Born in Bielefeld, she studied German, English and psychology. The emergence of the Internet in the early '90s led her from university to training in graphic design and marketing communications. After years of agency work in corporate branding, she switched to publishing and learned her editorial craft at Hubert Burda Media.

She discovered the world of the stock market in 1998. With her passion for innovation and digitalization, she focused on companies from the technology and healthcare sectors early on.

Analyzing fundamentals, business models and their scalability is as much her passion as thinking into complex future scenarios. Since 2019, she has regularly organized stock exchange roundtables and attended international investment events to deepen and pass on her knowledge.

Commented by Juliane Zielonka

Commented by Juliane Zielonka on March 21st, 2024 | 06:45 CET

Energy in transition: RWE, Kraken Energy, and Plug Power in focus

The energy sector remains in flux. RWE was able to double its adjusted EBITDA. CEO Markus Krebber, who has been in office since 2021, is doing everything he can to make the energy giant fit for renewable energies. Under the term "Phaseout Technologies," he aims to bid farewell to nuclear energy and fossil fuels. However, nuclear energy is a low-carbon and adequate supply for many industrialized nations. There are 93 reactors in the USA alone, which account for 20% of the national energy supply. This is reason enough for Kraken Energy to explore uranium deposits in the US in order to establish the shortest possible supply chains. The US is also a pioneer in hydrogen technologies. Plug Power can, therefore, look forward to a considerable amount of government funding and is becoming a job engine...

ReadCommented by Juliane Zielonka on March 15th, 2024 | 06:00 CET

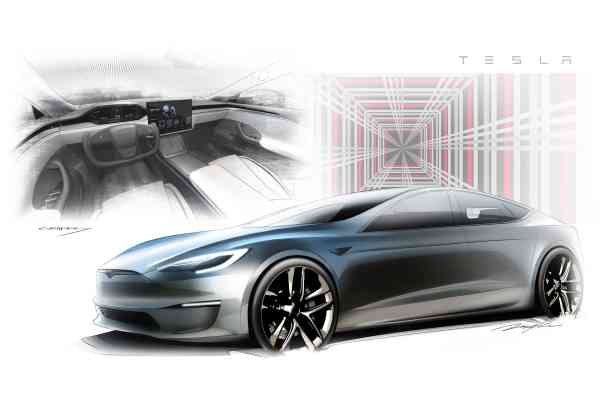

Altech Advanced Materials, Tesla, E.ON - Accelerators of the Future in Europe

Germany's automotive industry is in a state of upheaval. With an annual turnover of EUR 411 billion, solutions are urgently needed to drive electrification forward. E.ON, as one of the largest utilities, is investing billions in European infrastructure for this purpose. The Company is also increasing its dividend. Heidelberg-based Altech Advanced Materials is launching stationary battery storage systems on the market at the beginning of April. It has also published the results of the current feasibility study for its second pillar: a special coating for silicon battery anodes that ensures greater power and longevity. These are exactly the sticking points that customers have been complaining about so far. Tesla also relies on silicon batteries in its models. This week, Elon Musk visited the German plant in Grünheide, and has some good news in store...

ReadCommented by Juliane Zielonka on March 14th, 2024 | 06:15 CET

Porsche, First Hydrogen, Mercedes-Benz: Which shares offer growth potential in the transformation phase towards clean energy?

The German automotive industry is facing drastic changes, one of the biggest transformation phases in history. The "Green Deal" is forcing car manufacturers to completely overhaul their requirements and supply chains. Porsche announces the introduction of hybrid drive in its popular 911 models, and the Macan is set to be offered entirely as an electric vehicle. However, CEO Blume links the transition to an important condition. Forecasts by McKinsey show that clean hydrogen will account for a significant part of the global energy supply by 2030. In this context, First Hydrogen is playing a decisive role in the development of zero-emission transportation solutions. First Hydrogen is developing emission-free vehicles and green hydrogen production in Vancouver, Montreal and London. In partnership with AVL Powertrain and Ballard Power Systems Inc., the Company is working on hydrogen-powered light commercial vehicles with a range of over 630 km. Around 8,000 Mercedes-Benz employees in Germany are currently experiencing the fact that the green transformation can be painful. We provide the details.

ReadCommented by Juliane Zielonka on March 8th, 2024 | 07:00 CET

Daimler Truck, dynaCERT, Apple shares - Who are the game changers in the market?

As the demand for consumer goods continues to grow, the number of diesel trucks on the roads is also increasing. Just 1.5 years after laying the foundation stone, Daimler Truck is clearly focusing on commercial vehicles powered by battery and fuel cell technology at its site in Stuttgart-Feuerbach. Until then, bridging technologies will continue to expand. The Canadian company dynaCERT has developed a pioneering method to reduce the environmental impact of diesel trucks and HGVs. With this innovative technology, hydrogen is fed directly into the engines, resulting in significantly lower harmful emissions such as CO₂ and nitrogen oxides. This technology has already been tested worldwide and is considered a decisive step in the fight against climate change in the transportation sector. The technology can also be used in other transportation sectors, such as shipping or mining. And when it comes to the automotive industry, Apple must recognize that not everything the Cupertino-based company touches turns to gold...

ReadCommented by Juliane Zielonka on March 7th, 2024 | 06:30 CET

Sustainable investments in focus: Occidental Petroleum, Carbon Done Right, Plug Power - Which stock offers the greatest advantage for a net zero economy?

True sustainability is a delicate balancing act for investors seeking high returns. Companies worldwide still need fossil fuels to keep their businesses running and growing. The US oil and gas producer Occidental Petroleum is no exception. The Company, in which Warren Buffett also invests, is doing a lot to reduce its carbon footprint. On the other hand, Carbon Done Right is sustainable through and through. Its business model involves the reforestation and greening of forests and rainforests to trade real CO2 certificates for companies such as Amazon and Microsoft. Thanks to innovative AI, Carbon Done Right is finally bringing the desired transparency to the carbon market by monitoring tree growth via satellite. Meanwhile, Plug Power relies on in-house hardware and expects a restructuring of tech companies to favour its CO2-friendly solutions. Who truly has the edge when it comes to sustainable measures and returns?

ReadCommented by Juliane Zielonka on March 1st, 2024 | 17:05 CET

Cardiol Therapeutics, Bayer, Coinbase - Which share will generate profits in the long term?

The world of pharmaceuticals and life sciences is characterized by precisely documented studies in clinical research. If an active ingredient makes it to approval, there is the potential for a blockbuster worth billions. Cardiol Therapeutics has an active ingredient in the second phase of clinical research for the treatment of heart disease in people under 35 years of age. This active ingredient can also restore the quality of life of 26 million people worldwide who suffer from heart failure. Bayer continues to clean up the unresolved issues left behind by the former CEO. Did the weedkiller RoundUp® from the Monsanto deal possibly lead to improper treatment due to a lack of consumer protection information? The five-figure lawsuits still pending against Roundup are dampening the share's profit prospects. The situation is currently quite different in the cryptocurrency market. Bitcoin is outperforming everyone, and the Coinbase share is benefiting from it. Which investment generates profits in the long term?

ReadCommented by Juliane Zielonka on February 29th, 2024 | 08:15 CET

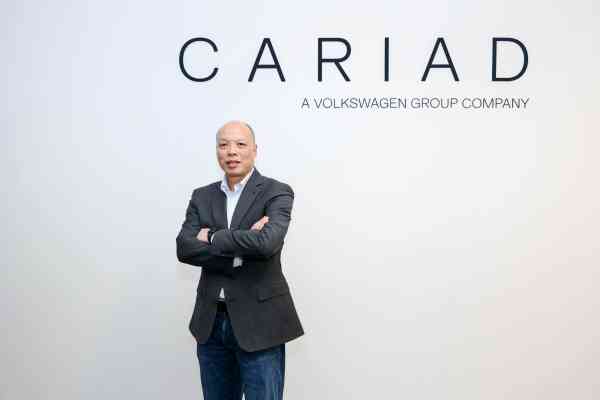

Defense Metals, Coinbase, Volkswagen: Critical metals for pioneering technologies

The demand for critical metals is increasing rapidly worldwide. From growing digitalization to the increased use of cryptocurrencies and AI, from advances in medical technology to electromobility and defense technology - all these areas rely on these critical raw materials. Defense Metals Corporation is an experienced explorer in British Columbia whose Wicheeda project is designed to provide these critical metals. Forward-thinking companies like the crypto exchange Coinbase serve many users who use rare earth metals to power their hard drives for crypto mining. Volkswagen also requires this raw material because car consumers in China have very different needs when it comes to vehicle software than those in the European market. A new CEO for the subsidiary and software company CARIAD knows exactly what needs to be done...

ReadCommented by Juliane Zielonka on February 22nd, 2024 | 07:00 CET

Royal Helium, Fresenius, BASF: Chemical and Healthcare industry - Where is the next investment opportunity?

Europe is in the midst of an industrial upheaval due to the Green Deal, which presents both challenges and opportunities for investors. While companies like BASF are arguing for deregulation and increased subsidies to support the green transition, healthcare company Fresenius is undergoing a period of radical change and realignment. The medical technology market is booming. The global MedTech market size amounted to USD 574,002.45 million in 2022 and is expected to increase to USD 814,159.2 million by 2028, with an annual growth rate of 6.0%. Critical raw materials such as helium are in particularly high demand. Royal Helium is one of the producers of this valuable gas and impresses with a well thought-out and sustainable business model. Where does the next investment opportunity lie?

ReadCommented by Juliane Zielonka on February 21st, 2024 | 07:15 CET

Saturn Oil + Gas, Plug Power, Deutsche Pfandbriefbank - Energy shares and falling knives - where is it worth getting in?

The Canadian company Saturn Oil & Gas has announced its capital and operating budget plans for 2024. The main focus is on sustainable oil and gas production with high capital returns, a structured capital allocation and continuous rapid debt repayment. Plug Power is also gaining momentum and taking strong cost-saving measures to maintain its position at the forefront as a green hydrogen provider. Deutsche Pfandbriefbank (pbb) came under the spotlight last week as investors dumped shares due to its involvement in the US office real estate market. Is this bank a falling knife, or does this week offer a potential entry point? We provide the background.

ReadCommented by Juliane Zielonka on February 16th, 2024 | 07:15 CET

Almonty Industries, thyssenkrupp, Rheinmetall: Three metal industry shares in focus

The metal industry contributes globally to the development of various sectors through continuous innovation driven by mining, R&D and technological advances. Tough times lie ahead for thyssenkrupp. During the Annual General Meeting, CEO Miguel López emphasized that energy costs for steel production will account for up to half of total costs. Quo Vadis, Germany, as a business location? So, let's take a look at South Korea, another renowned steel producer. The tungsten mining company Almonty Industries is positioning itself as a pioneer here, aiming to cover 7% of the global market. Its strategy involves mining in democratically governed countries and establishing first-class trade partners such as the US and South Korea. Given the geopolitical tensions, in which 90% of tungsten production comes from China and Russia, investors should analyze Almonty more closely. Meanwhile, Rheinmetall, an arms manufacturer, is enjoying full-order books and, for the first time, is exploring a completely new technology division for its portfolio expansion.

Read