Born in Mönchengladbach, he studied business administration in the Netherlands. In the course of his studies he came into contact with the stock exchange for the first time. He has more than 25 years of experience in stock market business.

After graduating, he worked as an IT consultant for a listed company before becoming self-employed, during which time he worked for various DAX-listed companies and a large Swiss insurance company, among others.

Since 2009, he has been exclusively involved in the capital markets, where he was able to gain experience as a day and swing trader, in investor relations and at board level. He was able to live out his passion for numbers in the controlling department of a securities trading house.

For him, fundamental analysis paired with the correct reading of the price action of a market provides the basis for successful trading.

Commented by Armin Schulz

Commented by Armin Schulz on July 7th, 2025 | 07:10 CEST

RENK, Globex Mining, BYD: The raw materials gap – A threat to defense and e-mobility, An opportunity for miners

Global industry is facing a turning point. While defense giants like RENK are experiencing record demand yet continue to face investor skepticism, and electric vehicle leader BYD grapples with market saturation, raw materials are redefining the competitive landscape. Raw materials such as tungsten, antimony, and rare earths are essential for high-tech industries. Globex Mining is directly benefiting from this shortage of strategic metals – an effect that is permeating supply chains, from tank manufacturing to electric vehicle production. The diverging paths of these three players underscore the importance of supply security in determining success. An analysis of the current status of RENK, Globex Mining, and BYD reveals the strategic levers for future value creation.

ReadCommented by Armin Schulz on July 3rd, 2025 | 07:20 CEST

Desert Gold's ingenious move: How the untapped gold anomaly and upcoming PEA could significantly enhance your portfolio

What if there were a vast, largely unexplored area right next to some of West Africa's most productive gold mines? And what if strong gold traces had already been found on surface, but no drill had ever been set up there? Desert Gold Ventures is now seizing this opportunity with the Tiegba Project in Ivory Coast. The deal is more than just a new exploration field. It is a strategically astute move with the potential to fundamentally transform the Company. Investors looking for exceptional opportunities in the commodities sector would be well advised to take a closer look.

ReadCommented by Armin Schulz on July 2nd, 2025 | 07:10 CEST

AI, personalized therapies, blockbusters: Evotec, NetraMark Holdings, Novo Nordisk – Your ticket to the pharmaceutical boom

As billion-dollar profits beckon and technological quantum leaps revolutionize the healthcare industry, investor excitement is surging in 2025. Investors are flocking back, attracted by unprecedented momentum. Artificial intelligence is discovering new drug candidates in record time, personalized medicine is unlocking entirely new markets, and solutions for widespread chronic diseases are driving valuations to dizzying heights. Those who understand the rules of this rapid change and identify the right partners are positioning themselves for exceptional returns. We therefore take a closer look at three compelling companies in this space: Evotec, NetraMark Holdings, and Novo Nordisk.

ReadCommented by Armin Schulz on July 2nd, 2025 | 07:00 CEST

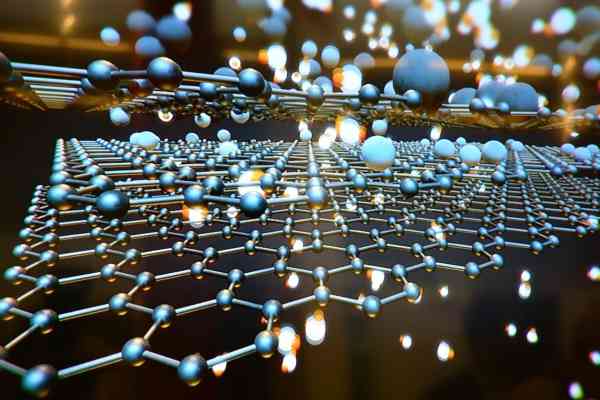

From microcap to market leader: How to get in on the booming billion-dollar graphene market with Argo Living Soils

Graphene sounds like something out of a science fiction novel, but it is already being used today where it matters most: in our roads and buildings. This miracle material, which is 200 times stronger than steel and as conductive as copper, is revolutionizing concrete and asphalt. It makes infrastructure more durable, drastically reduces CO₂ emissions, and lowers construction costs. For investors, this creates a perfect storm of technological advancement and sustainability pressure. Those who get in early with the companies driving this change will position themselves at the forefront of a billion-dollar market.

ReadCommented by Armin Schulz on June 30th, 2025 | 07:05 CEST

Gold on track for a new all-time high: How to profit with Barrick Mining, AJN Resources, and Newmont

Gold is heading inexorably toward new records in 2025, driven by geopolitical crises, fluctuating currencies, and nervous markets. Following a rapid start to the year, the price surged to historic highs, driven by substantial demand from investors and central banks. Interestingly, Asian private investors, in particular, have jumped on the gold bandwagon. If Asian "gold bugs" are now also on board, their purchasing power could support the market. Experts predict further increases, potentially reaching USD 3,956, especially with the strong season just beginning. Anyone looking to profit from this dynamic rally should keep an eye on these three companies: Barrick Mining, AJN Resources, and Newmont.

ReadCommented by Armin Schulz on June 26th, 2025 | 07:15 CEST

NATO's 5% target: Why Almonty Industries' mega mine and NASDAQ listing are a perfect fit for investors

Geopolitical conflicts and trade restrictions are making it increasingly difficult to source critical raw materials. Western companies in the high-tech and defense sectors are particularly struggling with scarce supplies and increasingly stringent export controls. With NATO's new 5% defense spending target, the battle for raw materials such as tungsten, which are essential for defense equipment, is set to gain further momentum. As a result, the demand for independent suppliers and the need for reliable partners with sufficient capacity is growing. Almonty Industries has already established a unique profile as a tungsten producer, with assets ranging from mines in Europe to the upcoming commissioning of a mega deposit in South Korea.

ReadCommented by Armin Schulz on June 25th, 2025 | 07:00 CEST

US hydrogen industry under pressure: Plug Power struggles - Things are looking much better for First Hydrogen and thyssenkrupp nucera

While Europe is hitting the hydrogen accelerator, as evidenced by more than 100 events during Hydrogen Week 2025 and billions being invested in infrastructure and electrolyzer factories, the US market is stumbling. Political U-turns are abruptly halting subsidies and jeopardizing projects, especially those involving green hydrogen. However, the global megatrend remains intact. Europe is pushing ahead with decarbonization, aiming to double its production capacity by 2030, and the market is growing dynamically. In this field of tension between setbacks and new beginnings, we take a look at three key players: Plug Power, First Hydrogen, and thyssenkrupp nucera.

ReadCommented by Armin Schulz on June 24th, 2025 | 07:30 CEST

Portfolio Doubler with Artificial Intelligence: Novo Nordisk, PanGenomic Health, and Pfizer Ignite the Profit Growth in 2025

According to BlackRock Health Sciences, the global healthcare sector is poised for an unprecedented boom in 2025. After years of volatility driven by the pandemic, the industry is now expected to achieve its highest profit growth in almost two decades - and across the board, not just among pandemic-driven outliers. Digital revolutions such as AI-assisted drug development and telemedicine are accelerating change and creating radically new business models. Those who understand the architects of this transformation will recognize the growth drivers of tomorrow. With this in mind, we take a closer look at three key companies: Novo Nordisk, PanGenomic Health, and Pfizer.

ReadCommented by Armin Schulz on June 24th, 2025 | 07:05 CEST

Western countries seek rare earth escape route: BYD, European Lithium, and Siemens Energy decoded

Our green future depends on tiny elements: neodymium, dysprosium, and others, which are irreplaceable for e-mobility and wind power. However, since China's export restrictions on rare earths in April 2025, prices have skyrocketed by up to 500%, and looming supply bottlenecks are shaking entire industries. Chinese automaker BYD should have no problems with supplies. European Lithium is a possible alternative for Western countries with its lithium and rare earth projects. At Siemens Energy, the wind power subsidiary Gamesa is particularly dependent on rare earths. We take a closer look at the three companies.

ReadCommented by Armin Schulz on June 23rd, 2025 | 07:25 CEST

China's antimony ban! Antimony Resources the winner in this crisis – next raw materials alert for Rheinmetall and the RENK Group!

A once-overlooked metalloid is now determining military power: antimony. Since 2024, China's export restrictions have driven prices to record highs and exposed the West's critical dependence on this raw material. Without this key element, ammunition, armor, and high-tech weapons fail to function. This is fatal in times of global tensions, as the US attack on Iran over the weekend once again made clear. However, while China dominates the market and Russia is out of the picture, alternative solutions are starting to emerge. One name gaining attention is Antimony Resources. We also take a look at Rheinmetall and the RENK Group and analyze where they currently stand.

Read