Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets. In the historic dot.com year 2000, he trained as a CEFA analyst in Frankfurt and has since then accompanied over 20 IPOs in Germany.

Until 2018, he held various positions at banks as an asset manager, capital market and macro expert as well as fundamental equity analyst. He is passionate about the energy, commodity and technology markets as well as the tactical and strategic asset allocation of liquid investment products. As an expert speaker at investment committee meetings of funds as well as at customer events, he can still describe the course of the 1987 crash, one of the major buying opportunities of the last 33 years on the stock market.

Today, he knows that the profit in shares is not necessarily the result of buying cheaply, but above all of avoiding mistakes and recognizing in good time when markets are ready to let air out. After all, in addition to basic fundamental analysis, investing in stocks is above all a phenomenon of global liquidity and this must be monitored regularly.

Commented by André Will-Laudien

Commented by André Will-Laudien on March 1st, 2022 | 12:25 CET

Gazprom, BP, Barrick Gold, Ximen Mining - Putin's Ukraine conflict boosts gold and silver!

Over the weekend, the buzzword "mobilization of nuclear weapons" was heard in the media. In the ears of investors, the loud saber-rattling sounded like the starting signal for a gold and silver rally. Events then rolled over in sequence: Russian accounts were frozen, the SWIFT system was disconnected, and there were likely payment difficulties at Sberbank. The sponsorship contract with Gazprom was terminated by Schalke 04 without notice. In this country, people are wondering what medium-term effects the Russian crisis will have on society, the relationship with Russia in general, and the economy. In this context, we are watching a few interesting stocks.

ReadCommented by André Will-Laudien on February 28th, 2022 | 11:10 CET

Russia crisis: Plug Power, Nel ASA, First Hydrogen - Which hydrogen stock to buy now?

Buy when the guns are thundering! This stock market wisdom has worked many times before. This time, the chances for a discussion in favor of "alternative energy sources" are excellent because the Russian crisis shows Europe's staggering dependence on fossil fuel energy supply. One of the main suppliers has historically been Russia, and there are virtually no alternatives, especially for the critical natural gas. To avoid getting into a supply bottleneck, the possibilities for extended EU sanctions against Putin are thus also limited. However, the traffic light coalition is unanimous: The development in the direction of hydrogen must get going now to finally get Europe's climate strategy and energy turnaround on track! Here is an overview of the best-positioned titles!

ReadCommented by André Will-Laudien on February 25th, 2022 | 11:21 CET

Gazprom, Sberbank, Defense Metals, Airbus: Buy when the cannons thunder!

The Ukraine crisis, or rather the Russia crisis, pulls its circles. The Putin case escalates more and more because the Russian president recognizes the eastern Ukrainian "separatist areas" of Donetsk and Luhansk as autonomous regions. A familiar tactics game of the Kremlin and at the same time an affront to the West. The EU and the US, as well as Great Britain and other states, are responding with sanctions. These hit several sectors - including banks and companies as well as Russian elites and families who support Putin's power apparatus. So far, trading in Russian stocks has not been sanctioned, creating low entry prices. We give a few important tips away from politics!

ReadCommented by André Will-Laudien on February 24th, 2022 | 09:41 CET

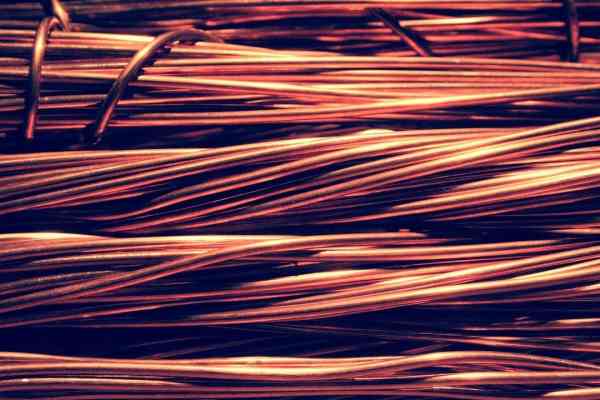

BYD, Nio, Nordex, Phoenix Copper: Nothing works without copper!

Electromobility is becoming increasingly crucial for the energy transition in transportation. And with it, the research and development of drives, batteries and power-saving components. However, in addition to electricity storage, vehicle cabling and the fitting of high-tech components are also coming to the fore. Today, an electric vehicle requires 3 to 4 times as much copper as it did 20 years ago. Still, the earth's deposits are exhaustible, and copper, in particular, is pretty much stretched to the limit. A spot price of just under USD 10,000 per kilo clearly shows how the markets are processing this situation. A current conflict, such as Ukraine, provides additional fuel and further rising prices! Where are the opportunities?

ReadCommented by André Will-Laudien on February 22nd, 2022 | 13:05 CET

BioNTech, Moderna, Valneva, Cardiol Therapeutics: The gold rush is over!

The mild progression of the Omicron variant and the associated massive relaxations of the Corona measures in many countries weighs heavily on the prospects of the vaccine manufacturers. That is because the winter is drawing to a close, clinical shortages are not occurring, and vaccination rates do not want to increase despite massive public campaigns. Meanwhile, even those in power realize that enforcing a general vaccination requirement could become a hot legal ride under the current circumstances. For the biotech sector and vaccine producers, in particular, this is a reason for profit-taking for the time being. Here are a few further ideas.

ReadCommented by André Will-Laudien on February 21st, 2022 | 12:46 CET

Varta, Standard Lithium, Edison Lithium - The demand for lithium is going through the roof!

E-mobility is permanently changing today's automotive industry. More and more electrified passenger cars are finding their way onto our roads, and the growth prospects for this booming industry are expected to improve even further in the coming years in light of increasing climate concerns. The Boston Consulting Group estimates that electric cars will account for 47% of global markets by 2025, up from 12% in 2020 - that is a very bold forecast! But it does show a way forward. Thanks to the accelerated acceptance of environmentally friendly vehicles among consumers, one metal, in particular, is moving into the spotlight: lithium. And it is here that investors should pay attention.

ReadCommented by André Will-Laudien on February 18th, 2022 | 11:15 CET

Palantir Technologies, Kleos Space, TeamViewer - The next data hype is coming!

In a political conflict like the current one between Russia-Ukraine and the rest of the world, the availability of accurate movement data would be a real asset. However, military data is guarded by governments like a holy grail - especially troop movement data is a hot commodity. In terms of consumer tracking and communications, data is already the most important element of the digitized world. What matters is when what content is seen on which channels and who is sitting in front of the end device. Here is a selection of data specialists with distinctive entry points.

ReadCommented by André Will-Laudien on February 17th, 2022 | 11:22 CET

Super numbers! Barrick Gold, Desert Gold, First Majestic - The gold and silver rally is coming!

Inflation is a buying time for precious metals - Inflation Protection. The political conflict with Ukraine seems to be slowly dissipating into thin air. But short-term surprises still lurk to drive the price of gold. Due to the pullback that has begun, there has been a slight easing in commodity prices, but the fundamental rally continues. Barrick has reported on 2021. And second-tier stocks are waiting in the wings. Here is a selection of promising gold and silver stocks.

ReadCommented by André Will-Laudien on February 16th, 2022 | 11:14 CET

The technical breakout: Barrick Gold, Tembo Gold, Delivery Hero - Huge gold rally ahead!

A lot is going on on the political fronts. Ukraine is put in fear by threatening gestures, and the West is mobilizing on Poland's border. With such maneuvers, the stock exchanges usually take a dive, and for gold and silver, it often produces a buy signal. A few days ago, there was an accompanying inflation figure of plus 7.5% from the United States. That signals a further increase in inflation, which was not expected even by the Fed. We are looking at potential winners from this large-scale situation.

ReadCommented by André Will-Laudien on February 15th, 2022 | 12:30 CET

Attention: Siemens Healthineers, Perimeter Medical Imaging AI, MorphoSys, Siemens - Riding the next hype with MedTech!

MedTech and pharma giants have been in high demand not only since the pandemic. The technification of diagnostics leads to the early detection of serious diseases and shortens the planning of necessary medical interventions. Of course, COVID-19 significantly impacts the availability and additional demand for high-tech in practices and emergency departments. It is creating a boom in demand from manufacturers rarely seen at this headline rate. We are looking at clear winners in medical digitization.

Read