For more than twenty years, the Cologne native has been intensively involved with the stock market, both professionally and privately. He is particularly passionate about national and international small and micro caps.

He first came into contact with the stock market and shares during his banking apprenticeship. After completing this in 2000, he gained his first journalistic experience in the editorial department of a financial portal. During his subsequent studies in business administration, he also worked in the area of investor relations.

Since then, he has remained true to the capital markets and is excited to report on every newly discovered interesting story - as well as on long-standing success stories.

Commented by Fabian Lorenz

Commented by Fabian Lorenz on August 5th, 2025 | 07:15 CEST

OPPORTUNITY and WARNING SIGNAL! Heidelberger Druckmaschinen, Steyr major shareholder Mutares, and Pure Hydrogen shares!

Strategic repositioning can drive shares sharply higher - the latest example being Heidelberger Druckmaschinen. The Company plans to participate in the defense boom, and management is buying shares. However, analysts are issuing warnings after the sharp rise in the share price. Pure Hydrogen is preparing to change its name. The Australian company has long offered more than just hydrogen vehicles. Is a new champion for alternative drive systems emerging? While Pure Hydrogen is still in its infancy and investors can speculate on a multiplication of its value, this has already happened at Steyr Motor this year. However, major shareholder Mutares is currently making headlines, with BaFin now investigating, and the stock showing high volatility! Is this an opportunity to get in or a clear warning to stay away?

ReadCommented by Fabian Lorenz on August 4th, 2025 | 07:20 CEST

Comeback or crash? Hydrogen stocks: thyssenkrupp nucera, SFC Energy, dynaCERT!

SFC Energy shocked investors with a revenue and profit warning. The stock fell by around 30% in one day, wiping out all of the year's gains. What were the reasons for this, and what does the future hold for the former insider tip in the defense and investment hype? dynaCERT has impressed with a new order from France. The cleantech company is helping a port reduce its greenhouse gas emissions. If the marketing offensive in the first half of the year continues to bear fruit, the stock could be poised for an exciting comeback. thyssenkrupp nucera is already on an upward trend. Although the share price failed to break through the EUR 11 mark, the situation is still significantly better than at Nel and Plug Power.

ReadCommented by Fabian Lorenz on July 31st, 2025 | 07:20 CEST

BYD facing problems! 300% stock Steyr Motors delivers! Green light for Sranan Gold!

Steyr Motors appears to be delivering what shareholders were hoping for. Following the rapid rise in its share price this year, the Austrian company has now reported new orders. This could enable the Company to grow into its ambitious valuation. Gold explorer Sranan Gold is still attractively valued. The important drilling program will start soon. Is this also the starting signal for a rally in the share price? There is currently no talk of a rally at BYD. The Chinese company is facing challenges both in its domestic market and in Europe. In Europe, sales figures are falling short of expectations. Can new personnel and a revamped sales strategy bring about a turnaround?

ReadCommented by Fabian Lorenz on July 31st, 2025 | 07:05 CEST

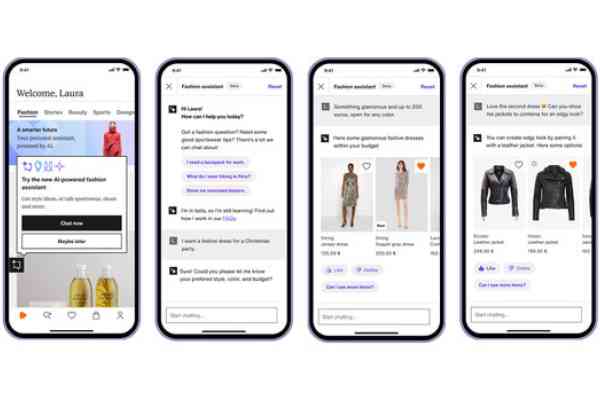

270% surprise! Rheinmetall, Zalando, Walmart partner MiMedia – Time to buy shares?

With a strong performance of 270%, MiMedia shares are one of this year's surprises. And the chances are good that the stock will continue to perform well in the future. With strong partners such as Walmart behind it, the cloud specialist aims to grow significantly in the coming years. Rheinmetall needs to grow massively to justify its ambitious valuation. However, the supercycle in the defense industry promises golden years ahead. The group also wants to carve out a large slice of the billion-dollar pie in other European countries. After a strong start to the year, Zalando shares have slipped considerably. The takeover of competitor AboutYou has now been completed, and analysts see upside potential.

ReadCommented by Fabian Lorenz on July 30th, 2025 | 07:15 CEST

BUY NOW? Puma, D-Wave, and Almonty Industries with 100% upside potential

Sometimes the stock market is not rational. That is precisely when great opportunities can arise. Almonty shares appear to be one such opportunity right now. The tungsten gem has corrected sharply following its NASDAQ listing. While the Company remains in its quiet period, analysts are speaking out and see significant upside potential. The rally could resume soon, as tungsten remains critical for defense and other industries. Staying the course despite sharp corrections has paid off for D-Wave this year. Those who bought additional shares were rewarded. Next week, the quantum stock is likely to see new momentum. No positive momentum is currently expected for Puma. Following the profit warning, the stock is at rock bottom, and analysts are slashing their price targets. Or is this the signal to buy?

ReadCommented by Fabian Lorenz on July 30th, 2025 | 07:05 CEST

RENK facing takeover? Crash at Novo Nordisk! Buying opportunity in AJN Resources shares!

AJN Resources shares currently offer an exciting opportunity to position yourself for the next rally in the gold price. The Company announced yesterday that it has received approval to explore its property in the vicinity of the largest gold deposit in Ethiopia. The regular news flow expected in the coming months should give AJN shares new momentum. There are currently exciting developments in the European defense industry. Ahead of its IPO, KNDS has further increased its stake in supplier RENK. There were problems with another major shareholder in the run-up to the IPO. Novo Nordisk is currently facing completely different issues. The Danish company has lowered its revenue and profit forecasts, causing its share price to crash. Is now the time to buy?

ReadCommented by Fabian Lorenz on July 29th, 2025 | 07:15 CEST

Watch out for BioNTech! Bayer, Formycon, and Vidac Pharma shares are on the rise!

While all eyes appear to be on BioNTech's upcoming quarterly results on August 4, other shares are on the rise. Analysts see strong upside potential for Vidac Pharma, citing the possibility of a multi-fold increase. The Company has appointed a new CEO, and its listing on a major German stock exchange is expected soon. This is an exciting mix that could break the sideways trend and ignite a rally. Bayer and Formycon have already shown that a 50% increase is possible in just a few months. However, the DAX-listed company had to report a delay in product approval last Friday. At Formycon, the upward trend is still intact. Analysts praise the progress made in biosimilar development.

ReadCommented by Fabian Lorenz on July 29th, 2025 | 07:00 CEST

YIELD MONSTERS 2025: Hensoldt, Steyr Motors, Veganz shares – another 250% gain?

When it comes to German return monsters for 2025, investors rightly think primarily of defense companies like Rheinmetall, RENK, Hensoldt, and Steyr Motors. However, with a 250% gain, the Veganz Group may well be the surprise of the year. The Company is currently reinventing itself and attacking a billion-dollar market. Analyst estimates appear to be far too conservative and are likely to be revised upward soon. The stock, therefore, remains very attractive. Hensoldt has multiplied in value in recent years and is now supplying radar systems for the protection of Ukraine. The order volume is in the mid-three-digit million range. Steyr Motors will have to grow to this revenue range in the coming years to justify its current valuation. Analysts nevertheless recommend buying the stock.

ReadCommented by Fabian Lorenz on July 28th, 2025 | 07:05 CEST

Shares with up to 200% Upside! Barrick Mining, RENK, and Dryden Gold

RENK's share price has more than tripled in the current year, and analysts still see further upside. However, expectations for revenue growth and order intake are sky-high, so investors are advised to proceed with caution. According to analysts, Dryden Gold is set to triple in value. The Company is currently developing a high-grade deposit where visible gold can be seen on surface - a promising indicator of future resource potential. Analysts also see a bright future for Barrick Mining. With a gold price of USD 4,000, they estimate the stock could gain 50%—or potentially even more.

ReadCommented by Fabian Lorenz on July 24th, 2025 | 07:20 CEST

AI stocks: Buy SAP now? BioNTech surprises! NetraMark beats ChatGPT!

SAP shares performed poorly yesterday. However, the software company is running smoothly and making progress in expanding its AI and cloud business. Is now a good time to get in? Analysts see around 50% upside potential for NetraMark shares. The AI specialist supports Big Pharma in efficient drug development – a billion-dollar market. Now NetraAI has even beaten ChatGPT and DeepSeek! BioNTech is also betting on artificial intelligence. However, the Mainz-based company is currently only making headlines with a change in personnel, but this could change on August 4. Will there be new impetus soon?

Read