For more than twenty years, the Cologne native has been intensively involved with the stock market, both professionally and privately. He is particularly passionate about national and international small and micro caps.

He first came into contact with the stock market and shares during his banking apprenticeship. After completing this in 2000, he gained his first journalistic experience in the editorial department of a financial portal. During his subsequent studies in business administration, he also worked in the area of investor relations.

Since then, he has remained true to the capital markets and is excited to report on every newly discovered interesting story - as well as on long-standing success stories.

Commented by Fabian Lorenz

Commented by Fabian Lorenz on May 29th, 2025 | 07:10 CEST

Rheinmetall unstoppable! Evotec shorted! Sensational news at Vidac Pharma! And what is BioNTech doing?

Sensational news at Vidac Pharma. Last year's biotech highflyer has published strong results for its cancer drug. The share price rose by 5% yesterday. Does this mean the consolidation is over? Analysts certainly see potential for a multiplication in value. Rheinmetall shares have gained over 200% this year alone. Analysts are raising their price targets and continue to recommend buying. Operationally, a lot is happening at the defense company. Meanwhile, Evotec has run out of steam operationally. The stock has become a plaything for takeover speculators and short sellers — who will win? BioNTech also wants to win the fight against cancer. Will the stock gain new momentum in the coming days?

ReadCommented by Fabian Lorenz on May 28th, 2025 | 07:05 CEST

OUT of defense, INTO crypto and quantum? RENK, Bitcoin Group, Strategy, and Credissential!

Defense stocks are unstoppable! RENK and Rheinmetall, among others, hit new all-time highs yesterday, with the entire defense sector on fire. The charts have already formed flagpole patterns. Crypto and quantum are also hot, but unlike defense, they are scalable. Credissential is one example of this. The tech company is currently still flying under the radar of most investors. However, with crypto, quantum, and AI, it aims to scale up in payment services and online car trading. If this succeeds during the current year, the stock could be a real bargain. Strategy – formerly Microstrategy – is valued higher than its own Bitcoin holdings, but investors seem to believe that CEO and industry star Michael Saylor can deliver outperformance. However, the Company is now facing a lawsuit. And what is the Bitcoin Group doing? The stock has jumped and forecasts have been exceeded, but...

ReadCommented by Fabian Lorenz on May 27th, 2025 | 07:10 CEST

Between bankruptcy and multiplication: Cleantech stocks Siemens Energy, Plug Power, and dynaCERT

More losses than revenue is never a good sign for any business model. Given the muted reactions to the quarterly figures, Plug Power investors seem to have grown accustomed to this pattern. Despite planned cost reductions, a return to profitability is not yet in sight. Still, a company executive has made a symbolic move, suggesting internal confidence. According to analysts, dynaCERT could make the leap into the black as early as next year. On this basis, the cleantech company is currently attractively valued, and experts consider a multiplication of its share price possible. Siemens Energy has shown how quickly a stock can shoot into a new dimension. Almost bankrupt 1.5 years ago, it is now one of the stars of the DAX and is receiving praise even from otherwise critical corners.

ReadCommented by Fabian Lorenz on May 26th, 2025 | 07:00 CEST

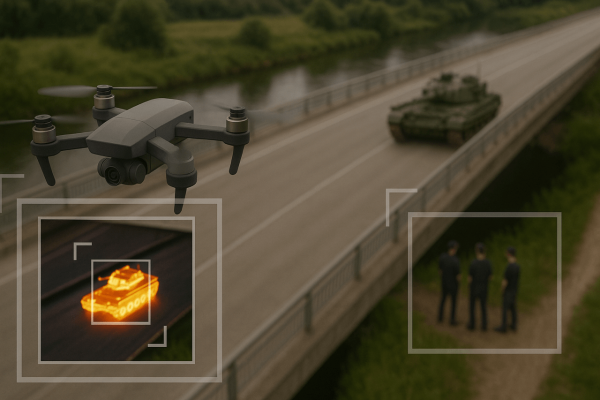

RENK, D-Wave, and drone insider tip Volatus Aerospace: INSIDER SALE, SHARE PRICE EXPLOSION, 100% OPPORTUNITY

Another drone insider tip is Volatus Aerospace. There is growth potential in civil and military applications. The Company earns money, among other things, by training drone pilots and monitoring areas and bridges. Analysts expect strong sales and profit growth in the coming years and conservatively estimate that the stock could rise by more than 100%. Is it time to take profits at RENK? In any case, one insider has cashed in. This is understandable, given that the defense stock has already gained around 270% this year alone. And the quantum hype is back. Following a "milestone for the industry," D-Wave shares exploded by 50% in one week.

ReadCommented by Fabian Lorenz on May 22nd, 2025 | 07:00 CEST

Another 100% with momentum stocks Rheinmetall, TUI, and 123fahrschule?! Analysts recommend buying

Are Rheinmetall's forecasts too conservative? One analyst thinks so. If this is true, there is a good chance that the defense company's shares will break through the EUR 2,000 mark. The 123fahrschule share is also riding a wave of momentum, rising by around 70% within just a few weeks. This could be just the beginning, as the Company is disrupting an analog industry with a digital business model. Analysts believe a further 100% price gain is possible, and the management board wants to buy shares well above the current price. In contrast, darker clouds are gathering at TUI. The tourism group has long been able to withstand the weak economy, but is that now over? The price targets vary widely.

ReadCommented by Fabian Lorenz on May 21st, 2025 | 07:00 CEST

Stocks on the verge of MULTIPLYING? BioNTech, D-Wave, and hot stock Argo Living Soils aim to revolutionize their markets! Buy now?

These companies want to turn billion-dollar markets upside down: Argo Living Soils, BioNTech, and D-Wave. Argo Living Soils aims to revolutionize infrastructure construction through nanotechnology. Concrete and asphalt are to become more durable and environmentally friendly through nanotechnology. This could, for example, make buildings and bridges better protected against earthquakes. The potential is enormous, and the hot stock is valued at less than CAD 10 million, offering the chance for a multiple increase. D-Wave has impressively demonstrated how quickly a revaluation can take place. Quantum computing has the potential to change the world. But big players like Alphabet, NVIDIA, and others also want a big piece of the pie. At BioNTech, the focus remains on the fight against cancer. The stock appears to have halted its sell-off, but analysts are lowering their price targets. Where is the right entry point now?

ReadCommented by Fabian Lorenz on May 19th, 2025 | 07:10 CEST

RAW MATERIALS and DEFENSE! Sell Hensoldt? Buy Deutz and Globex Mining shares?

Raw materials and defense remain among the hot topics of the year. Globex Mining is benefiting not only from the gold boom but also from the battle for raw materials. The stock of the mining incubator currently offers an exciting entry opportunity. Analysts recommend buying Deutz. However, after a solid quarter, the engine manufacturer needs to shift up a gear or two to justify its valuation. A highlight was the development in order intake. This is precisely what Hensoldt is lacking. When a growth company's revenue increases more strongly than its order intake, investors should at least keep an eye on it. Analysts are also skeptical regarding Hensoldt's valuation and recommend selling the stock.

ReadCommented by Fabian Lorenz on May 15th, 2025 | 07:00 CEST

Another 150%+ with Almonty stock? US defense industry and NASDAQ listing drive revaluation of the tungsten gem!

The revaluation of Almonty shares is progressing excellently and gaining new momentum. After rising over 150% within six months, the tungsten gem has consolidated healthily in recent weeks. However, there are good reasons to expect further price increases: China is using tungsten as a weapon in the geopolitical power struggle. The latest major order for Almonty from the US shows how urgently defense companies – but also other key industries – need this critical metal. An upcoming NASDAQ listing is expected to drive the share price and could pave the way for an anchor investor or even lead to a takeover. Analysts consider the fair value of Almonty shares well above the current level.

ReadCommented by Fabian Lorenz on May 13th, 2025 | 07:15 CEST

Stocks are taking off! Nel, RENK, Walmart partner MiMedia! Is the tariff chaos coming to an end?

Will MiMedia's stock break through resistance and shoot to a new all-time high? The chances are good, as the cloud insider tip has navigated the tariff chaos of recent weeks surprisingly well. Now, the Company is set to scale up in Latin America with retail giant Walmart. With gross margins of 80% and above, the upside is substantial. Could new momentum come from the CEO soon? Things are already heating up at Renk - tomorrow's update will be crucial. Can the high-flyer's order backlog and outlook convince investors? Analysts remain cautious, and the potential downside for the stock should not be underestimated. And what is Nel doing? For shareholders, it is a rollercoaster once again. An order cancellation is followed by new hopes that the EU might completely cut off the Russian gas tap.

ReadCommented by Fabian Lorenz on May 13th, 2025 | 07:05 CEST

A bombshell for D-Wave and Siemens Energy! Is AI stock NetraMark too cheap?

D-Wave has made a spectacular comeback. The reasons are strong figures, positive analyst comments, and cooperation with the auto giant Ford. Is the quantum hot stock heading for a new all-time high? AI gem NetraMark still has a long way to go, but its valuation is extremely exciting. Donald Trump's latest statements show that drug prices must come down. Pharma and biotech companies can achieve this by using NetraMark's AI. The stock appears cheap and also has takeover potential. Siemens Energy shares are unstoppable. However, analysts' opinions continue to diverge. On the one hand, the price target is being raised, while on the other, a sell recommendation is being issued. What to do?

Read