July 24th, 2025 | 07:00 CEST

What is going on here? Watch out for DroneShield, Pure Hydrogen, and Nel ASA

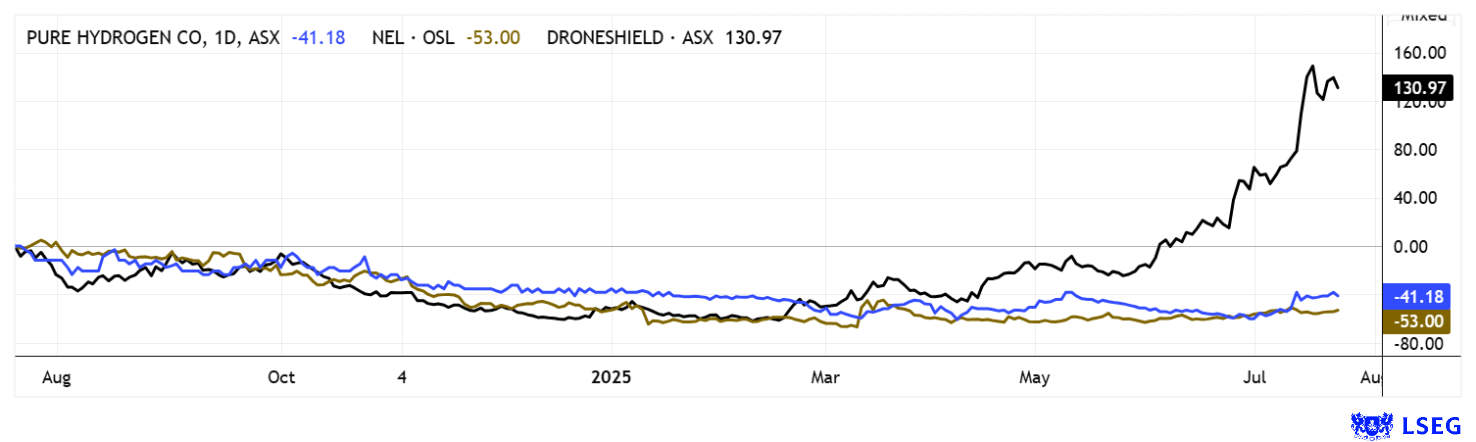

The stock market is currently taking no prisoners. Megatrends such as AI and high-tech have enabled investors to reap substantial returns over the past two years. But for the past three months, defense and armament stocks have been performing a wild dance on the trading floor. With special public programs to upgrade NATO, investors are expecting billions to flow into companies that maintain a defense segment in their business model. But how can a 600% rise in share prices be justified with just 20% more orders? What if DroneShield disappoints in September? The Australian hydrogen specialist Pure Hydrogen is currently expanding into the US, and much remains to be seen here. So where are the opportunities for investors?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

DRONESHIELD LTD | AU000000DRO2 , PURE HYDROGEN CORPORATION LIMITED | AU0000138190 , NEL ASA NK-_20 | NO0010081235

Table of contents:

"[...] We can convert buses and trucks to be completely climate neutral. In doing so, we take a modular and incremental approach. That means we can work with all current vehicle types and respond to new technology and innovation [...]" Dirk Graszt, CEO, Clean Logistics SE

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Nel ASA – Storm clouds on the horizon

Well-known hydrogen stocks from the hype years of 2020 to 2022 have recently attracted renewed attention. In particular, the two former hopefuls, Nel ASA and Plug Power, are struggling with weak momentum, disappointed investors, and challenging conditions. While the US under Donald Trump has significantly scaled back climate protection at the national level, the EU's unclear subsidy policy is also causing uncertainty. Ironically, however, the United States is one of the world's largest CO₂ emitters.

Norwegian pioneer Nel ASA could get back on track with the help of the recently announced EU climate and infrastructure programs. However, progress was still bumpy in the second quarter of 2025. Revenue fell by 48% to NOK 174 million, and operating income was once again deep in the red at NOK -86 million. At least cash reserves remain solid at just under NOK 1.93 billion, which leaves room for manoeuvre. Strategically, Nel is now focusing on PEM electrolysers and sees opportunities on an industrial scale if the EU plans become reality. In any case, Nel's share price is not far from its all-time low. Technically, it could jump upwards without any major reason, as the market seems to have dried up completely after years of sell-offs.

Pure Hydrogen – Paving the way for the green hydrogen economy in Australia

In an increasingly unstable world, independent energy production is becoming more and more important. Australian hydrogen specialist Pure Hydrogen is pursuing this exact path and establishing itself as a leader in innovation for clean energy solutions. The goal is to reposition Australia as an energy nation through regional production and global export of emission-free hydrogen. Its activities focus on three technologies: green hydrogen from renewable energies, turquoise hydrogen from methane pyrolysis with fixed carbon binding, and the still young category of emerald hydrogen, whose low-emission production is currently being tested in several pilot projects. Studies show that hydrogen-based solutions in combination with existing gas infrastructure are often cheaper and faster to implement than a purely electric transformation. Very exciting!

Pure Hydrogen is already developing a wide range of applications, from hydrogen-powered commercial vehicles and generators to mobile refueling solutions. The Company is thus addressing both the industrial and mobility sectors. In parallel, Pure Hydrogen is working with Botswana H2 and Botala Energy on an energy project in southern Africa. Another milestone is the recently approved gas exploration in the Cooper Basin, which provides its subsidiary, Real Energy Queensland, with 25 years of production security, a strategic foothold for stabilizing the transition to a hydrogen economy.

The next step in expansion is now underway in the US. Pure Hydrogen has signed a term sheet with Riverview International, a leading US commercial vehicle dealer based in California, for the purchase of a hydrogen-powered garbage truck. Under this agreement, Riverview has committed to purchase a TG23-110 H2 fuel cell vehicle. The vehicle, which complies with CARB (California Air Resources Board) certification and other US standards, will be assembled in Australia and shipped to the Riverview plant in West Sacramento. The truck, valued at AUD 600,000, will initially serve as a demonstration vehicle for potential US customers. Pure plans to work with Riverview to organize test drives at various customer locations to demonstrate the vehicle's performance and overall suitability for fleet applications. The Company hopes to secure larger orders for entire fleets of garbage trucks. This development follows participation in ACT Expo 2025, North America's largest event for clean and advanced commercial vehicle technology.

With its clear focus, technical breadth, and ambitious projects, Pure Hydrogen is well positioned to play a leading role in the growing hydrogen market. The stock is currently trading at around AUD 0.10 in Australia and is also listed on the Frankfurt Stock Exchange. For forward-thinking investors, this offers a speculative entry point into an exciting sector with a promising future. The valuation is still low!

DroneShield – Flying high until the crash landing

A quick word about Australian defense company DroneShield. According to reports, the hyped defense technology specialist is investing another AUD 13 million to triple its production capacity. This is a drop in the ocean given the size of the industry, as the market for anti-drone technology, estimated at over USD 10 billion, is growing twice as fast as other defense segments. An even more sobering look at the fundamentals: With estimated revenue of around AUD 200 million, the Company is currently valued at around AUD 3.2 billion. This translates into a price-to-sales ratio of 16. DroneShield's share price has increased sixfold in just five months. The Company will release its Q2 figures at the beginning of September. If no dramatic jump in revenue and order intake can be reported, the stock could face a sharp sell-off. So those looking to seize the moment may want to realize their profits before the Q2 report is released.

Industry rotation is underway. While defense stocks are gradually giving up gains, alternative energy producers such as Nel ASA, Plug Power, and Pure Hydrogen are back in demand. DroneShield's share price appears to be overvalued, so be cautious of a shift in sentiment here. In short, selection is therefore key once again.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.