Feulner on February 9th, 2022 | 12:20 CET

BioNTech, Barsele Minerals, Pfizer - Markets facing a turnaround

The vaccination pace in Germany continues to decline. According to experts, the Omicron variant could be the end of the pandemic and the change to an endemic. Is this why we have already seen the highs in vaccine manufacturers? With the FED's plan to raise interest rates in several steps, technology stocks corrected sharply, while new life was breathed into shares from the financial services sector. Companies in the gold sector should also be in strong demand over the long term because one thing is certain, even if the pandemic goes away, government debt will remain.

ReadCommented by Stefan Feulner on February 8th, 2022 | 10:48 CET

BYD, Altech Advanced Materials, Standard Lithium - Battle for pole position

Germany is not the only country where the energy turnaround is at the top of the political agenda. Achieving climate neutrality in the transport sector by 2045 is a particular challenge. After all, according to the Federal Environment Agency, the sector is responsible for around 20% of total greenhouse gas emissions. In the passenger car sector, both the automotive industry and politicians are focusing on battery technology. As a result, a battle has broken out between electric car manufacturers for the longest ranges and shortest charging times. Young companies with innovative technologies are flocking to the market and could become the new stock market stars soon.

ReadCommented by Stefan Feulner on February 7th, 2022 | 11:31 CET

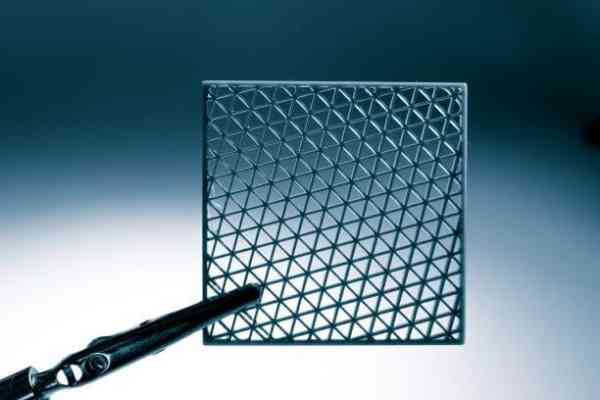

Steinhoff, Meta Materials, QuantumScape - Milestones in development

Will the international retail group Steinhoff manage the turnaround? After the positively concluded settlement and the approval of the courts in South Africa, hope is germinating. Now the focus is on reducing the enormous debt burden and the possible sale of the silverware. While Steinhoff is still busy cleaning up the past, there is a constant stream of new innovations in the mobility turnaround and metamaterials. The still young companies have a dazzling future ahead of them. So far, however, this has hardly been noticed on the capital market.

ReadCommented by Stefan Feulner on February 3rd, 2022 | 13:46 CET

Allkem, Edison Lithium, NIO - The battery of the future

The transformation from diesel- or gasoline-fueled vehicles to battery-powered electric vehicles is underway, the market is growing strongly, and automakers are increasingly adopting an electric strategy. However, this requires the necessary raw materials such as cobalt, copper, lithium and nickel. Increased demand meets a more than scarce supply. The result is sharply rising prices. The primary beneficiaries are the producers, who can expect growing sales in the coming years.

ReadCommented by Stefan Feulner on February 3rd, 2022 | 10:19 CET

TeamViewer, Kodiak Copper, XPeng - Opportunities after the setback

It is numbers season again. The Goeppingen-based company TeamViewer achieved its forecasts, which had been revised downwards twice. Whether the remote maintenance business is sustainable after the pandemic has subsided remains to be seen. By contrast, demand for raw materials for the energy transition is almost sure to be sustainable. In particular, the eminently essential copper is likely to be subject to a further increase in demand for years to come.

ReadCommented by Stefan Feulner on February 2nd, 2022 | 12:45 CET

Bayer, Almonty Industries, HeidelbergCement - Delivered

To start, the good news, the inflation rate fell in January for the first time since December 2020. However, the level of 4.9% remains at a threateningly high level, and economists had expected a sharper fall. The main reasons for the inflation are the continued exorbitant rise in energy prices and rising commodities prices. High inflation is reducing consumers' purchasing power. In addition, rising production costs are squeezing companies' margins.

ReadCommented by Stefan Feulner on January 31st, 2022 | 11:28 CET

Steinhoff, Hong Lai Huat, JinkoSolar - Is the lid flying off?

Will international furniture group Steinhoff get back on its feet after the accounting scandal of 2017? The settlement with creditors has been confirmed, and now it is all about reducing the horrendous mountain of debt. The situation in the German real estate market is quite different. Here, the German Federal Bank is already warning of overheating following the sharp rise in prices in recent years. There is more potential on other continents of the world, especially in Southeast Asia.

ReadCommented by Stefan Feulner on January 28th, 2022 | 11:55 CET

Deutsche Bank, Memiontec, Texas Instruments - Worrying development

The highly anticipated interest rate decision of the FED came as expected, and nothing will change in the interest rate level for the time being. It was only Jerome Powell's statements due to the urgency of the planned interest rate steps, intended to catch the runaway inflation, that brought the markets down. From a monetary policy perspective, society is facing a turning point. However, beyond money and the capital market, far more pressing problems need to be solved soon. Water scarcity, which denies some 2.2 billion people safe and sustainable access to clean drinking water, is taking on increasingly dire forms. Smart water management is one piece of the puzzle that could be a game-changer in this area.

ReadCommented by Stefan Feulner on January 27th, 2022 | 12:12 CET

RWE, Tembo Gold, Barrick Gold - The course is set

For many shares, the market correction offers the opportunity to add quality to the portfolio at a more favorable level in the long term. Even if the low has probably not yet been reached, long-term anti-cyclical entry opportunities are currently available. The gold price entered a correction after reaching new highs in August 2020, when prices of over USD 2,060 per ounce were paid. Although the chart-technical picture for the gold price is not yet compelling, the current prices should at least be used to build initial positions. Fundamentally, the prospects for the precious yellow metal are already better than ever.

Read