August 7th, 2023 | 07:55 CEST

Wild times - quarterly figures on the move! Tupperware, Defence Therapeutics, PayPal and Amazon under the magnifying glass!

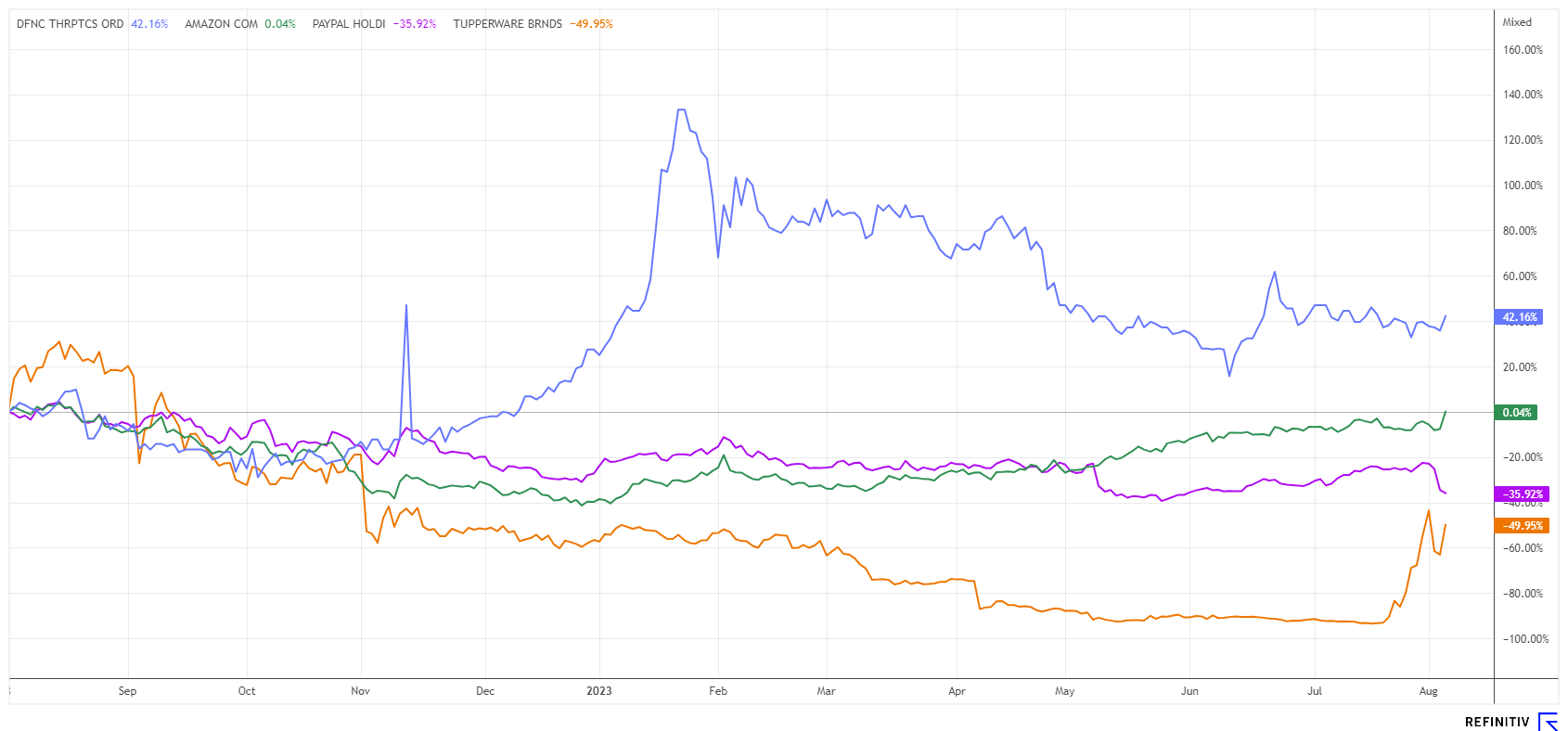

After a pronounced summer rally on the stock markets, there have been individual setbacks in early August. It should come as no surprise that the reaction to quarterly figures can sometimes be more intense. Often, stocks have simply run too far and experienced a healthy consolidation; in the case of Tupperware, the opposite is probably the case. Here, too many speculators have positioned themselves on the short side, and there were hopeful reports. We analyze a few highlights of the last week.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

TUPPERW.BRAND.CORP.DL-_01 | US8998961044 , DEFENCE THERAPEUTICS INC | CA24463V1013 , PAYPAL HDGS INC.DL-_0001 | US70450Y1038 , AMAZON.COM INC. DL-_01 | US0231351067

Table of contents:

"[...] As a company dedicated to developing treatments for rare heart diseases, we see this as an opportune moment to contribute to the fight against heart disease and make meaningful strides in improving heart health worldwide. [...]" David Elsley, CEO, Cardiol Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

PayPal versus Amazon - Good numbers do not always help

Although online payment service provider PayPal's numbers landed at the upper band of its forecast, investors punished the Company. What happened? PayPal ended the past quarter with a 7% increase in revenue to USD 7.3 billion, and profits rose by as much as 19% to USD 1.29 billion. The Company now serves 431 million customers, up 2 million from the same quarter last year. It all sounds pretty good, but analysts complained about the operating margin falling one percentage point to 21.5%. How petty!

Due to the poor economic situation, loan provisions to dealers had to be increased. This is particularly difficult, as PayPal's margins have been under the scrutiny of experts for some time. Even a small boost in user numbers ultimately does not help to lift the depressed mood. The PayPal share lost 14% after the figures and is also 40% behind in a 12-month comparison. Still, the 47 analysts on the Refinitiv Eikon platform are hopeful and, on average, expect a price target of USD 85.30, a 36% premium to the current price of USD 62.80. **We find the Company very interesting because, at the current level, the 2024 P/S ratio is only 1.8, and the P/E ratio is no longer in double digits at 9.5.

The reaction at Amazon is entirely different. The online retail giant has outperformed both its own and market expectations across the board, wrote Goldman Sachs analyst Eric Sheridan. Amazon benefited from global momentum in its online business, increased its operating margin and saw revenue growth stabilize in its AWS cloud division. The share price gain since the beginning of the year now amounts to around 70%. Voting "top pick buy," Bank of America analyst Justin Post said the analysts' new price targets of USD 180 and USD 174 are slightly above the consensus rating at Refinitiv Eikon of USD 168.50. The positive sentiment for the online giant is likely to increase somewhat due to the promising outlook.

Defence Therapeutics - Acceleration through collaboration with Okano

The Canadian biotech company Defence Therapeutics (DTC) is currently convincing its investors with good progress in cancer research. Thus, the share price increased substantially in 2023; currently the plus is almost 22%. The cooperation with the French nuclear group Okano SA is currently the focus of attention. In July, Defence Therapeutics successfully reached the first milestone set in the framework of the collaboration. Orano SA is a French multinational company developing next-generation radio-immunoconjugates using Defence's intracellular targeting technology.

The first milestone consists of synthesising the AccuTOX™ peptide containing the DOTA chelator and the azide moiety. The DOTA chelator encapsulates the radioactive molecule, while the Azide moiety is used for antibody binding using click chemistry. Subsequent steps include synthesising a second AccuTOX™ variant and conjugating the non-cleavable AccuTOX™ peptide variant to the Herceptin antibody (trastuzumab). There should be more good news here soon. Defence believes that the development of novel therapies will have higher specificity and selectivity by combining intracellular targeting technology with anticancer antibodies. In addition, the Company expects to achieve greater therapeutic efficacy with fewer side effects.

The Vancouver-based company is seeking a listing on the NASDAQ, which will give it better access to institutional investors and allow it to better refinance until product maturity. The share has recently attracted attention again and is now targeting the EUR 2 mark. With a market capitalization of USD 85 million, the required size for a NASDAQ listing will soon be reached. There is still time to top up.

Tupperware - The new meme share is making capers

Totally out of control, the stock of Tupperware, the world-renowned manufacturer of storage tools, appears to be going crazy. Just a few weeks ago, the Company was expected to undergo a tough restructuring, and now Reddit investor crowds have jumped on the value. The "meme stock" phenomenon is no longer unheard of. Usually, it involves heavily sold-off stocks with high short ratios that catch the attention of speculators.

In the case of Tupperware, there was now also good news. The Company reached an agreement with its financing banks on a reduction of the repayments and an extension of the credit facilities totaling approximately USD 350 million until 2025. Short-term debt is cushioned by a rolling USD 21 million credit line. This provides a fair amount of breathing room. Chief Financial Officer Mariela Matute commented: "I am confident that this agreement will provide us with the financial flexibility to continue our short-term turnaround efforts as well as our long-term strategy to create a global omnichannel consumer brand."

With a market capitalization of just USD 212 million, over 1 billion company shares have been traded in the last 7 days, about 20 times its outstanding capital. From the low of about USD 0.60 on July 19, 2023, the share price has multiplied tenfold by early August. Perhaps the Company can even place a small capital increase at the current price of USD 4.70; the Tupperware fan would be pleased. As a trader, betting on black or red is, of course, possible but requires a consistent stop-loss strategy. This is a casino-like stock for specialists!

The stock market has gone through months of steep growth. Last week there was a sharp correction with volatility indices turning. Amazon and PayPal are good standard stocks, and Defence Therapeutics is making great strides. Broad diversification achieves declining portfolio risks..

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.