Born in Mönchengladbach, he studied business administration in the Netherlands. In the course of his studies he came into contact with the stock exchange for the first time. He has more than 25 years of experience in stock market business.

After graduating, he worked as an IT consultant for a listed company before becoming self-employed, during which time he worked for various DAX-listed companies and a large Swiss insurance company, among others.

Since 2009, he has been exclusively involved in the capital markets, where he was able to gain experience as a day and swing trader, in investor relations and at board level. He was able to live out his passion for numbers in the controlling department of a securities trading house.

For him, fundamental analysis paired with the correct reading of the price action of a market provides the basis for successful trading.

Commented by Armin Schulz

Commented by Armin Schulz on January 6th, 2025 | 07:15 CET

Volkswagen undervalued! What about European Lithium and BYD?

Looking at the market for electric vehicles in Germany, the outlook seems bleak. However, taking a broader view, the global picture tells a different story. Battery production is also steadily rising, driving a growing demand for lithium. Currently, the lithium supply is still sufficient, but experts predict that by 2030 demand will exceed supply. The reason for this is not only the automotive industry but also the demand for energy storage for renewable energies. We take a look at three companies and their current situation.

ReadCommented by Armin Schulz on January 3rd, 2025 | 07:00 CET

D-Wave Quantum, ARI Motors, Bayer – Which stocks should be in the portfolio for 2025?

After Google presented its quantum processor, Willow, D-Wave Quantum's shares skyrocketed. The question is how sustainable this increase is and whether quantum computing will be the next big hype after artificial intelligence. For the automotive industry, 2024 was a year to forget. Many automakers are currently struggling with problems. ARI Motors, an electric vehicle manufacturer that has secured a niche for itself, is faring better. Will the entire automotive industry manage a turnaround in the coming year? Bayer's shareholders are also hoping for a turnaround. The share price took a significant hit last year. 2025 is expected to be much better. We take a closer look at the individual stocks.

ReadCommented by Armin Schulz on January 2nd, 2025 | 07:10 CET

Palantir – Data as gold, or should one add Desert Gold and MicroStrategy to the portfolio for 2025?

In today's world, digital technologies are integral to our lives, and as we navigate the internet, we disclose data that is now considered the gold of the 21st century. Tech giants leverage this data for personalised offerings, thereby securing competitive advantages. Palantir has made a name for itself as a big data analyst and has grown considerably as a result. The other option is to invest in gold or crypto companies. The price of gold and Bitcoin has risen significantly in the past year. We look at a company from each sector and see which stock deserves a place in your portfolio.

ReadCommented by Armin Schulz on December 30th, 2024 | 07:10 CET

Myriad Uranium - Uranium prices are exploding! What is the outlook for Nel ASA and RWE?

Uranium is increasingly coming into focus. Recently, the largest uranium producers, Kazatomprom and Cameco, revised their production forecasts downward, and this at a time when the world needs more energy. Data centres for quantum computing, crypto mining, artificial intelligence, and electromobility are driving the world's hunger for electricity. At the same time, some large tech companies are researching modular nuclear reactors, which could further boost the demand for uranium. While the uranium sector is performing well, 2024 has been a tough year for hydrogen and renewable energies. We look at one company from each sector and examine the prospects for 2025.

ReadCommented by Armin Schulz on December 27th, 2024 | 07:10 CET

Volkswagen, Globex Mining, Novo Nordisk – Here are the opportunities for the coming year

The vbw commodity price index recorded a remarkable increase of 4.4% in October 2024 compared to the previous month – an increase of 18.4% year-on-year. On the one hand, this is surprising, as the economy has reportedly noticeably slowed down. On the other hand, geopolitical tensions seem to be causing overcompensation. Raw materials are the engine of the economy, and it is not for nothing that the price of copper is considered a leading indicator of economic activity. In times of export restrictions, it is clear how dependent the world is on China and Russia. Without the crucial raw materials, production comes to a halt. We take a look at three companies and assess whether they are well-positioned in the raw materials sector for the upcoming year.

ReadCommented by Armin Schulz on December 27th, 2024 | 07:00 CET

Barrick Gold, Thunder Gold, MicroStrategy – Precious metals and digital assets as an investment in uncertain times

In a world that feels increasingly uncertain with each passing day, gold is becoming increasingly important. The times of high interest rates are over, and with central banks even considering interest rate cuts again, many investors are turning to the shiny metal. Why? While gold does not pay interest, when the alternatives do not offer decent returns either, it suddenly becomes quite interesting.

Geopolitical crises, which seem never-ending, also play a significant role. The war in Ukraine, tensions in the Middle East – issues like these are once again making gold a hotly sought-after safe haven. Central banks, which have bought a record amount of gold in recent years, are also helping to keep the price stable. Not to mention the still tangible inflation and economic risks.

In any case, the experts agree: the current consolidation in the gold price – that is, this minor setback – is likely to be only a breather. In the long term, the trend is clearly pointing upwards. And while gold continues to have its fans, many investors are also increasingly looking towards Bitcoin and other cryptocurrencies, which are also considered a hedge in the current climate.

ReadCommented by Armin Schulz on December 23rd, 2024 | 08:15 CET

Nel ASA, dynaCERT, Super Micro Computer – Portfolio realignment: What should be in the portfolio?

At the end of the year, many investors critically review their portfolios in order to align them with the challenges and opportunities of the year ahead. This phase, often referred to as "window dressing" or year-end rally, offers investors the opportunity to review their investment strategies, take profits, offset losses in a targeted manner or tactically reweight positions. At the same time, the new year represents a fresh start, with a renewed focus on future developments, macroeconomic trends and long-term goals. We take a look at three interesting stocks and analyse the opportunities for the coming year.

ReadCommented by Armin Schulz on December 20th, 2024 | 07:30 CET

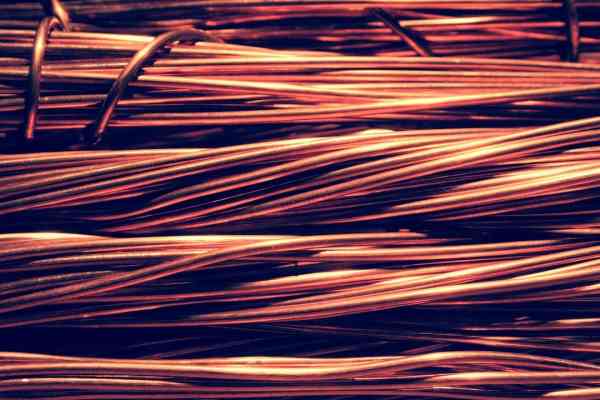

Mercedes-Benz, XXIX Metal, D-Wave Quantum - Copper shortage: Is a bottleneck looming due to new technologies?

Copper is an elementary industrial raw material whose importance is steadily increasing due to technological innovations and global megatrends. In particular, the rapid expansion of electromobility, the development of quantum computers, and artificial intelligence are driving demand to new heights. Electric vehicles require many times more copper than conventional vehicles with combustion engines due to batteries, engines and charging infrastructure. At the same time, demand is increasing in data centres and networks that rely on high-performance cables and cooling systems. Experts predict that global copper demand will increase by millions of tonnes by 2030 – and with it, new challenges for production and supply.

ReadCommented by Armin Schulz on December 18th, 2024 | 07:15 CET

RWE, F3 Uranium, Super Micro Computer – Profiting from the world's growing hunger for energy

Global energy demand is skyrocketing, fuelled by technological progress and the enormous appetite for electricity for electric vehicles and AI-powered data centres, whose consumption could more than double by 2028. At the same time, the energy transition faces unresolved challenges: Weather-dependent wind and solar energy supply electricity in an unreliable manner, bureaucratic hurdles slow down the expansion, and without sufficient storage, alternatives for the base load are lacking. Given these developments, nuclear power is increasingly seen as the only reliable option for both satisfying the growing hunger for energy and ensuring a stable and climate-friendly energy supply in the long term.

ReadCommented by Armin Schulz on December 17th, 2024 | 07:15 CET

TUI share takes off – When will Almonty Industries and Bayer follow suit?

At the end of 2024, the stock market is characterised by a dynamic spirit of optimism, driven by encouraging share price developments and optimistic future prospects. While some companies are showing impressive share price increases, it remains to be seen whether this positive trend will also spread to other sectors or companies. Global developments such as technological advances, sustainable investment strategies and geopolitical dynamics shape the market environment just as much as macroeconomic factors. In particular, interest rate cuts and declining inflation create tailwinds for investors.

Read