December 17th, 2025 | 07:00 CET

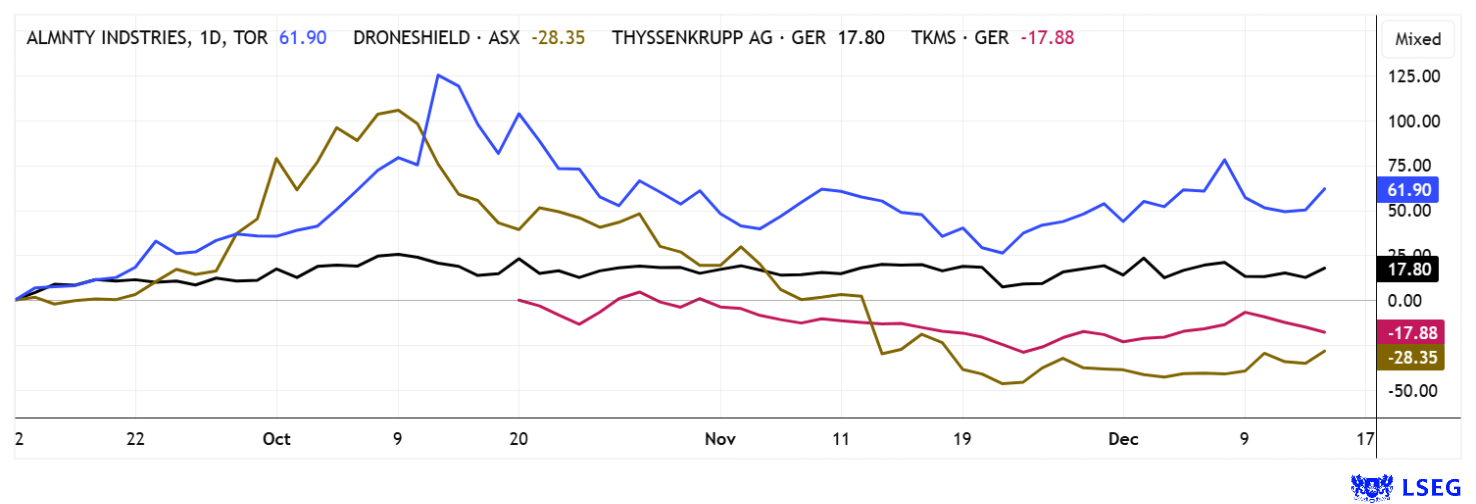

Year-end rally ahead! Selected positioning for 2026 in Almonty, DroneShield, thyssenkrupp, and TKMS

Incredible volatility at year-end. No surprise - the past stock market year will go down in history as one of the best for the DAX and NASDAQ. And this despite shrinking economic growth and rising inflation. But seasoned investors already know that inflation boosts stock prices, and what drives them even more is defense spending. War is terrible, but it fills the coffers of financiers - led, as always, by the US. Donald Trump likes to sell himself as a peacemaker to the outside world, yet the US remains the world's largest producer of offensive and defensive technology. Business is booming, NATO is among the biggest customers, and demand runs into the trillions. Whether 2026 will continue in the same vein is doubtful, but conflicts at least continue to enable hyperinflationary money printing. As a result, the gigantic debt flywheel spins ever faster – this is how FIAT money systems have functioned for millennia! Where do opportunities lie for risk-aware investors?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

ALMONTY INDUSTRIES INC. | CA0203987072 , DRONESHIELD LTD | AU000000DRO2 , THYSSENKRUPP AG O.N. | DE0007500001 , TKMS AG & CO KGAA | DE000TKMS001

Table of contents:

"[...] While tungsten has always played an important role in the chip industry, it is now being added to batteries for e-cars. [...]" Lewis Black, CEO, Almonty Industries

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Almonty Industries – Capital requirements met, now full speed ahead

Almonty Industries, the critical metals expert, is currently benefiting from a fundamental shift in sentiment on the commodity markets, where valuations are no longer driven by short-term geopolitical headlines, but by resilient supply chains and strategic integration into Western industries. In this environment, tungsten and molybdenum are coming into focus as security-relevant metals, as they are indispensable for defense systems, aerospace, semiconductor manufacturing, and the expansion of AI infrastructure.

A real bombshell hit the markets on December 11! Almonty Industries launched a capital increase of USD 129.37 million, a scale that no one would have believed the Company capable of after its last move in October. Despite initial surprise, the prevailing view now is that there will be no further dilution in the near future. The Company is underpinning its future goals with a clearly defined growth path. An extensive drilling program is underway at the Panasqueira mine in Portugal to prepare for the expansion to the new "Level 4" production level. Around 14,000 meters of drilling within a year will serve to update the resource model, identify new mineralization zones, and sustainably extend both production volume and mine life. At the same time, the Sangdong mine in South Korea, one of the largest and highest-grade tungsten projects in the world, is about to open. Once ramped up to full capacity, Sangdong could account for the majority of non-Chinese tungsten production in the future and become the Company's primary source of cash flow.

With the complete acquisition of the Gentung Browns Lake project in Montana, Almonty has also taken a strategic step into the US market. The project is located in an established tungsten district and has proven underground deposits in skarn rock, high metallurgical yields, and existing infrastructure, which significantly reduces development risks. According to current plans, Gentung Browns Lake is expected to be ready for production in the second half of 2026 and to supply approximately 140,000 MTU of tungsten oxide annually.

Following the USD 130 million measure, CEO Lewis Black emphasizes that the Company is now fully financed and has no plans for further capital measures for the time being. The voluntary withdrawal of the base shelf prospectus underscores this promise. Supported by higher tungsten prices and long-term purchase agreements, the investment story is consolidating into a rare mix of geopolitical relevance, operational leverage, and predictable scaling. Research houses are giving the thumbs up and already expect strong growth in revenue and earnings by 2026. Oppenheim Research sees good chances of reaching a target of USD 12, while Germany's Sphene Capital believes CAD 13.50 could well be achieved in 36 months. Exciting!

CEO Lewis Black spoke at the recent 17th International Investment Forum (www.ii-forum.com) on December 3 without any presentation. This made the impression of Almonty all the more intense. Click here for the video.

IIF moderator Lindsay Malchuk also provides new insight into the tungsten deal in Montana.

DroneShield – What a revival!

We have often pointed out the horrendous valuation of DroneShield shares. With strange options and sales campaigns, the Australians recently shot themselves out of orbit. When it became known that employees and executives were throwing approximately 5% of the outstanding share capital onto the market regardless of losses, the share price plummeted by over 80% from EUR 3.80 to EUR 0.85. But now this rise! For the second time in a few days, the stock has risen sharply after the Company received a major order worth AUD 49.6 million. Through a European distribution partner, DroneShield is supplying modern drone defense systems to a military end customer, thereby strengthening its position in the security-related technology market. A significant portion of the required hardware is already in stock, enabling rapid processing. Full delivery and payment can be expected by the end of the first quarter of 2026. Investors brushed aside the recent negative events and snapped up shares again. Overall, DroneShield has recorded a price increase of around 250% since the beginning of the year and continues to benefit from the growing global demand for effective drone defense solutions. Speculatively noteworthy, but fundamentally overpriced!

thyssenkrupp and TKMS – Analysts see potential

The Duisburg-based steel group thyssenkrupp is benefiting from the spin-off of its naval subsidiary TKMS. The restructuring of debt on the balance sheet also reduces the unpopular conglomerate discount on the stock market. The now independent TKMS can even look forward to positive analyst comments and a lot of advance praise for the new stock. Based on the figures for the 2025 financial year, Deutsche Bank is very optimistic about the potential for a medium-term increase in margins. Although the final results of important orders are not expected until 2026, the long-term growth opportunities in terms of revenue are convincing, which also increases the EBIT forecasts. Deutsche Bank has issued a "Buy" recommendation with a 12-month price target of EUR 82, which is also the consensus on the LSEG platform. The recommendations from Metzler and mwb research are outstanding at EUR 96 and EUR 100, respectively. Sentiment has also improved for the parent company, thyssenkrupp. Here, experts are even estimating a price target of EUR 10.90. This is a strong vote, given that TKA shares have already risen 194% from EUR 2.86 to EUR 9.24. Both stocks are interesting in the long term, but too expensive in the short term!

**Arms and defense stocks made a good contribution to portfolio returns in 2025. However, it can be assumed that there will be extensive profit-taking in 2026 due to the increasing trend toward peacemaking. For companies such as Almonty Industries, however, the defense aspect is less important than the widely anticipated opening of the South Korean tungsten mine.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.