August 5th, 2025 | 07:00 CEST

Xiaomi, Almonty Industries, and BioNTech achieve strategic milestones

The trade war between China and the US is entering the next round and reaching a new peak. The Middle Kingdom is restricting the supply of important minerals to Western defense companies, which are needed for everything from ammunition to fighter jets. This development is prompting manufacturers to urgently seek alternative global sources for such critical raw materials to ensure continued production. One producer in particular has come to the forefront in recent weeks, as it can solve the shortage of the essential metal tungsten for the Western world.

time to read: 3 minutes

|

Author:

Stefan Feulner

ISIN:

ALMONTY INDUSTRIES INC. | CA0203987072 , XIAOMI CORP. CL.B | KYG9830T1067 , BIONTECH SE SPON. ADRS 1 | US09075V1026

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

Stefan Feulner

The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

He is passionate about analyzing a wide variety of business models and investigating new trends.

Tag cloud

Shares cloud

Almonty Industries – A Second Chance

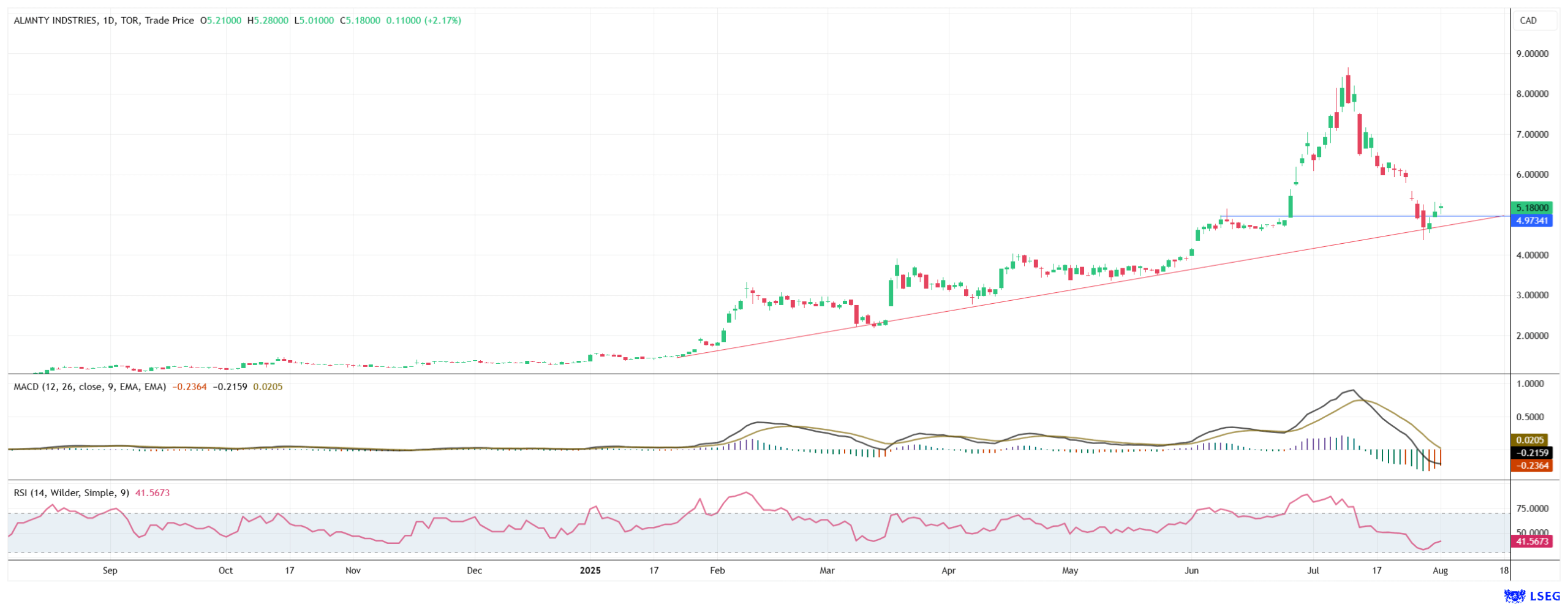

The stock market is sometimes irrational, as evidenced by the decline in Almonty's share price over the past two weeks. On one hand, geopolitical tensions are escalating between the West and countries like China and Russia, increasing the strategic importance of critical raw materials. On the other hand, the Canadian company Almonty Industries announced two major strategic milestones that could strengthen its long-term position. Yet, despite the positive news, the share price plummeted by almost 40% from CAD 8.66 to CAD 5.18. At times, the share even fell below the CAD 5 mark, but was able to defend the significant support level at CAD 4.60.

With its Nasdaq listing and the completion of an oversubscribed issue of 20,000,000 common shares at an issue price of USD 4.50 per share, which will bring total gross proceeds of USD 90 million, the team led by its experienced CEO Lewis Black is ideally positioned to escape China's quasi-monopoly. The cash cushion will not only enable Almonty to expand its tungsten oxide production, but also to create a USP by building its own smelting facility with the only fully integrated Western tungsten source, thereby sealing its independence from the Chinese refining market.

Several analyst firms are euphoric about the potential of Almonty shares. In their latest study, analysts at GBC AG set the target price for December 31, 2026, at EUR 5.28, equivalent to approximately CAD 8.50. Meanwhile, B. Riley confirms its previous target price of EUR 5.19, and Alliance Global Partners is more bullish with a target of EUR 5.84.

BioNTech – Strong Partnership

In the early 2020s, it was a party atmosphere at Goldgrube 12. While Corona raged, BioNTech played a central role by developing, together with its US partner, Pfizer, the world's first approved mRNA vaccine. It obtained approval within weeks, bringing billions into the Company's coffers.

The pandemic is over, and the Mainz-based company has been forced to shift its focus to the development of innovative cancer therapies, particularly through its mRNA platform.

After several quarters of declining revenue and earnings, BioNTech almost doubled its revenue year-on-year in the second quarter of 2025. BioNTech reported revenue of EUR 260.8 million in the second quarter, compared to EUR 128.7 million in the same period last year. In the first half of the year, the Company generated EUR 443.6 million, an increase of EUR 127.3 million compared to EUR 316.3 million in 2024. The main driver remains the COVID-19 vaccine partnership.

The net loss of EUR 386.6 million was significantly lower compared to the previous year, when it amounted to EUR 807.8 million. For the first half of 2025, the net loss was EUR 802.4 million, which is more than EUR 300 million less than the loss reported for the first half of 2024.

Of particular significance are the partnerships with Bristol Myers Squibb for the development of BNT327 and the planned acquisition of CureVac. These are intended to strengthen the Company's position in oncology.

The BMS partnership is expected to have a financial impact starting in the third quarter. An upfront payment of USD 1.5 billion will be recognized over the entire development phase. By 2028, BioNTech expects payments totaling USD 2 billion and milestone payments of up to USD 7.6 billion, which will be shared between BioNTech and BMS.

Xiaomi – Entry into a mega market

Xiaomi's management has already demonstrated its flexibility when the innovator, which originally started out as a smartphone manufacturer, announced its entry into the electric vehicle business. The Chinese company is now delivering 30,000 units. The YU7 crossover is in particularly high demand, with waiting lists already stretching into the second half of 2026. Founder Lei Jun emphasized that extensive investments are being made in autonomous driving technologies to achieve the ambitious goal of delivering 350,000 vehicles in 2025.

Yesterday, Xiaomi shocked the competition once again with the unveiling of a new open-source language model designed to improve its technologies for vehicles and smart home devices.

The "MiDashengLM-7B" is not only designed to understand voice commands, but also to integrate seamlessly into Xiaomi's growing ecosystem of vehicles and connected home appliances.

The goal is to fundamentally improve the user experience of its products. Leading Chinese tech companies like Alibaba and Tencent have also developed similar models that process images, videos, and sound in addition to speech.

The trade dispute is escalating, and tungsten producer Almonty Industries is likely to become one of the Western world's most important partners. Xiaomi unveiled its new language model, and BioNTech was able to halt its negative trend with its first-half figures.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.