December 30th, 2024 | 07:55 CET

Trump, Bitcoin and a gold rally in 2025? Barrick, Thunder Gold, Agnico-Eagle and D-Wave in focus

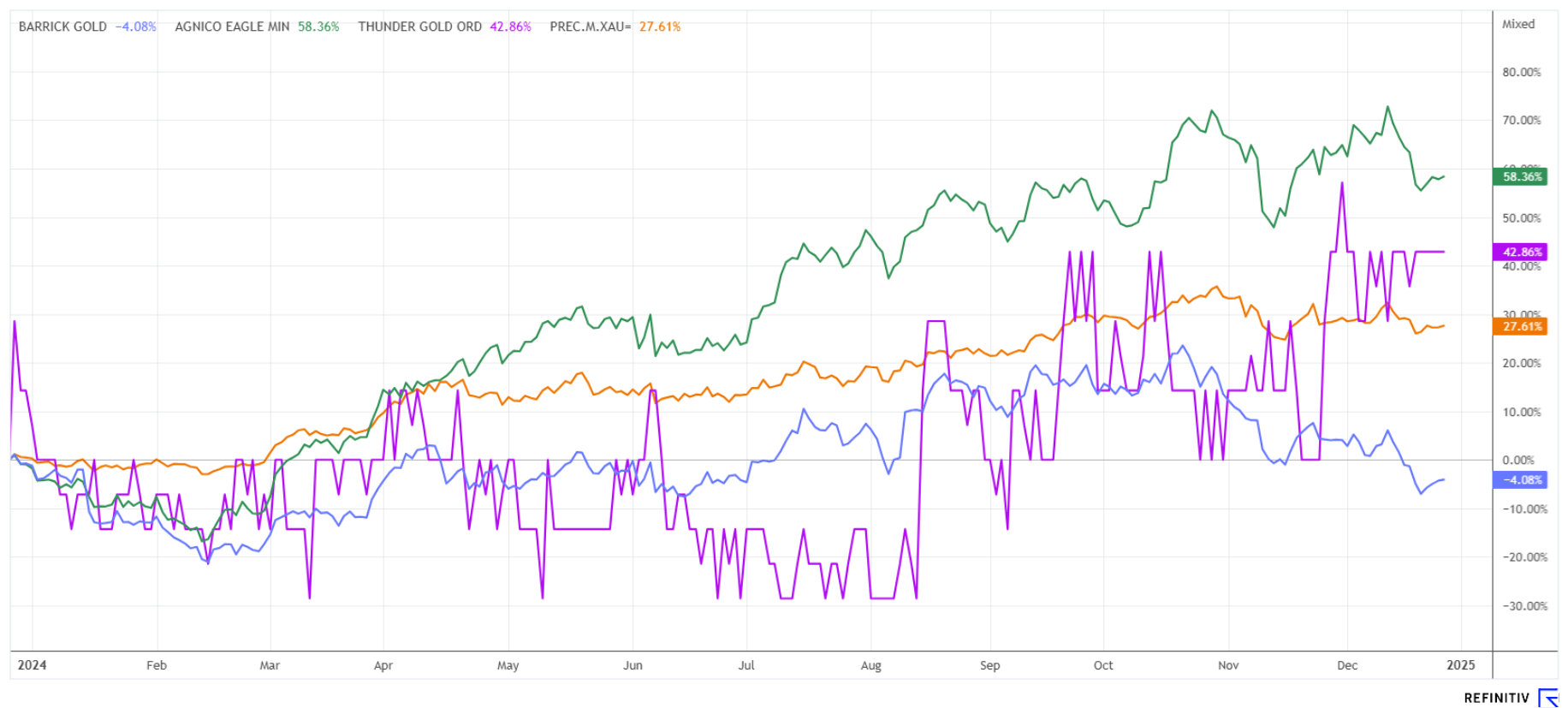

Geopolitical tensions, war, inflation, spiralling national debt and clueless politicians – a set-up that hardly impacted stock markets negatively in 2024. Fueled by immense expectations of productivity gains from high-tech advancements, cloud computing, artificial intelligence, and high-performance computing in the coming years, valuations on the NASDAQ soared to unprecedented heights. The local DAX 40 index was also able to keep pace, albeit with reduced momentum. As the year ends just shy of December highs, major uncertainties in 2024 also sparked a rush for precious metals. A troy ounce of gold peaked at USD 2,790, while silver exceeded the USD 32 mark several times - prices not seen in years. Technical analysts now predict a super cycle for commodities. The key point: compared to the overheated high-tech sector, the current metal prices for mining stocks are more likely to produce upward surprises than profit warnings. The time is ripe for a selective entry.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

BARRICK GOLD CORP. | CA0679011084 , THUNDER GOLD CORP | CA88605F1009 , AGNICO EAGLE MINES LTD. | CA0084741085 , D-WAVE QUANTUM INC | US26740W1099

Table of contents:

"[...] We can make a big increase in value with little capital. [...]" David Mason, Managing Director, CEO, NewPeak Metals Ltd.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Barrick Gold and Agnico-Eagle – A question of valuation

In the gold sector, investing in large mining stocks with dividends as portfolio anchors makes sense. This is because the industry giants have become accustomed to the higher costs of mining operations, allowing producer prices to settle between USD 900 and 1300. Depending on the location of the mine and the degree of mineralization present, this offers operating profit margins of USD 1,400 to USD 1,800 per ounce. Barrick has been a reliable supplier of steady cash flows and distributions to its shareholders for years. The gold and copper producer owns six so-called Tier One gold mines with an annual production of over 500,000 ounces and a mine life of more than 10 years. At an investor event in November, CEO Mark Bristow drew an extremely positive balance of the past few years. Since 2019, the Company has generated an operating cash flow of USD 23 billion and invested USD 15 billion in the future of the Company. The solid financial policy is paying off: net debt fell by USD 3.7 billion, while shareholders shared in the success with distributions of more than USD 5.4 billion. A long-term investment in the Barrick Gold share makes sense, as the 2025 P/E ratio currently falls below 10.

The internationally active mining group Agnico-Eagle made history in 2024. With a share price increase of 65%, the highly profitable miner outshone all its competitors. Agnico Eagle is a leading gold company that impresses with a combination of strategic growth, risk minimization and efficiency. The majority of the mines are located in stable regions such as Canada, Finland and Australia, which minimizes the political and regulatory risks that can often arise in other countries. The acquisition of Kirkland Lake Gold and the complete acquisition of the Malartic complex have significantly increased production capacity and the resource base. Compared to other major gold producers, Agnico Eagle has lower all-in sustaining costs (AISC). With a dividend yield of over 3%, Agnico Eagle offers a rare balance of growth and stable distributions, making it highly attractive to investors over the long term. However, quality comes at a price: for USD 79 and a market capitalization of USD 39.5 billion, investors are currently paying around 3.4 times revenue and a 2025 P/E ratio of 16.

Thunder Gold – The set up for a rally is in place

For those looking to supplement their gold portfolio with opportunity-oriented explorers, Thunder Gold is a prime choice. The Company operates in Ontario, a province renowned for its excellent mining conditions. Good infrastructure, a socially responsible approach and a mining-friendly jurisdiction support the projects on the ground. The primary focus is on the Tower Mountain property. It is located next to the Trans-Canada Highway, about 50 km west of Thunder Bay. The 2,500-hectare property surrounds the largest exposed intrusive complex in the eastern Shebandowan Greenstone Belt, where most known gold occurrences have been outlined within or near intrusive rocks.

The Company believes that the gold mineralization at Tower Mountain may represent the upper expression of an "Intrusion Related Gold Deposit" (IRGD). Deposits of the IRGD type offer an enhanced opportunity for Tier 1 gold discoveries and typically host deposits in-excess-of 100 million tons, which on average contain between 0.75 and 1.25 g/t Au and exceed 5 million ounces of gold. Thunder Gold has already identified 58 surface rock samples at the A-target, with mineralization ranging from 0.07 to 23.60 g/t Au. The average grade reached 3.16 g/t over a 20-metre-wide zone over a distance of 75 m. In the most recent exploration program on the P-target, CEO and President Wes Hanson stated: "The gold assay results show excellent continuity. The results are not skewed by outlying values. TMCH24-01 is the highest-grade intersection over a 1.0 g/t Au cut-off ever reported at Tower Mountain. The two long channels averaged 3.95 g/t Au over an average length of 22.7 m. The observed gold grade and thickness at surface at P-Target offers the potential for higher-grade mineralization that can complement the lower-grade gold mineralization identified along the western margin of the TMIC."

The Company is planning eight shallow diamond drill holes targeting this trend. A total of four 25-metre drill intercepts are planned in a southeasterly direction along the observed trend of mineralization. The completion date for this drilling is expected soon. This could significantly boost Thunder Gold's approximately 206 million shares, as the year-end market capitalization of CAD 10 million remains extremely undervalued.

D-Wave Quantum – The year 2000 sends its regards

A high-flyer from the high-tech sector is D-Wave Quantum, a global leader in commercial quantum computing systems and software. The main focus is on providing products and services that offer the fastest path to value-added cloud applications. D-Wave is the only company developing both annealing and gate model quantum computers, two commercial solutions with a high degree of innovation. Unlike many competitors, who are still working on basic concepts, D-Wave can already demonstrate concrete applications in areas such as AI, logistics and cyber security. Meanwhile, with the 5,000-qubit Advantage-QC, it has established itself as a technological leader in the practical application of quantum computing. However, revenues in the closing year of 2024 remain below USD 10 million and are projected to reach around USD 50 million by 2027. Profitability prospects, however, remain in the negative range. A key catalyst for the recent increase was Alphabet's announcement that it would develop new quantum chips called "Willow". This technological advance is seen as a breakthrough in the commercial use of quantum computing. D-Wave is also benefiting from this momentum, as it is considered one of the pioneers in the industry. Shortly before the end of the year, the Company secured USD 175 million in financing.

The shares of the Canadian pioneer experienced an unprecedented price explosion of over 1000% in 2024, resulting in valuations of over USD 2.8 billion. However, caution is warranted: the Canadian pension fund PSP Investments, as the largest investor, is active on the sell side and profitably reduced its stake to 18%. The recent volatility and a 2025 price-to-sales multiple of over 200 urge caution. At least the 25-year-old company has now regained its 2022 IPO price. Currently, short products on D-Wave are arguably the better choice.

In October, the ounce reached a new all-time high of around USD 2,785. American investment banks estimate the target line for 2025 to be between USD 2,850 and 3,250. This puts a strong focus on producers and explorers. Thunder Gold is exploring an outstanding property in Ontario and is making good progress. The precious metals sector could be the high flyer in the coming year. Selective short-selling in the high-tech sector could be equally successful.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.